November 1, 2022

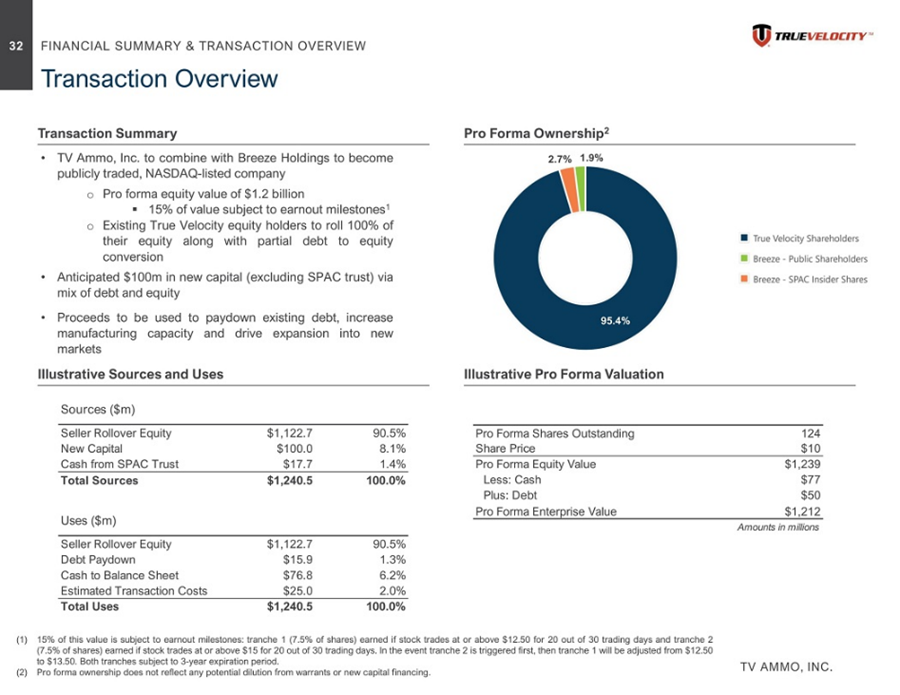

- Breeze Holdings Acquisition Corp. (BREZ) to acquire TV Ammo (True Velocity) (private) in a transaction valuing the pro forma entity at $1.21 billion in Enterprise Value ($1.24 billion equity value assuming minimum cash condition met).

- TV Ammo (True Velocity) shareholders will receive 118.52* million shares of BREZas merger consideration along with 16.28* million earnout shares.

- 16.28* million sponsor shares are subject to earn-out provisions at $12.50 and $13.50/share.

- TV Ammo is expected to raise $100.00 million of the permitted financing.

- Minimum net cash condition of $30 million.

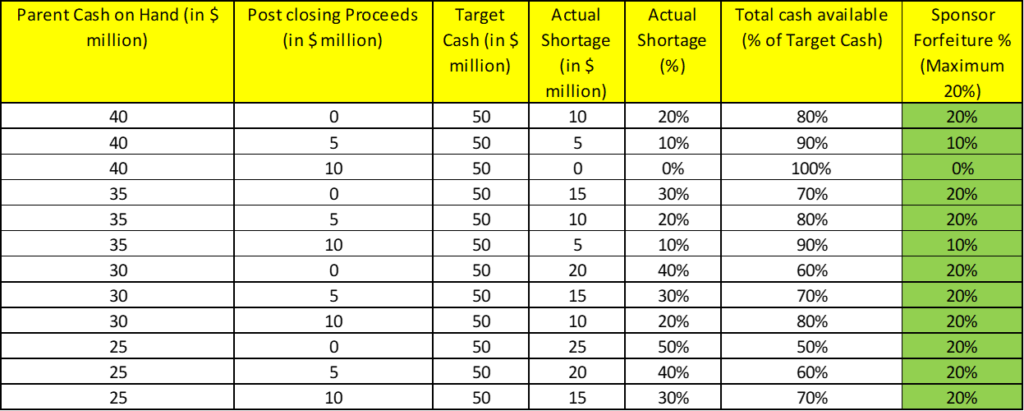

- Sponsor agrees to forfeit up to 20% of founder shares depending on the shortfall of cash delivered relative to target of $50 million.

- Up to $1 million expense reimbursement to BREZ if the transaction is terminated due to failure to obtain TV Ammo shareholder approval or TV Ammo breach of reps & warranties.

- Business combination transaction is targeted to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock+ 1 right + 1 redeemable warrant

- *#Cash in Trust: $17,612,655 (104.2% of Public Offering) – Assumes 1 additional trust deposit for October Extension

- Public Shares Outstanding: 1,690,196 shares

- Private Shares Outstanding: 2.875 million shares

- Reported Trust Value/Share: $10.42

- Original Liquidation Date: November 26, 2021

- Current Liquidation Date: November 26, 2022

- Liquidation Outside Date: March 26, 2023

- Name of Target: TV Ammo (True Velocity)

