October 1, 2022

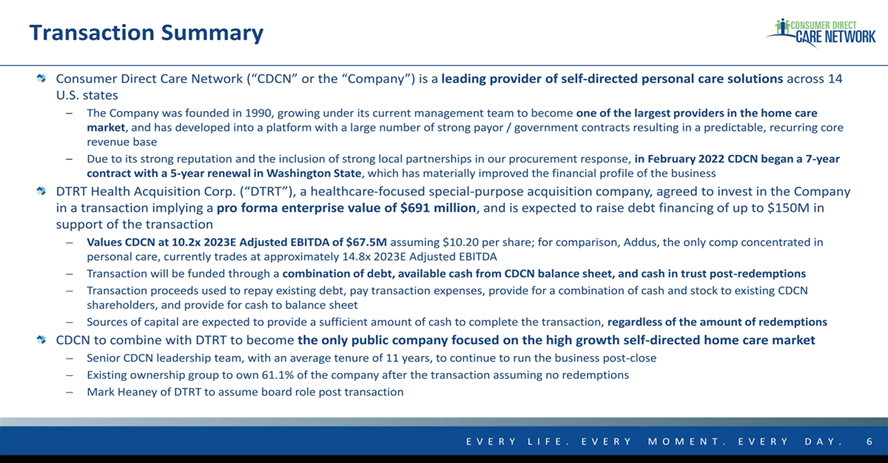

- DTRT Health Acquisition Corp. (DTRT) to acquire Consumer Direct Holdings (Private) in a transaction valuing the pro forma entity at $691 million of enterprise value ($858 million equity value).

- DTRT shareholders will receive an equal number of shares & warrants in the combined company.

- CDH shareholders will receive an aggregate consideration of $527 million of which cash consideration is expected to be $118.35 million & balance shall be in the form of equity consideration at $10.20/share (subject to adjustments).

- DTRT is expected to raise debt financing of up to $150 million in support of the transaction.

- No minimum cash condition.

- The transaction includes reimbursement of the termination fee payable to CDH under certain circumstances.

- The business combination is expected to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.5 Redeemable Warrant

- #Cash in Trust: $234,592,205 (102.0% of Public Offering)

- Public Shares Outstanding: 23.00 million

- Private Shares Outstanding: 5.75 million

- Reported Trust Value/Share: $10.20

- Liquidation Date: December 7, 2022

- Name of Target: Consumer Direct Holdings

- Target Description: CDH is a leading self-directed in-home personal care network whose services and operating models address the crucial role of in-home personal caregiving as part of the healthcare continuum. CDH provides services under agreements with state Medicaid agencies, federal Veterans Administration providers, local government agencies, managed care organizations, commercial insurers and private individuals. Care provided in the home generally costs less than facility-based care and is preferred by clients and their families. Self-directed care also provides significant value to state Medicaid agencies and managed care organizations, including lower cost of services and higher satisfaction rates versus care in a facility or through a traditional home care agency. CDH’s expertise and experience provides significant competitive advantages when responding to requests for proposals and in creating unique program attributes required by some payors.

- Announced Date: September 29, 2022

- Expected Close: “First Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1865537/000119312522253719/d378588dex991.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1865537/000119312522258536/g385033ex99_1p6g1.jpg & https://www.sec.gov/Archives/edgar/data/1865537/000119312522258536/g385033ex99_1p31g1.jpg):

- Enterprise Value: $ 691 million, 10.2x 2023E Adjusted EBITDA of $67.5 million

- Market Cap Value: $858 million

- SPAC Shareholders Receive:

- *23.00 million Shares of New Pubco

- *11.50 million Public Warrants of New Pubco

- SPAC Sponsors Receive:

- *5.75 million Shares of New Pubco

- *11.20 million Private Warrants of New Pubco

- Target Shareholders Receive:

- $527 million of aggregate consideration (subject to adjustments)

- Expected cash consideration of $118.35 million (less advisor expenses)

- Equity consideration of *$408.65 million (balance) at $10.20/share subject to following adjustments:

- $527 million of aggregate consideration (subject to adjustments)

| Increase by: | Decrease by: |

| Target’s closing cash | Certain Advisor’s Expenses |

| Credited expenses paid by Target | Target’s closing indebtedness |

| Target’s Working capital as compared to a working capital target | |

| Amount by which Target’s transaction expenses are less than (or greater than) $7 million | |

- Current Estimate is 51.4 million shares of New Pubco (due to $100 million net cash on CDN balance sheet)

- PIPE / Financing:

- Expected to raise $150 million of debt financing

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors & Target shareholders (Holdings~71%)

- New PubCo Common Stock: 365 days post-closing

- Early Release: If equal or above $12 per share after 181 days of closing (Any sale before 365 days after & excluding the closing date can be made to purchasers who do not constitute affiliates of New PubCo)

