September 7, 2022

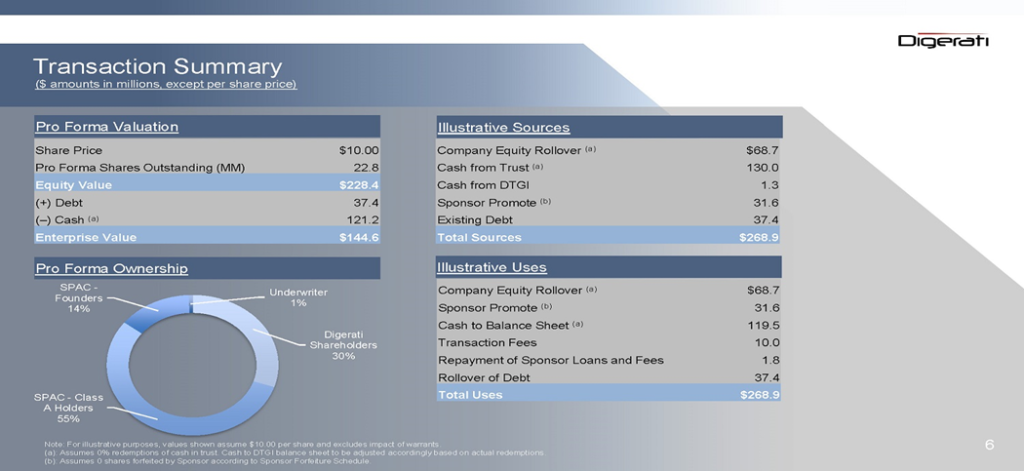

- Minority Equality Opportunities Acquisition Inc. (MEOA) to acquire Digerati Technologies (OTCQB: DTGI) in a transaction valuing the pro forma enterprise value at $144.6 million ($228.4 million equity value).

- Digerati shareholders will receive an aggregate consideration of 6,868,080 SPAC Shares at $10.00/share.

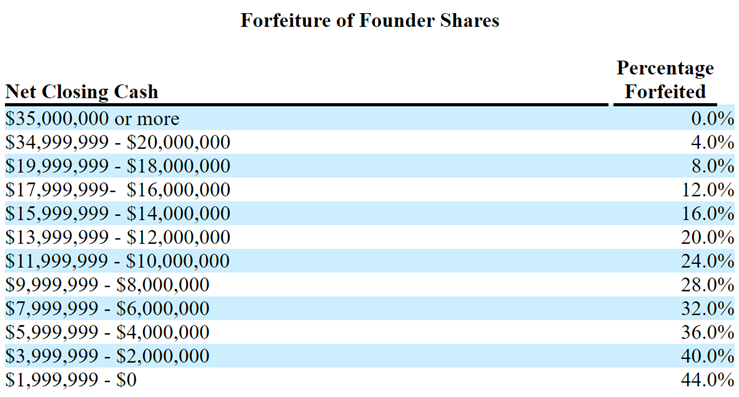

- Founder shares are subject to forfeiture, the % of which shall be decided on the basis of Net closing cash amount.

- Sponsor agreed to forfeit 3,776,500 sponsor warrants (or 70%) for no consideration.

- Agreement includes a bilateral termination fee of $2 million & a target termination fee of $1.265 million payable to MEOA if Digerati fails to deposit 3-months extension funds from November 30, 2022 & in case of non-fulfillment of NASDAQ listing requirements.

- No minimum cash condition.

- The business combination is expected to close in fourth quarter of 2022.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 1 Redeemable Warrant

- #Cash in Trust: $128,576,560 (101.6% of Public Offering)

- Public Shares Outstanding: 12.65 million

- Private Shares Outstanding: 3.1625 million

- Reported Trust Value/Share: $10.16

- Liquidation Date: November 30, 2022 (On 9/2/2022, MEOA announced extension to 11/30/2022, as permitted under its Amended and Restated Certificate of Incorporation; On 11/10/2022, MEOA was seeking extension up to 6 times, for 1 month each till 5/30/2023)