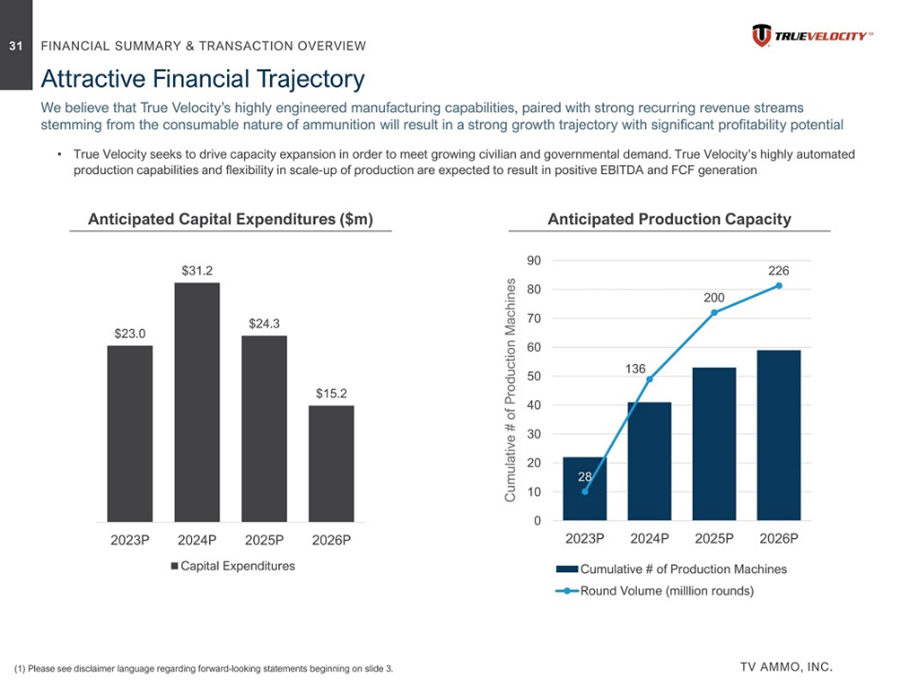

- Description of Target: Founded in 2012 True Velocity is delivering real innovation to the ammunition industry through proprietary processes, superior services, and unmatched products. True Velocity’s composite cartridges are a step toward the future of national defense, self-defense, hunting, and sport shooting and are a critical component of force modernization for defense agencies worldwide. Approximately 30 percent lighter than traditional brass-cased cartridges, True Velocity’s composite-cased ammunition provides significant shipping and logistical cost savings, while also delivering improved accuracy, enhanced efficiency, unprecedented consistency, and reduced supply chain risk. With approximately 300 patents pending or issued on its products, technology, and manufacturing processes, True Velocity is on a mission to produce the best ammunition in the world.

- Announced Date: November 1, 2022

- Expected Close: “First Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1817640/000121390022067959/ea167651ex99-1_breezehold.htm

- Transaction Terms (https://content.bamsec.com/0001213900-22-067959/ex99-2_032.jpg )

- Diluted Enterprise Value: $1.21 billion

- Market Cap Value: $1.24 billion (assuming min net cash condition met)

- Target Shareholders Receive:

- $1,185 million of equity consideration (118.52 million shares of Breeze Common Stock at $10.00 per share)

- 16,278,518 Earnout Shares of Breeze Common Stock (3 years after closing)

- 8,139,259 shares @ $12.50 per share

- 8,139,259 shares @ $15.00 per share

- PIPE / Financing:

- Expected to raise $100 million of the “Permitted Financing”

- Redemption Protections:

- If closing cash is less than $30 million, Breeze will have the right to:

- Enter into subscription agreements (at $10.00 per share) for the deficit amount

- Or

- Enter into agreements to incentivize Redeeming Shareholders to either unwind their exercise of Redemption Right

- If closing cash is less than $30 million, Breeze will have the right to:

- Support Agreement:

- Standard voting support

- Forfeiture: Up to *0.575 million Founder Shares (or 20%) if the sum of Breeze’s cash on hand at closing and funds raised via ATM (or similar facility) by Breeze within six months following the Closing is less than $50 million

- Forfeiture % = 1- [(Parent Cash on Hand + Post-Closing Proceeds)/$50 million]

- Maximum shares that can be forfeited are 20% (in case of shortage above $10 million)

- Lock-up:

- SPAC Sponsors, Other holders of founder shares and Key Target Shareholders: 8 months post-closing

- Early Release Period: after four-months from Closing Date

- First Tranche: 10% of the Lock-Up Shares held by each Stockholder if shares ≥ $12.50

- Second Tranche: additional 10% of the Lock-Up Shares if shares ≥ $15.00

- Closing Conditions:

- Termination date: April 28, 2023

- Minimum net cash condition of $30 million

- Cash includes:

| Cash in Trust | |

| Add: | Permitted Financings |

| Less: | Redemptions |

| Less: | Transaction expenses |

- Other customary closing conditions

- Termination:

- $1 million, of the Expense Reimbursement by TV AMMO to Breeze Holdings Acquisition Corp. if termination is due to:

- TV Ammo failure to obtain shareholder approval

- TV Ammo breach of reps & warranties

- No termination fees

- Other standard termination clauses

- $1 million, of the Expense Reimbursement by TV AMMO to Breeze Holdings Acquisition Corp. if termination is due to:

- Advisors:

- Target Financial Advisors: Stout Capital, LLC

- SPAC Financial Advisors: I-Bankers Securities, Inc.

- Target Legal Advisors: Lathrop GPM LLP and Shearman & Sterling LLP

- SPAC Legal Advisors: ArentFox Schiff LLP and Woolery & Co. PLLC

- Target M&A Advisors: IB Capital LLC

- SPAC Fairness Opinion Providers: Marshall & Stevens Transaction Advisory Services LLC

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- 10% of pro forma equity

- Includes 3% evergreen provision for annual automatic increase

*Denotes estimated figures by CPC

#Reported as on September 15, 2022