September 30, 2022

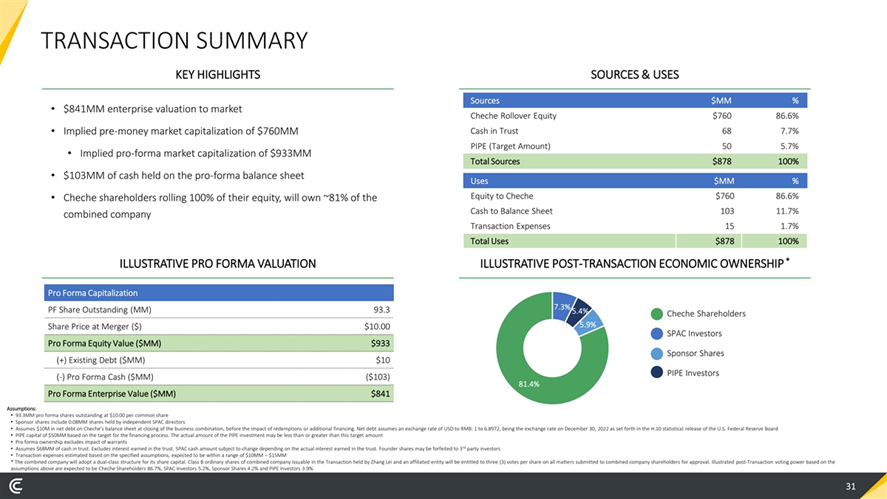

- Prime Impact Acquisition I (PIAI) to merge with Cheche Technology Inc. (private) in a transaction valuing the pro forma entity at $841 million in Enterprise Value ($933 million equity value) assuming no further redemptions.

- Cheche Technology shareholders will receive equity consideration of $760 million at $10.0 per share.

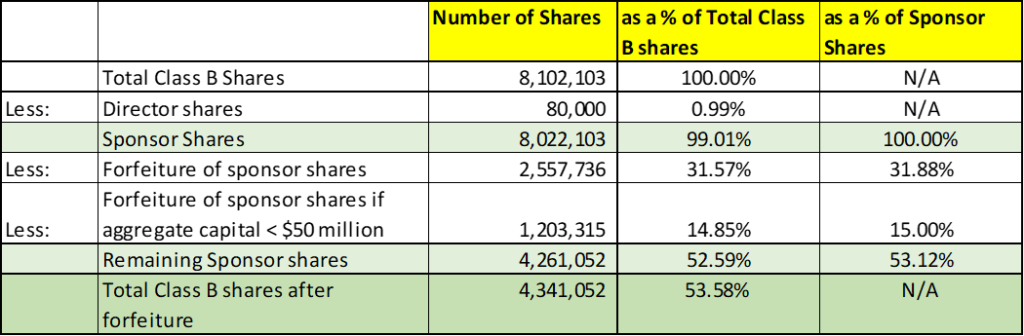

- Sponsor agreed to forfeit 2,557,736 (*31.57%) shares and 2,860,561 (*50.0%) warrants. If the aggregate capital raised is less than $50.0 million, an additional 1,203,315 (*14.85%) sponsor shares will be forfeited.

- Transaction is expected to be supported by PIPE of $50.0 million at $10.0 per share.

- No minimum cash condition.

- Business combination transaction is targeted to close in the third quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.33 warrant

- #Cash in Trust: $69,405,841 (102.2% of Public Offering)

- Public Shares Outstanding: 6,794,168 shares

- Private Shares Outstanding: 8,102,103 shares (including Director 80,000 founder shares)

- Reported Trust Value/Share: $10.22

- Liquidation Date: September 14, 2022

- Current Liquidation Date: February 14, 2023

- Outside Liquidation Date: March 14, 2023

- Name of Target: Cheche Technology Inc.

