July 6th, 2022

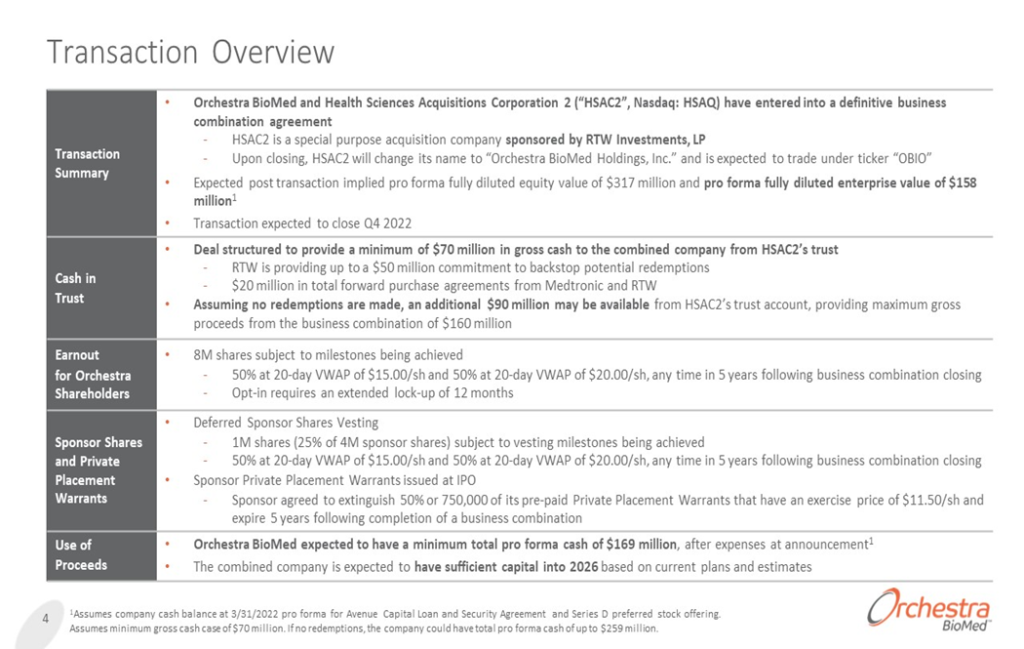

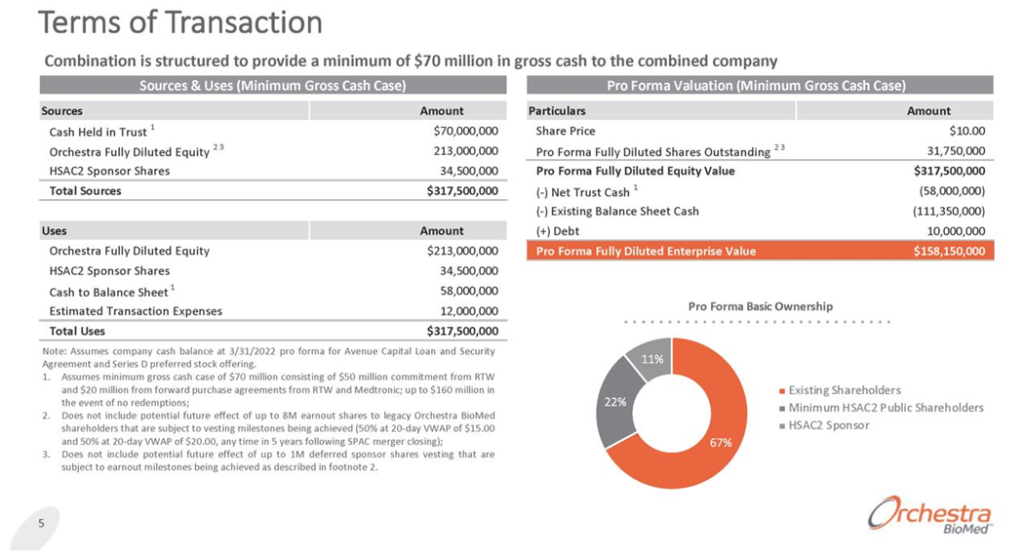

- Health Sciences Acquisition Corporation 2 (HSAQ) to acquire Orchestra BioMed (private) in a transaction valuing the pro forma entity at $158 million in Enterprise Value ($318 million equity value assuming minimum cash condition met).

- Orchestra BioMed shareholders will receive 23.1 million shares of New Orchestra as merger consideration along with 8 million earnout shares. However, the shareholders who extend lock-up from 6 to 12 months will only be eligible to receive pro rata share of Earn-Out shares.

