October 6, 2022

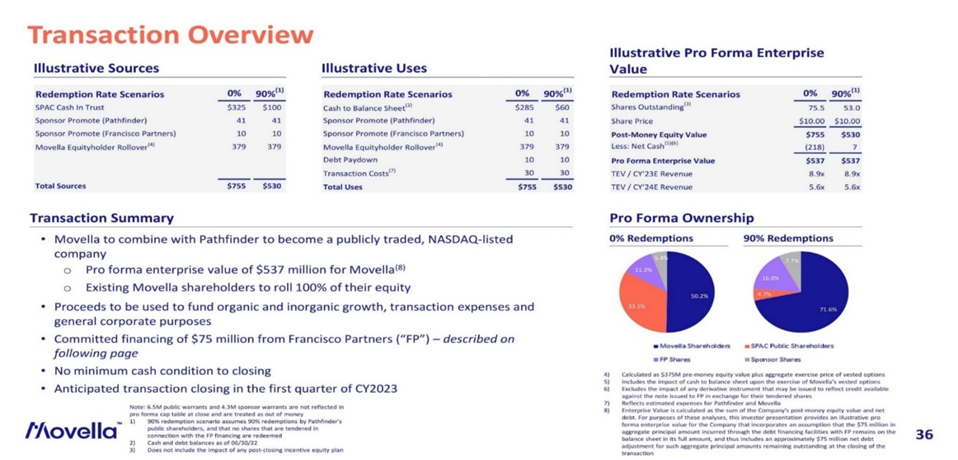

- Pathfinder Acquisition Corporation (PFDR) to acquire Movella (Private) in a transaction valuing the combined company at pro forma enterprise value of $537 million ($755 million of equity value).

- Movella Shareholders will receive $379 million of equity consideration at$10.00/share.

- Up to $75 million of Pathfinder common stock will be purchased by FP before closing, which will be executed through a tender offer or direct placement of Pathfinder stock. In exchange for a non-redemption agreement for FP’s purchased stock, Movella will issue to FP at closing a 5-year PIK note. Under the terms of the financing, Movella will have the right to direct the sale of FP’s purchased stock into the public market at any time following the closing of transaction until repayment or prepayment of the note, the proceeds of which will provide material credits against the note balance at a repayment or refinancing event.

- Sponsor agreed to forfeit 50% of sponsor shares (or 4,062,500 shares) for no consideration.

- No minimum cash condition.

- The business combination is expected to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.20 Redeemable Warrant

- #Cash in Trust: $325,243,799 (100.1% of Public Offering)

- Public Shares Outstanding: 32.5 million

- Private Shares Outstanding: 8.125 million

- Reported Trust Value/Share: $10.01

- Liquidation Date: February 19, 2023

- Name of Target: Movella

- Target Description: Movella is a leading full-stack provider of sensors, software, and analytics that enable the digitization of movement. Movella serves the entertainment, health & sports, and automation & mobility markets. Our innovations enable our customers to capitalize on the value of movement by transforming data into meaningful and actionable insights. Partnering with leading global brands such as Electronic Arts, EPIC Games, NBC Universal, Netflix, Daimler, Siemens, and over 500 sports organizations, Movella is creating extraordinary outcomes that move humanity forward.

- Announced Date: October 4, 2022

- Expected Close: “First Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1839132/000121390022061537/ea166626ex99-1_pathfin.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1839132/000121390022061537/ex99-2_036.jpg):

| Redemption Rate | 0% | 90% |

| Enterprise Value | $537 million | $537 million |

| Post-Money Market Cap Value | $755 million | $530 million |

| TEV/ 2023E Revenue | 8.9x | 8.9x |

| TEV/ 2024E Revenue | 5.6x | 5.6x |

- Target Shareholders Receive:

- $379 million of Equity Consideration (including aggregate exercise price of vested options)

- PIPE / Financing:

- $75 million of committed financing by FP Credit Partners (affiliate of Francisco Partners)

- 7.5 million SPAC Class A ordinary shares (called “FP Shares”) at $10.00/share

- FP have committed to launch a tender offer for the purchase of up to $75 million of Pathfinder’s Class A ordinary shares and if it is less than $75 million at closing, the difference will be privately purchased from SPAC in the form Post-Closing Common Shares

- The funds attributable to the “FP Shares” will be retained in SPAC’s trust by virtue of non-redemption agreement and the Target in exchange will issue $75 million Ventured Linked Secured Note (VLN Facility) to FP at closing:

- Payment in Kind

- Matures in 5 years from closing

- Combined Company will have Unilateral Right to direct the sale of FP’s purchased stock into the public market over the life of VLN Facility