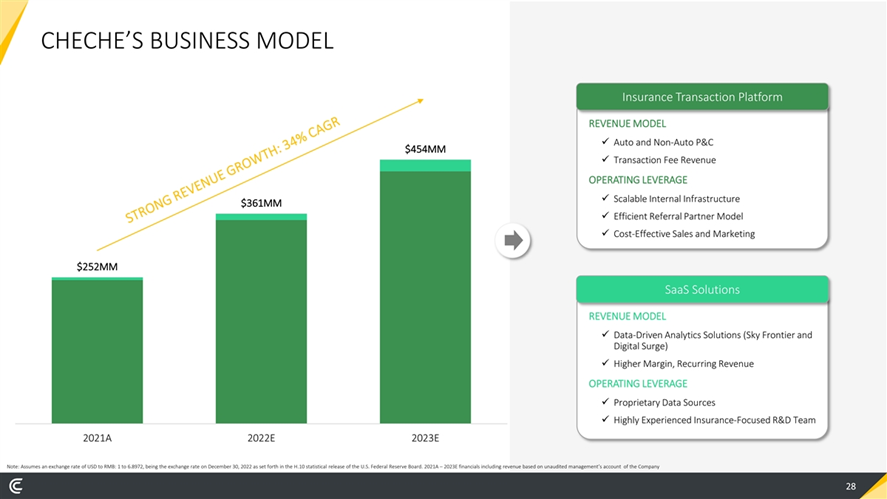

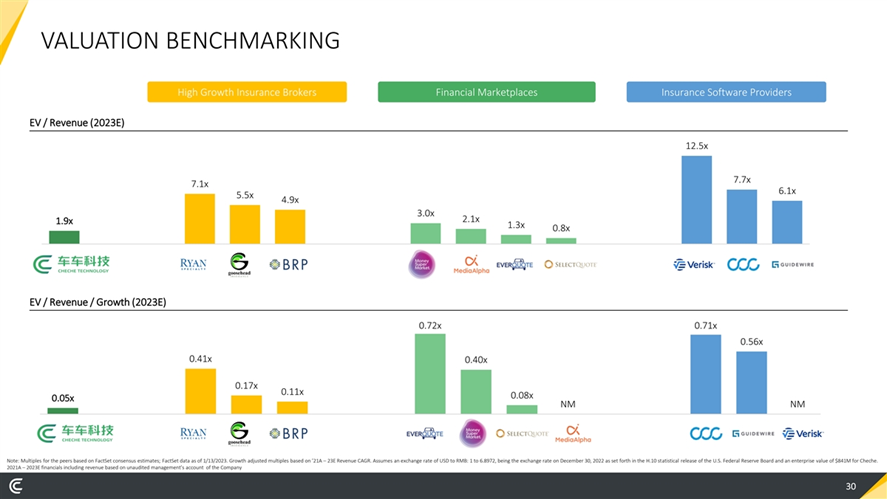

- Description of Target: Established in 2014 and headquartered in Beijing, China, Cheche Technology is a leading auto insurance technology platform, with a nationwide network of around 110 branches licensed to distribute insurance policies across 24 provinces, autonomous regions and municipalities in China. Capitalizing on its leading position in auto insurance transaction services, Cheche Technology has evolved into a comprehensive, data-driven technology platform that offers a full suite of services and products for digital insurance transactions and insurance SaaS solutions in China.

- Announced Date: January 30, 2023

- Expected Close: “Third Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1819175/000119312523018460/d431429dex991.htm

- Transaction Terms (https://content.bamsec.com/0001193125-23-018460/g431429ex99_3p31g1.jpg):

- Enterprise Value: $841.0 million

- Market Cap Value: $933.0 million

- SPAC Public Shareholders Receive (~7.3%):

- *6,794,168 Surviving Company Class A Ordinary Shares (1 for 1)

- SPAC Sponsor Receive:

- *4,341,052 Surviving Company Class A Ordinary Shares (1 for 1)

- Target Shareholders Receive (~81.4%):

- Equity Consideration of $760 million (*76.0 million shares of common stock at $10.00 per share)

- PIPE / Financing:

- May enter a PIPE Subscription Agreement of $50.0 million at $10.0 per share

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Forfeiture:

- 2,557,736 (*31.57%) Founder Shares + 2,860,561 (*50.00%) Private Warrants

- 3,761,051 (*46.42%) Founder Shares + 2,860,561 (*50.00%) Private Warrants if the Aggregate Capital Raised < $50.0 million

- Aggregate Capital = CIT – Redemptions + PIPE

- Lock-up:

- SPAC Sponsors and Shareholders: 6 months post-closing

- Early release: If price equals or exceeds $12.5 per share after closing

- SPAC Sponsors and Shareholders: 6 months post-closing

- Closing Conditions:

- No Minimum Cash Condition

- Termination date: September 13, 2023

- PCAOB Financials within 75 days of the date of Business Combination Agreement (April 15, 2023)

- Other customary closing conditions

- Termination:

- Standard termination clauses

- Advisors:

- SPAC Financial Advisors: Cohen & Company Capital Markets, a division of J.V.B. Financial Group, LLC

- Target Legal Advisors: Wilson Sonsini

- SPAC International Legal Advisors: Goodwin

- SPAC PRC Legal Advisors: Zhong Lun Law Firm

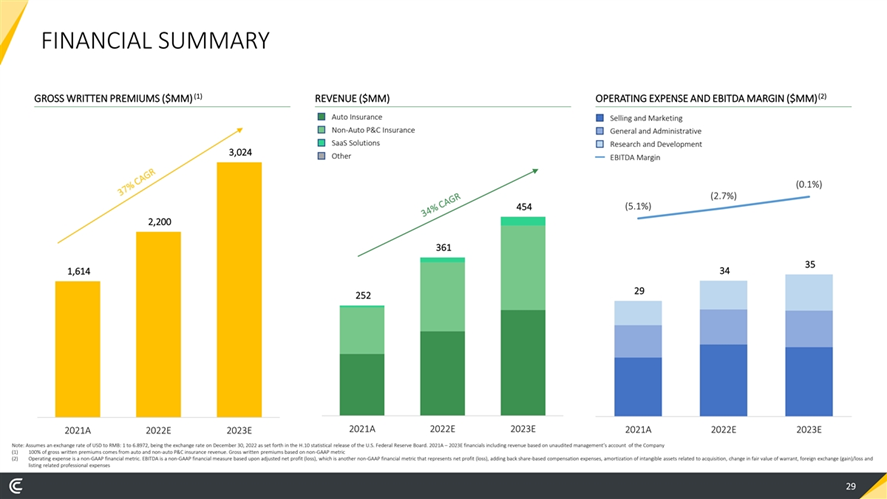

& https://content.bamsec.com/0001193125-23-018460/g431429ex99_3p29g1.jpg ):

- Equity Incentive Plan

- 10.0% of shares outstanding post-closing

*Denotes estimated figures by CPC

#Reported as on September 30, 2022