- Transaction is supported by $20 million in total forward purchase agreements at $10.00/share.

- $50 million of redemption protections are being provided by RTW in the form of backstop agreement at $10.00/share.

- 25% of Sponsor shares are subject to earn-out provisions at $15.00 and $20.00/share. Sponsor has agreed to forfeit 50% of its private placement warrants.

- Minimum gross cash condition of $60 million.

- Business combination transaction is targeted to close in the fourth quarter of 2022.

- SPAC Details:

- Unit Structure: 1 ordinary share

- #Cash in Trust: $160,239,964 (100.2% of Public Offering)

- Public Shares Outstanding: 16.00 million shares

- Private Shares Outstanding: 8.50 million shares

- Reported Trust Value/Share: $10.02

- Liquidation Date: August 6, 2022 (As on the date of announcement, HSAQ was seeking extension to November 6, 2022; Succeeded on 7/26/2022 and 6,762,117 shares remain post redemption)

- Name of Target: Orchestra BioMed, Inc

- Description of Target: Orchestra BioMed is a biomedical company with a business model designed to accelerate high-impact technologies to patients through risk-reward sharing partnerships. Orchestra BioMed’s partnership-enabled business model focuses on forging strategic collaborations with leading medical device companies to drive successful global commercialization of products it develops. Orchestra BioMed’s flagship product candidates include BackBeat Cardiac Neuromodulation Therapy™ for the treatment of hypertension, the leading risk factor for death worldwide, and Virtue® Sirolimus AngioInfusion™ Balloon (SAB) for the treatment of certain forms of artery disease, the leading cause of mortality worldwide. Orchestra BioMed has a strategic collaboration with Medtronic, one of the largest medical device companies in the world, for development and commercialization of BackBeat CNT for the treatment of hypertension in pacemaker-indicated patients, and a strategic partnership with Terumo Corporation, a global leader in medical technology, for development and commercialization of Virtue SAB for the treatment of artery disease. Orchestra BioMed has additional product candidates and plans to potentially expand its product pipeline through acquisitions, strategic collaborations, licensing, and organic development.

- Announced Date: July 5, 2022

- Expected Close: “Fourth Quarter of 2022”

- Press Release: https://www.sec.gov/Archives/edgar/data/1814114/000114036122024892/ny20004465x4_ex99-2.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1814114/000114036122024892/ny20004465x4_ex99-1slide4.jpg):

- Diluted Enterprise Value: $158.15 million

- Market Cap Value: $317.5 million (assuming min cash condition met)

- Target Shareholders Receive:

- Orchestra common stock = 0.465 x HSAC2 common stock = 23.1 million HSAC2 shares

- Earn-Out: 8 million New Orchestra Common Stock (5 years after closing)

- 4 million shares @ $15 per share

- 4 million shares @ $20 per share

- In case of first change in control, earn-out shares will be received if above share price hurdle

- PIPE / Financing:

- $20 million from FPAs from Medtronic & RTW (10 million shares each at $10/share)

- $110 million of Series D-PE financing

- Redemption Protections:

- $50 million backstop arrangements by RTW (5 million shares at $10/share)

- Support Agreement:

- Standard voting support

- Forfeiture: 1 million Founder Shares + 750,000 Private Warrants

- Vesting shares: (5 years after closing)

- 500,000 shares @ $15

- 500,000 shares @ $20

- Lock-up:

- SPAC Sponsors (Insider shares & PP Shares): 12 months post-closing

- Target Security holders: 6 months post-closing

- Target Earnout Participants: 12 months post-closing

- Closing Conditions:

- Gross Cash Condition: $60 Million ($50 million backstop & $10 million FPA)

- Domiciliation: HSAC2 will deregister in Cayman Islands & domesticate as a Delaware Corporation.

- Termination date: February 6, 2023

- Conversion of Target Preferred stock into SPAC Common Stock

- Completion of Forward Purchase transaction with Medtronic

- Other customary closing conditions

- Termination:

- Non-Approval of Extension proposal

- Other standard termination clauses

- Advisors:

- Target Financial Advisors: Jefferies LLC and Piper Sandler & Co.

- SPAC Financial Advisors: Chardan Capital Markets LLC and Barclays Capital Inc.

- Target Legal Advisors: Paul Hastings LLP

- SPAC Legal Advisors: Loeb & Loeb LLP

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- 17.5% of shares outstanding post-closing

- Includes evergreen provision for annual automatic increase

*Denotes estimated figures by CPC

#Reported as on June 30, 2022