September 30, 2022

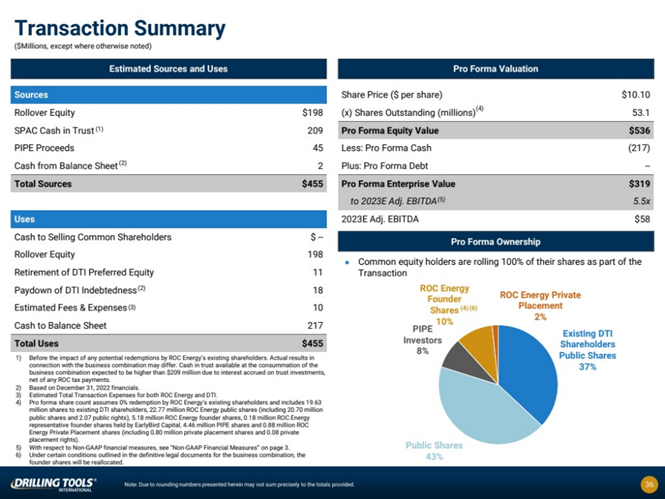

- ROC Energy Acquisition Corporation (ROC) to acquire Drilling Tools International (private) in a transaction valuing the pro forma entity at $319 million in Enterprise Value ($536 million equity value) assuming zero redemptions.

- Drilling Tools International shareholders will receive an equity consideration of $198 million (19.63 million shares of Pubco Common Stock at $10.10 per share) subject to adjustments.

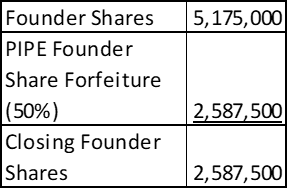

- Sponsor agreed to forfeit up to 50% (or *2,587,500) founder shares to ROC Energy for reissuance to investors in connection with the Equity Financing and to split the remainder of the founder shares with Drilling Tools stockholders.

- Minimum gross cash condition of $55.0 million.

- Business combination transaction is targeted to close in the second quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 right (to receive 1/10th of a share)

- #Cash in Trust: $210,111,564 (101.5% of Public Offering)

- Public Shares Outstanding: 20.7 million shares

- Private Shares Outstanding: 5.971 million shares (including private placement shares contained in 796,000 in private units)

- Reported Trust Value/Share: $10.15

- Liquidation Date: June 6, 2023

- Name of Target: Drilling Tools International

- Description of Target: Drilling Tools International is a Houston, Texas based leading oilfield services company that rents downhole drilling tools used in horizontal and directional drilling of oil and natural gas wells. Drilling Tools operates from 22 locations across North America, Europe and the Middle East.

- Announced Date: February 14, 2023

- Expected Close: “Second Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1884516/000110465923020480/tm236420d1_ex99-1.htm

- Transaction Terms (https://content.bamsec.com/0001104659-23-020480/tm236420d1_ex99-2img037.jpg):

- Enterprise Value: $319 million

- Market Cap Value: $536 million

- SPAC Public Shareholders Receive:

- 22.77 million shares of Pubco Common Stock (including 20.7 million public shares & 2.07 public rights)

- SPAC Sponsor Receive:

- 5.175 million shares of Pubco Common Stock (subject to forfeiture)

- 0.88 million shares of Pubco Common Stock (including 0.80 million private placement shares & 0.08 placement rights)

- Target Shareholders Receive (~37%):

- Preferred Shareholders:

- Cash consideration of $11,000,002

- Stock consideration of 4,408,861 at $10.10 per share

- Preferred Shareholders:

- Equity Shareholders:

- Equity consideration of 198,273,031 at $10.10 per share (19,630,993 million shares of Pubco common stock) subject to sponsor share forfeiture adjustment (see “Support Agreement”)

- PIPE / Financing:

- $45.0 million of PIPE is expected to be raised at $10.10 per share

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

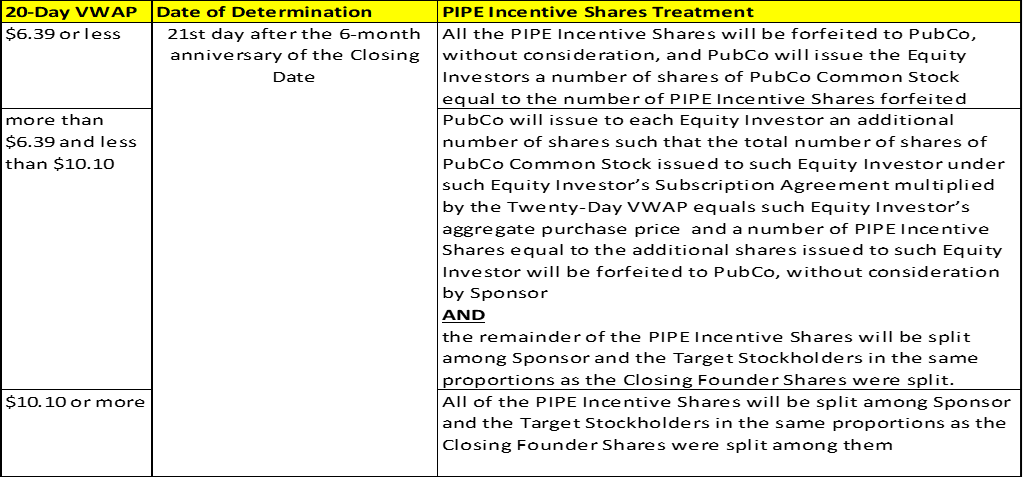

- Sponsor agreed to forfeit up to 2,587,500 (*50%) founder shares for no consideration depending on the 20-Day VWAP