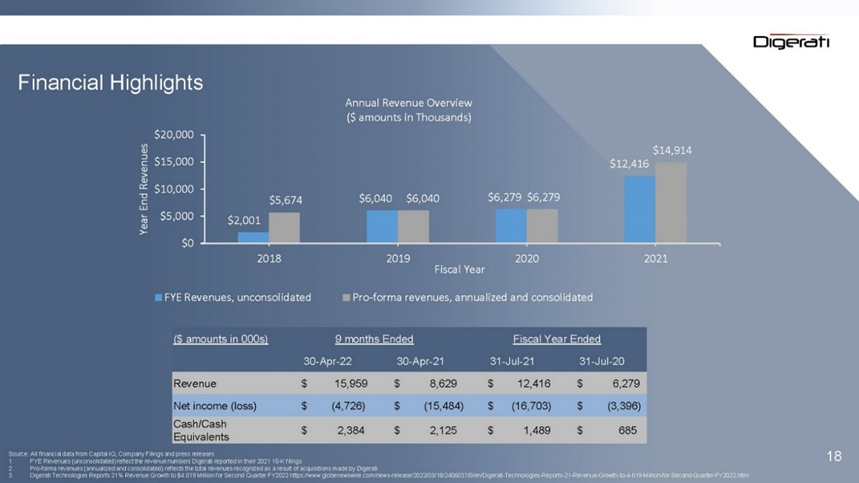

- Name of Target: Digerati Technologies

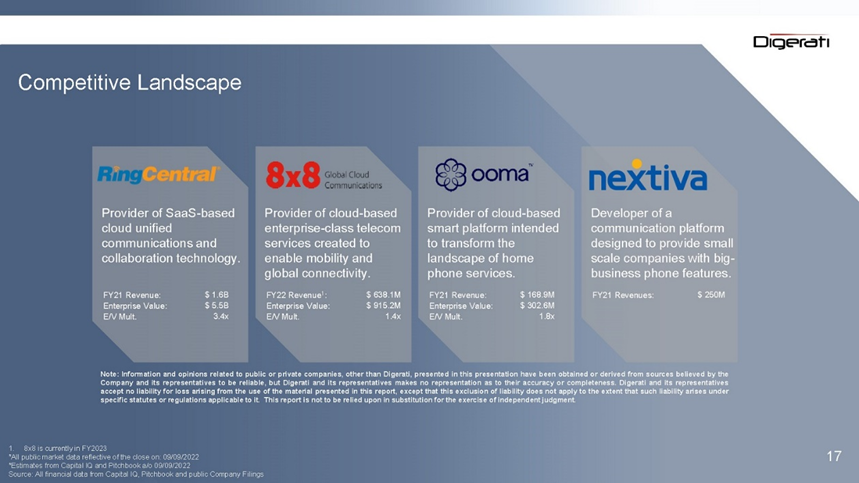

- Target Description: Digerati Technologies, Inc. (OTCQB: DTGI) is a provider of cloud services specializing in UCaaS (Unified Communications as a Service) solutions for the business market. Through its operating subsidiaries NextLevel Internet (NextLevelinternet.com), T3 Communications (T3com.com), Nexogy (Nexogy.com), and SkyNet Telecom (Skynettelecom.net), Digerati is meeting the global needs of small businesses seeking simple, flexible, reliable, and cost-effective communication and network solutions including, cloud PBX, cloud telephony, cloud WAN, cloud call center, cloud mobile, and the delivery of digital oxygen on its broadband network. Digerati has developed a robust integration platform to fuel mergers and acquisitions in a highly fragmented market as it delivers business solutions on its carrier-grade network and Only in the Cloud™.

- Announced Date: September 6, 2022

- Expected Close: “fourth quarter of 2022”

- Press Release: https://www.sec.gov/Archives/edgar/data/1859310/000121390022054072/ea165315ex99-1_minority.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1859310/000121390022058188/ex99-1_006.jpg):

- Enterprise Value: $144.6 million

- Market Cap Value: $228.4 million (vs. Market Cap of ~$15.40 million before announcement)

- Target Aggregate Share Consideration:

- 6,868,080 MEOA Shares @$10.00/share

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Sponsor Support Agreement:

- Standard voting support

- Forfeiture of 3,776,500 Sponsor Warrants (or 70%) (exercisable to purchase SPAC Class A Shares)

- Forfeiture of founder shares (%) based on Net Closing Cash determined:

- Lock-up:

- SPAC Sponsors: 180 days post-closing

- Certain Target Stockholders: 180 days post-closing

- Closing Conditions:

- Termination Date: February 25, 2023

- Repayment of sponsor loans or conversion thereof into Warrants to purchase SPAC Shares

- Any breach of the covenants has been resolved to the reasonable satisfaction of SPAC (PRG Resolution Agreement) & receipt thereof by SPAC

- PCAOB Financial by September 15, 2022

- No minimum cash condition

- Other customary closing conditions

- Termination fee:

- Termination Fee (Applicable for both):

- $2,000,000

- Target Termination Fee (Payable to SPAC):

- $1,265,000 if the Target:

- Fails to deposit 3-months extension funds from November 30, 2022

- Non-fulfillment of NASDAQ listing requirements

- $1,265,000 if the Target:

- Termination Fee (Applicable for both):

- Advisors:

- SPAC Financial Advisors: PGP Capital Advisors, LLC and Vaughan Capital Advisors, LLC

- Target Financial Advisors: Maxim Group LLC

- SPAC Legal Counsel: Pryor Cashman LLP

- Target Legal Counsel: Lucosky Brookman

- Incentive Equity Plan:

- 10% of shares (including shares issuable upon Rollover warrants) outstanding post-closing

*Denotes estimated figures by CPC

#Reported as on June 30, 2022