July 14, 2022

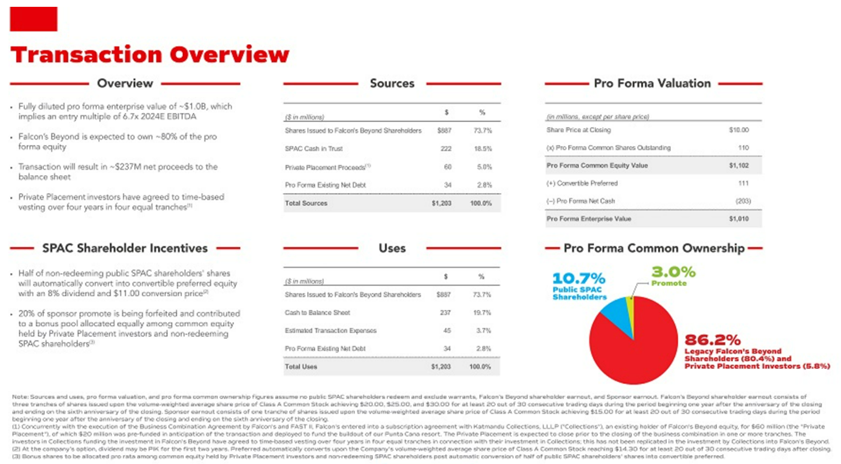

- Fast Acquisition Corporation (FZT) to merge with Falcon’s Beyond (Private) in a transaction valuing the pro forma entity at $1,010 million in Enterprise Value ($1,102 million equity value) assuming zero redemptions.

- The combined company will be organized in an “Up-C” structure.

- Falcon’s shareholders will receive an equity consideration of $887 million at $10 per unit.

- Transaction includes earnout to Falcon’s shareholders in three tranches of shares issued upon VWAP of $20, $25, and $30 respectively during the period of 5 years beginning 1 year after closing.

- Falcon entered into a subscription agreement with Katmandu Collections, LLLP (an existing holder of equity in Falcon’s Beyond) for a $60 million PIPE, of which $20 million has been pre-funded and deployed to Falcon’s Beyond investment in its Punta Cana resort, at the same value per share to be received by Falcon’s Beyond’s existing equity holders.

- Transaction will provide downside protection, 50% of the position of each non-redeeming stockholder of FAST II’s will automatically convert into convertible preferred equity with an 8% dividend and $11.00 conversion price, and 20% of the founder shares (or *1,111,684 shares) held by FAST II’s sponsor are being forfeited and contributed to a bonus pool allocated pro rata among private placement investors and non-redeeming public stockholders of FAST II, excluding any common shares converted to convertible preferred.

- Sponsor forfeited up to 40% (or *2,223,368) of Founder Shares. Half of the forfeited Founder Shares can be put into an earn-out pool depending on redemption levels (higher redemption lowers size of earn-out pool):

- If 0% redemptions, 20% (or 1,111,684) of Founder Shares shall be placed in earn-out (total 20% of Founder Shares are forfeited and earn-out pool holding 20% of Founder Shares).

- If 100% redemptions, 0% of Founder Shares placed in earn-out (total 40% of Founder Shares are forfeited and no earn-out pool).

- Sponsor earnout consists of one tranche issued upon VWAP of $15 during the period of 5 years after 1 year of closing.

- No minimum cash condition.

- Agreement includes a termination fee (payable to FZT if after termination date Falcon fails to close and terminates deal) of $12.50 million if redemption is less than 90% (or unknown) or $6.25 million if redemption is known and is equal to or greater than 90% along with reimbursement of all fees and expenses (plus interest).

- Business combination transaction is targeted to close either in the second half of 2022 or the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.25 Redeemable Warrant

- #Cash in Trust: $222,320,512 (100.0 % of Public Offering)

- Public Shares Outstanding: 22,233,687 shares

- Private Shares Outstanding: 5,558,422 shares

- Reported Trust Value/Share: $10.00

- Liquidation Date: March 18, 2023

- Name of Target: Falcon’s Beyond

- Target Description: Headquartered in Orlando, Florida, Falcon’s Beyond is a fully integrated, top-tier experiential entertainment development enterprise focusing on a 360° IP Expander™ model. The company brings its own proprietary and partner IPs to global markets through owned and operated theme parks, resorts, attractions, patented technologies, feature films, episodic series, consumer products, licensing, and beyond. The company has won numerous design awards and provided design services in 40 countries around the world, turning imagined worlds into reality.