- New PubCo Warrants: 30 days post-closing

- New PubCo Common Stock: 365 days post-closing

- SPAC Sponsors & Target shareholders (Holdings~71%)

- Closing Conditions:

- Termination date: June 27, 2023 (270 days following merger)

- No minimum cash condition

- SPAC obtaining financing satisfactory to Target

- Other customary closing conditions

- Termination:

- Reimbursement of termination expenses (payable to Target) if agreement is terminated:

- By mutual agreement

- Merger not completed on or before termination date

- Merger becoming illegal or is prohibited

- SPAC’s failure to obtain stockholder approval

- SPAC’s breach of its representations & warranties

- Other standard termination clauses

- Reimbursement of termination expenses (payable to Target) if agreement is terminated:

- Advisors:

- SPAC Financial Advisor: Deutsche Bank Securities Inc.

- Target Financial Advisor: Bank of Montana

- SPAC Legal Advisors: Winston & Strawn

- Target Legal Advisors: Holland & Hart

- SPAC BOD Advisor: Lincoln International, LLC

- Target Investor Relation Advisor: Blueshirt Capital Advisors

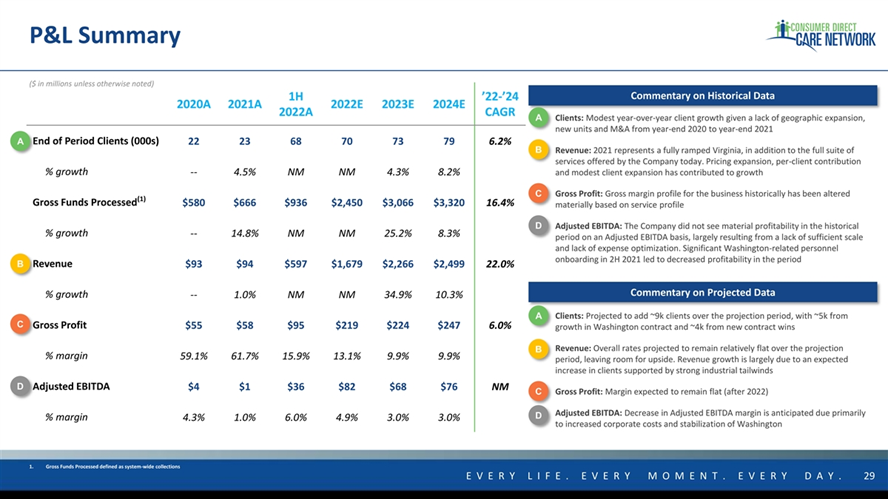

- Financials (https://www.sec.gov/Archives/edgar/data/1865537/000119312522258536/g385033ex99_1p29g1.jpg):

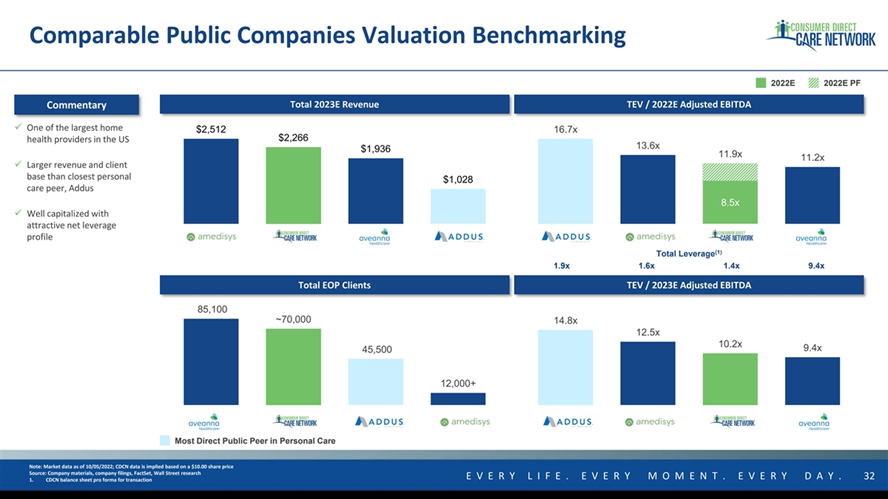

- Comparables (https://www.sec.gov/Archives/edgar/data/1865537/000119312522258536/g385033ex99_1p32g1.jpg):

- Incentive Equity Plan:

- 8% of shares outstanding post-closing shall be reserved for Initial Incentive Equity Plan Pool

- On the effectiveness of the registration statement, the board will authorize the issuance of an aggregate of 75% of the Initial Incentive Equity Plan Pool to the Company’s employees

*Denotes estimated figures by CPC

#Reported as on June 30, 2022