- Secured by Target’s assets or Combined company’s assets post-closing

- $75 million of committed financing by FP Credit Partners (affiliate of Francisco Partners)

- The Commitment Letter also contemplates the issuance of 1 million common shares by SPAC to FP (or certain of its affiliates) conditioned upon the merger & the full deemed funding of the VLN Facility

- No provisions to issue additional shares to FP after closing

- $25 million of Senior Secured Note (Pre-closing Facility)

| If advanced, it would be available to Target for: Working capitalTo refinance certain existing debt of Target, To pay transaction costs and expenses Other general corporate purposes | If deemed advanced, the VLN Facility will be comprised of the aggregate amount of the Tender Offer and the Private Placement and would refinance the Pre-Close Facility and be available for other general corporate purposes. |

| Interest: 9.25% p.a. | Interest: SOFR + 9.25% p.a. and paid in kind |

| If the VLN Facility is paid or prepaid, combined company is required to pay an amount equal to the greater: Principal balance being paid or prepaid + Accrued and Unpaid Interest a minimum agreed contractual return that increases in each year | |

| Pre-Close Facility and the VLN Facility will be secured by substantially all of Target’s and certain of its subsidiaries’ assets and by combined company (after the Closing) | |

- Second Amended and Restated Working Capital Note:

- Unsecured Promissory Note issued by SPAC to Sponsor:

- Bears no interest

- Due & payable upon earlier of April 30, 2023 or Date of merger

- Repayable at anytime

- Failure of payments allows the Sponsor to declare the Second Amended and Restated Working Capital Note due and payable and a bankruptcy can automatically trigger the unpaid principal balance (including all other sums payable)

- Unsecured Promissory Note issued by SPAC to Sponsor:

| Issue/Amendment | Date | Maximum Aggregate Principal Amount | Additional Borrowings Allowed |

| Working Capital Note | July 15, 2021 | $500,000 | – |

| Amended and Restated Working Capital Note | May 24, 2022 | $750,000 | $250,000 |

| Second Amended and Restated Working Capital Note | October 3, 2022 | $1,250,000 | $500,000 |

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- 4,062,500 (or 50%) of Sponsor shares shall be forfeited

- Lock-up:

- SPAC Sponsors, Legacy SPAC Holders & Francisco Partners: 365 days post-closing

- Early Release: If equal or above $12.00 per share after 150 days post-closing

- Target shareholders: 180 days post-closing

- SPAC Sponsors, Legacy SPAC Holders & Francisco Partners: 365 days post-closing

- Closing Conditions:

- Termination date: April 30, 2023

- Receipt of funding from FP Credit Partners (& its affiliates)

- No minimum cash condition

- Other customary closing conditions

- Termination:

- No termination fees

- Standard termination clauses

- Advisors:

- Target Financial Advisors: Stifel

- SPAC Advisors: Kirkland & Ellis LLP

- Target Advisors: Pillsbury Winthrop Shaw Pittman LLP

- Francisco Partners Advisor: Latham & Watkins LLP

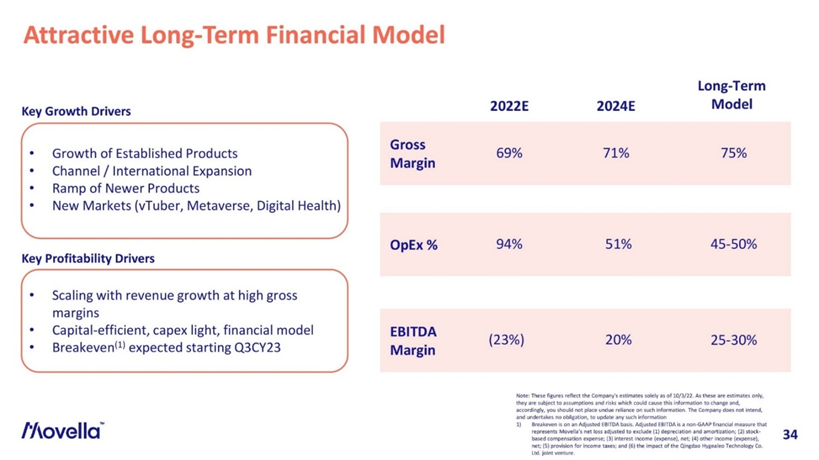

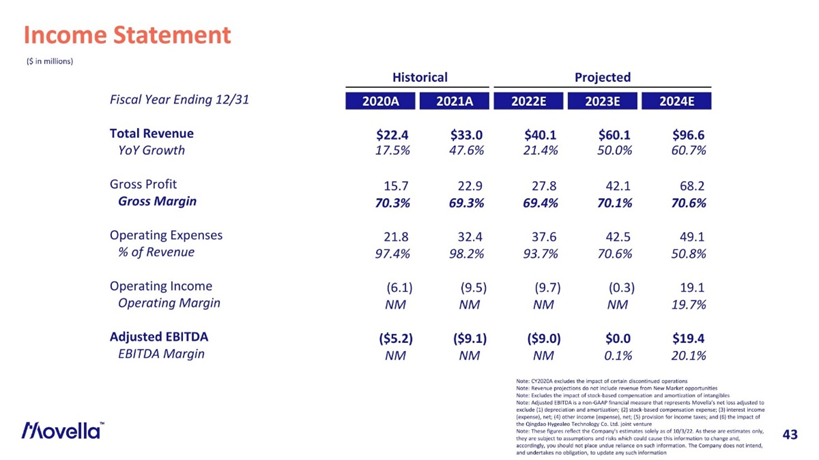

- Financials (https://www.sec.gov/Archives/edgar/data/1839132/000121390022061537/ex99-2_034.jpg & https://www.sec.gov/Archives/edgar/data/1839132/000121390022061537/ex99-2_043.jpg):

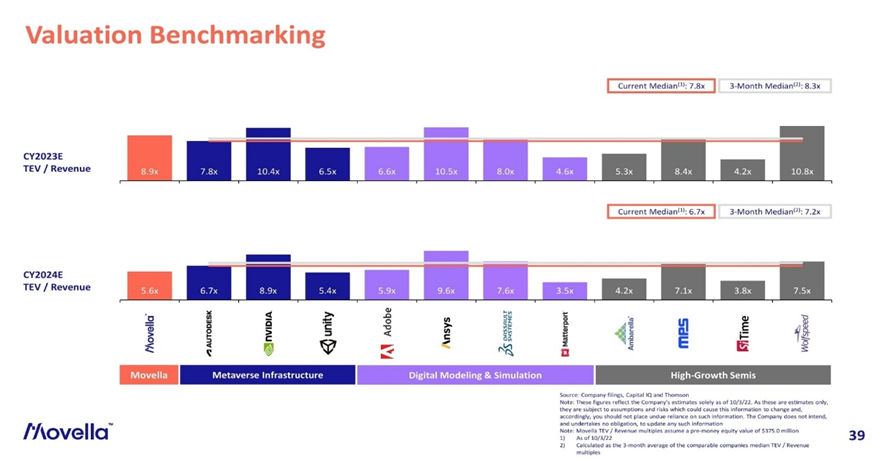

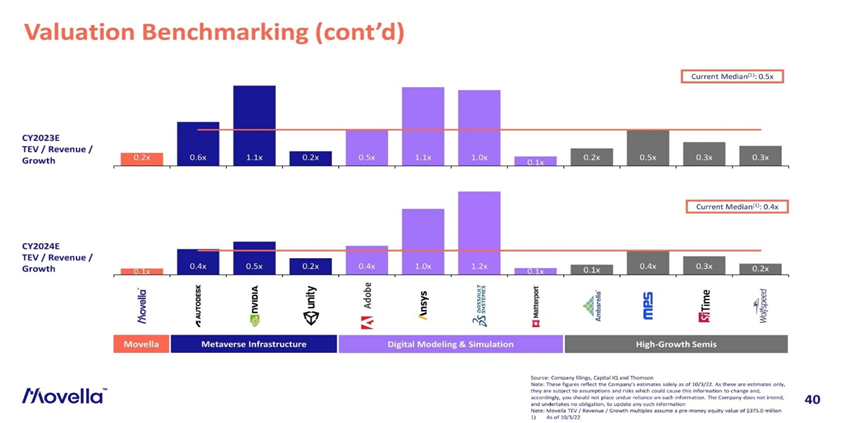

- Comparables (https://www.sec.gov/Archives/edgar/data/1839132/000121390022061537/ex99-2_039.jpg & https://www.sec.gov/Archives/edgar/data/1839132/000121390022061537/ex99-2_040.jpg):

- Equity Incentive Plan

- Up to 12% of shares outstanding post-closing

- Includes annual increase (for a period of not more than 10 years beginning on January 1, 2023 & ending on January 1, 2032) of:

- 5% of the total number of Shares outstanding OR

- the number of shares (including zero) determined by Board/Committee

*Denotes estimated figures by CPC

#Reported as on June 30, 2022