- Announced Date: July 12, 2022

- Expected Close: “Either the second half of 2022 or the first quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1839824/000121390022038700/ea162701ex99-1_fastacq2.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1839824/000121390022038700/ex99-2_042.jpg):

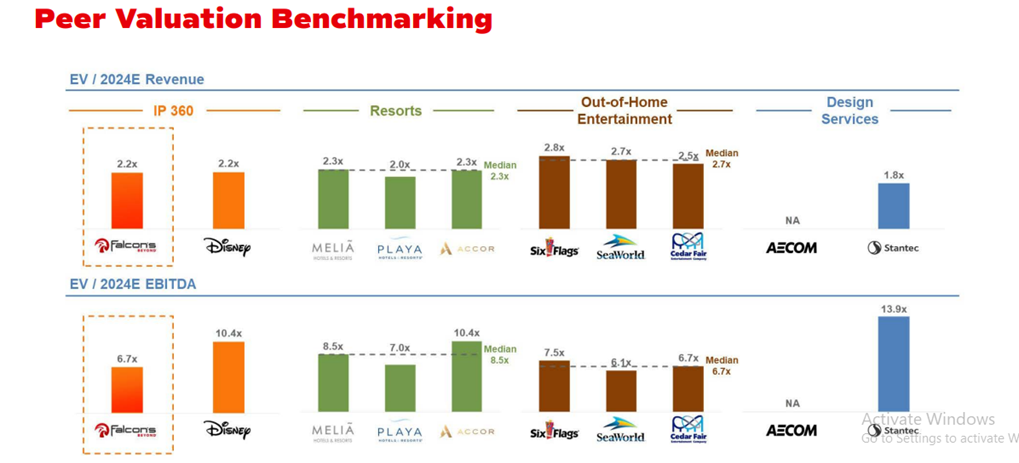

- Enterprise Value: $1,010 million, 6.7x 2024E EBITDA

- Market Cap Value: $1,102 million

- Target Unitholders Receive (Up-C Structure):

- 88.7 million Class B PubCo Share (vote only, non-economic)

- 88.7 million NewCo Units

- Earn-out: 40 million Class B PubCo Shares + 40 million NewCo Units (5 years beginning 1 year after closing)

- 15 million Class B shares + NewCo Units @ $20

- 15 million Class B shares + NewCo Units @ $25

- 10 million Class B shares + NewCo Units @ $30

- SPAC Sponsor Shareholders Receive:

- 1 Class A PubCo share for each Founder Share

- Earn-out Class A shares @ $15 (5 years beginning 1 year after closing)

- Earn-out shares subject to redemption levels:

- 0% redemptions = 20% of founder shares

- Earnout shares = 50%*[40% of sponsor shares – (40% of sponsor shares*rate of redemption)]

- SPAC Shareholders Receive:

- 0.5 Class A PubCo share for each SPAC common share

- 0.5 Preferred share of PubCo for each SPAC common share

- [50%] pro rata share of 1,111,684 shares (“Tontine Pool”)

- PIPE / Financing:

- $60 million Common Unit PIPE @ $10/Unit

- Pro rata share of 1,111,684 shares (“Tontine Pool”)

- Redemption Protections:

- 50% of non-redeeming shares will receive convertible preferred equity with an 8% dividend and conversion price at $11.0

- Sponsor will not receive preferred equity and will instead receive 100% common shares

- 20% (or 1,111,684) of founder shares will be contributed to a tontine pool equally available to PIPE and non-redeeming investors

- 50% of non-redeeming shares will receive convertible preferred equity with an 8% dividend and conversion price at $11.0

- Sponsor Support Agreement:

- Standard voting support

- Sponsor forfeited up to 40% (or 2,223,368) of Founder Shares. Half of the forfeited Founder Shares can be put into an earn-out pool depending on redemption levels (higher redemption lowers size of earn-out pool):

- If 0% redemptions, 20% (or 1,111,684) of Founder Shares placed in earn-out (i.e. total 20% of Founder Shares are forfeited and earn-out pool holding 20% of Founder Shares)

- If 100% redemptions, 0% of Founder Shares placed in earn-out (i.e. total 40% of Founder Shares are forfeited and no earn-out pool)

- Lock-up:

- Certain Target Investors: 180 days post-closing

- Early release from Lock-up: If equal to or above $12.00 per share after 6 months from the Closing Date.

- SPAC Sponsors:

- Sponsor Lock-up Shares: 365 days post-closing

- Sponsor Lock-up Warrants: 180 days post-closing

- Early release from Lock-up: If equal to or above $12.00 per share after 6 months from the Closing Date.

- Certain Target Investors: 180 days post-closing

- Closing Conditions:

- No Minimum Cash Condition

- PCAOB Financials by September 14, 2022

- Termination Date: 9 months from business combination (April 11, 2023)

- Termination Fee:

- Target Termination Fee (payable to SPAC if after Termination Date Target fails to close and terminates deal):

- Reimbursement of all fees and expenses (plus interest), and

- $12,500,000 if the SPAC Redeemed Share Percentage is less than 90% or is unknown or

- $6,250,000 if the SPAC Redeemed Share Percentage is known and is equal to or greater than 90%.

- Reimbursement of all fees and expenses (plus interest), and

- Target Termination Fee (payable to SPAC if after Termination Date Target fails to close and terminates deal):

- Advisors:

- Target Financial Advisors: Guggenheim Securities, LLC

- SPAC Financial Advisors: Jefferies LLC

- Target Legal Advisors: White & Case LLP

- SPAC Legal Advisors: Gibson, Dunn & Crutcher LLP

- Jefferies Legal Advisors: Paul Hastings LLP

- Financials (N/A):

- No historical or projected financials provided

- Based on 6.7x 2024 multiple, implied 2024E EBITDA = ~$151 million

- Equity Incentive Plan:

- No information provided

*Denotes estimated figures by CPC

#Reported as on March 31, 2022