October 8, 2022

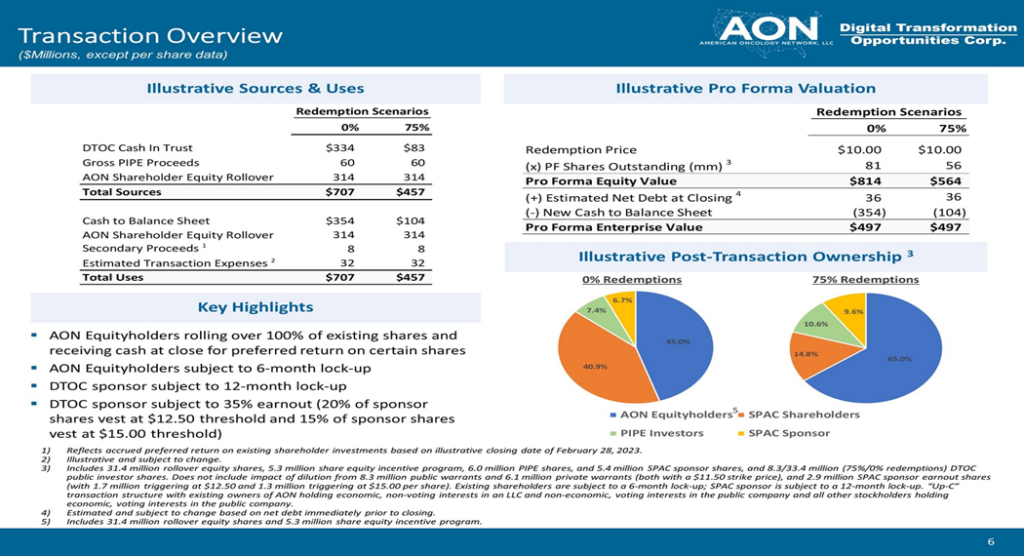

- Digital Transformation Opportunities Corp. (DTOC) to acquire American Oncology Network (private) in a transaction valuing the pro forma entity at $497 million in Enterprise Value ($814 million equity value) assuming zero redemptions.

- Existing AON equity holders will roll over 100% of their equity in AON.

- DTOC is expected to raise $60 million in Preferred Stock PIPE which can go further up to $100 million.

- 2,918,125 Sponsor Shares (or 35%) are subject earnout provisions at $12.50 and $15.00/share.

- Minimum gross cash condition of $60 million.

- Agreement provides for a termination fee of $18 million payable to DTOC in case AON enters into definitive agreement with another party & reimbursement of expenses to AON if DTOC fails to close the transaction.

- Business combination transaction is targeted to close in the first half of 2023.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.25 Redeemable Warrant

- #Cash in Trust: $335,530,659 (100.6% of Public Offering)

- Public Shares Outstanding: 33,350,000 shares

- Private Shares Outstanding: 8,337,500 shares

- Reported Trust Value/Share: $10.06

- Liquidation Date: March 12, 2023

- Name of Target: American Oncology Network

- Target Description: The American Oncology Network, LLC (AON) is an alliance of physicians and seasoned healthcare leaders partnering to ensure the long-term success of community oncology. Launched in 2018, the rapidly expanding AON network represents 107 physicians practicing across 18 states. The executive management team of AON encompasses members with an average of more than three decades of oncology practice management experience, enabling physicians to focus on what matters most — providing the highest quality care for patients.

- Announced Date: October 6, 2022

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1839998/000110465922106540/tm2227227d1_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1839998/000110465922106540/image_006.jpg):

| Redemption Rate | 0% | 75% |

| Enterprise Value | $497 million | $497 million |

| Post-Money Market Cap Value | $814 million | $564 million |

- Target Shareholders Receive:

- AON Equity Holders (Up-C Structure):

- $314 million of Equity Consideration rolling 100% of existing shares (Economic, but Non-Voting Interest)

- AON Unitholders (Class A, Class A-1, Class B) will convert their units to new AON Common Units

- AON Class A, Class A-1 Unitholders to receive preferred return in cash

- 31.4* million AON Common Units convertible on 1-for-1 to DTOC Class A common stock

- 31.4* million DTOC Class B Common Stock (Non-Economic, but Voting interest)

- $314 million of Equity Consideration rolling 100% of existing shares (Economic, but Non-Voting Interest)

- AON Equity Holders (Up-C Structure):

- PIPE / Financing:

- Expected to raise $60 million of Preferred Stock PIPE @10/share (Upper limit: $100,000,000 before closing)

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Sponsor Earn-out: Total of 35% or 2,918,125 Sponsor Shares (60 months after closing)

- 20% or 1,667,500 Sponsor Shares @ $12.50

- 15% or 1,250,625 Sponsor Shares @$15.00

- Lock-up:

- SPAC Sponsors (including Earn-out shares): 12 months post-closing

- Target shareholders: 6 months post-closing

- Closing Conditions:

- Termination date: October 5, 2023 (With extension)

- Gross minimum cash condition of $60 million

- Other customary closing conditions

- Termination:

- Target Termination Fee of $18 million (Payable to SPAC Sponsor if termination is due to target’s entry into a definitive agreement with another party)

- Becomes payable on the earlier of: (a) the date after 6 months of the termination date and (b) the date on which the alternative transaction is completed by Target

- Reimbursement of Legal & Accounting Expenses (to Target due to SPAC’s failure to close the transaction)

- Other standard termination clauses

- Target Termination Fee of $18 million (Payable to SPAC Sponsor if termination is due to target’s entry into a definitive agreement with another party)

- Advisors:

- Target Legal Advisors: Woolery & Co. PLLC and Dentons US LLP

- SPAC Legal Advisors: Paul Hastings LLP

- Comparables (N/A):

- No Valuations provided

- Equity Incentive Plan:

- Up to 5.3 million of shares outstanding post-closing

- Automatic share reserve increase of (a) 5% or (b) a lesser number of shares determined by Administrator

*Denotes estimated figures by CPC

#Reported as on September 30, 2022