October 27, 2022

- Yotta Acquisition Corporation (YOTA) to acquire NaturalShrimp (OTCQB: SHMP) in a transaction valuing the pro forma entity at $275 million in Enterprise value (*$387.90 million of equity value).

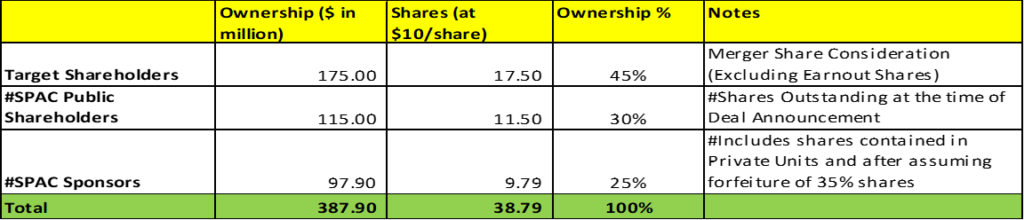

- NaturalShrimp shareholders will receive $175 million of merger consideration at $10.0/share.

- NaturalShrimp shareholders will also receive 10.0 million earnout shares if combined company meets or exceeds either of two annual revenue thresholds of $15.0 million (2024) and $30.0 million (2025).

- Sponsor agreed to forfeit 35% shares at closing which shall be issued to YOTA shareholders entering into a non-redemption agreement.

- No minimum cash condition.

- Agreement includes Bilateral Breakup fee of $3.00 million.

- Business combination transaction is targeted to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 Redeemable Warrant + 1 Right

- #Cash in Trust: $115,658,994 (100.6% of Public Offering)

- Public Shares Outstanding: 11,500,000 shares

- Private Shares Outstanding: 15,061,999 shares (including 343,500 shares contained in Units)

- Reported Trust Value/Share: $10.06

- Liquidation Date: January 22, 2023

- Name of Target: NaturalShrimp

- Description of Target: NaturalShrimp, Incorporated is a publicly traded aquaculture Company, headquartered in Dallas, with production facilities located near San Antonio, Texas and Webster City, Iowa. The Company has developed the first commercially viable system for growing shrimp in enclosed, salt-water systems, using patented technology to produce fresh, naturally grown shrimp, without the use of antibiotics or toxic chemicals. NaturalShrimp systems can be located anywhere in the world to produce gourmet-grade Pacific white shrimp.

- Announced Date: October 25, 2022

- Expected Close: “first Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1907730/000182912622018217/yottaacq_ex99-1.htm

- Transaction Terms (N/A):

- Enterprise Value: $275 million (assuming no redemptions)

- Market Capitalization: *$387.90 million

- Target Shareholders Receive:

- 17.5 million common shares of SPAC at $10.00/share

- 10.0 million earnout shares of SPAC (2 years after closing)

| No of Earnout shares | Current Valuation | Revenue equals or exceeds | |

| 5.00 million shares | $50.0 million | $15.0 million | March 31, 2024 |

| 5.00 million shares | $50.0 million | $30.0 million | March 31, 2025 |

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Sponsor to forfeit 35% shares (*5,271,700 shares) at Closing and

- Equal number of shares shall be issued to existing SPAC stockholders that execute non-redemption agreements on a pro rata basis based on the total number of shares represented by SPAC stockholders that execute such agreements

- Lock-up:

- SPAC Sponsor: 6 months post-closing

- Target shareholders: 6 months post-closing

- Closing Conditions:

- Termination date: July 22, 2023 (October 22, 2023 with extension)

- No minimum cash condition

- Sponsor will enter into a Sponsor Forfeiture Agreement:

- to forfeit 35% of sponsor shares at closing

- to issue equal number of shares to SPAC existing shareholders that execute non-redemption agreements (on a pro rata basis)

- Dissenting Shares not to exceed 5% of the issued & outstanding shares of Target

- Other customary closing conditions

- Termination:

- Breakup Fee: Valid termination of agreement by one party will lead to a payment of $3.00 million (plus interest) by the other party

- Other standard termination clauses

- Advisors:

- SPAC Financial Advisor: Chardan

- Target Advisors: Joseph Gunnar & Co., LLC and Roth Capital Partners, LLC

- SPAC Legal Advisors: Loeb & Loeb LLP

- Target Legal Advisors: Lucosky Brookman LLP

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No Valuations provided

*Denotes estimated figures by CPC

#Reported as on September 30, 2022