- SPAC expects to agree to issue to the Equity Investors the number of shares of PubCo Common Stock forfeited in the PIPE Founder Share Forfeiture:

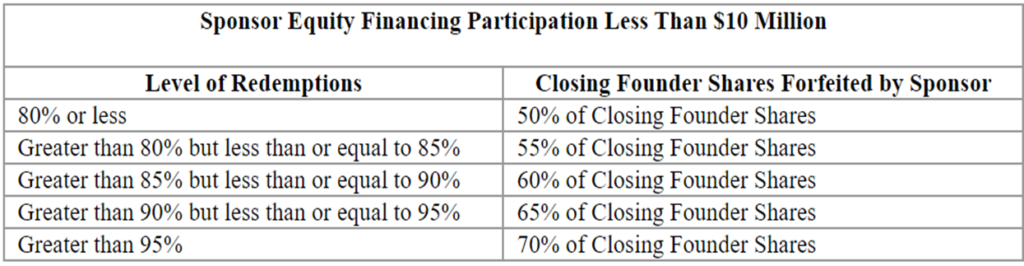

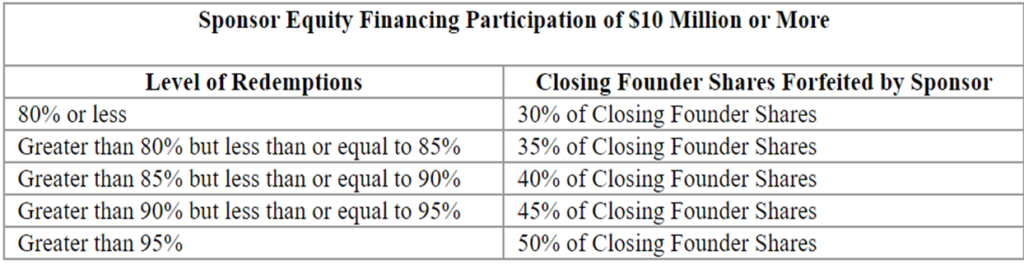

- Sponsor has also agreed to forfeit between 30% and 70% of Closing Founder Shares depending on the level of redemptions at closing and SPAC shall issue a number of shares of PubCo Common Stock to Target Stockholders equal to the number of the Closing Founder Shares required to be forfeited by Sponsor (treated as an adjustment to the merger consideration):

- Lock-up:

- SPAC Sponsors: 180 days post-closing

- Key Target Shareholders (Holding > 5%): 180 days post-closing

- Closing Conditions:

- Termination date: March 6, 2023 (may extend to June 6, 2023)

- Minimum Gross Cash Condition: $55.0 Million

- Cash includes: Cash In Trust – Redemptions + Equity Financing

- Less than 95% pf the public shares redemption by SPAC

- Other customary closing conditions

- Termination:

- Standard termination clauses

- Advisors:

- SPAC Financial Advisors: EarlyBirdCapital, Inc.

- Target Legal Advisors: Bracewell LLP

- SPAC Legal Advisors: Winston & Strawn LLP

- SPAC Capital Markets Advisors: Jefferies LLC

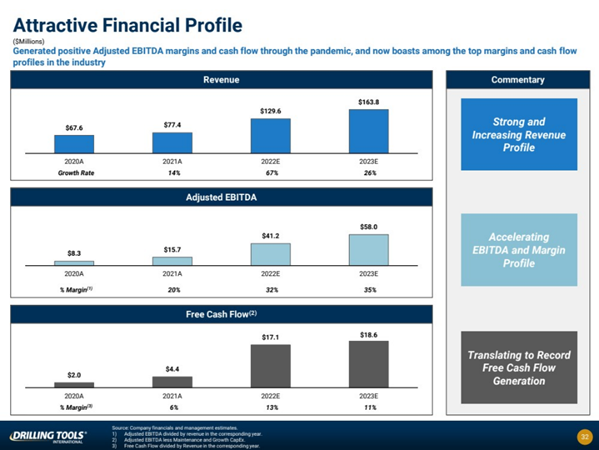

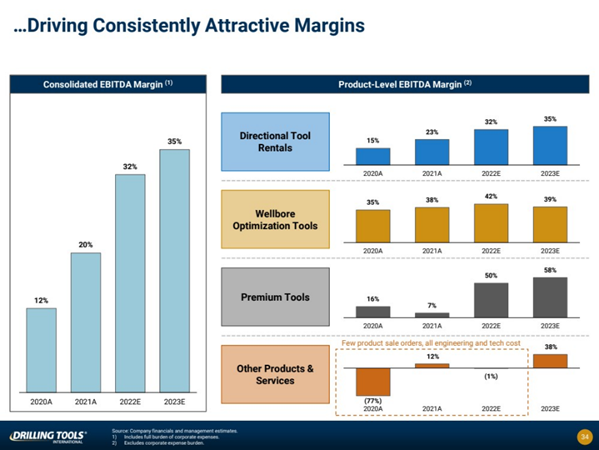

- Financials (https://content.bamsec.com/0001104659-23-020480/tm236420d1_ex99-2img033.jpg & https://content.bamsec.com/0001104659-23-020480/tm236420d1_ex99-2img035.jpg):

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- 10.0% of shares outstanding post-closing

*Denotes estimated figures by CPC

#Reported as on September 30, 2022