November 2, 2022

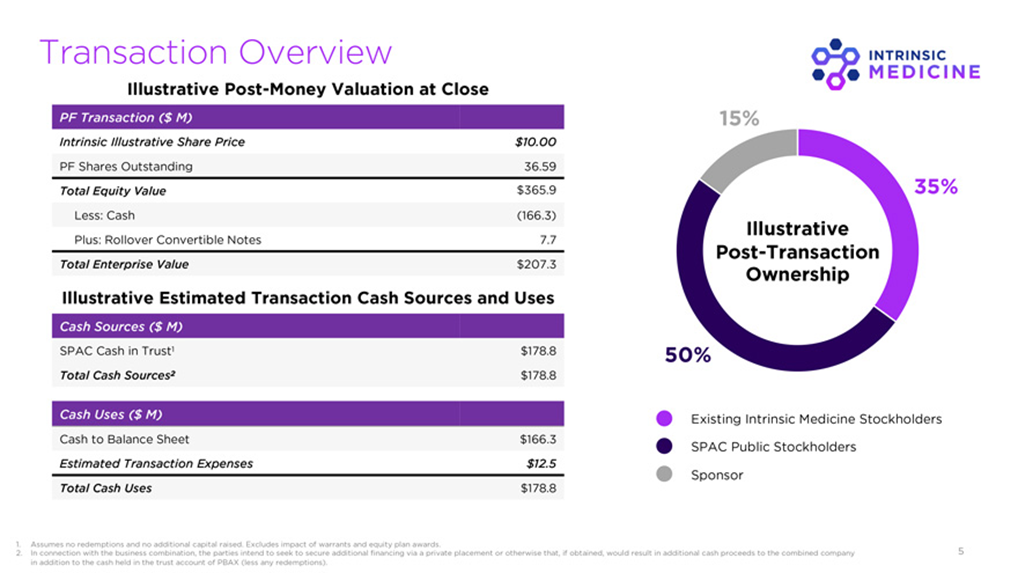

- Phoenix Biotech Acquisition Corps. (PBAX) to acquire Intrinsic Medicine, Inc. (private) in a transaction valuing the pro forma entity at $207.3 million in Enterprise Value ($365.9 million equity value assuming minimum cash condition met).

- Intrinsic shareholders will receive 13.6 million shares of PBAXas merger consideration

- Minimum net cash condition of $15 million.

- No termination fee.

- Business combination transaction is targeted to close in the first half of 2023.

- SPAC Details:

- Unit Structure: 1 share of Class A Common Stock + 0.5 Redeemable Warrant

- #Cash in Trust: $178,791,405 (102.2% of Public Offering)

- Public Shares Outstanding: 17.5 million shares

- Private Shares Outstanding: 4.6 million shares plus 0.885 million private units

- Reported Trust Value/Share: $10.22

- Liquidation Date: January 8, 2023

- Outside Liquidation Date: January 8, 2023

- Name of Target: Intrinsic Medicine, Inc.

- Description of Target: Intrinsic Medicine, Inc. is a preclinical-stage therapeutics company leveraging synthetic biology-manufactured human milk oligosaccharides (HMOs), as new medicines to treat large patient populations underserved by current treatment options. In the first half of 2023, Intrinsic plans to initiate a Phase 2 clinical trial under an approved protocol in Australia using FDA recommended primary end points to test its lead drug candidate in over 400 patients with the constipation dominant form of irritable bowel syndrome (IBS), which is estimated to affect approximately five million patients in the United States alone.

- Announced Date: Oct 31, 2022

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1870404/000119312522273358/d417140dex991.htm

- Transaction Terms (https://content.bamsec.com/0001193125-22-273358/g417140dsp005.jpg)

- Diluted Enterprise Value: $207.3 million

- Market Cap Value: $365.9 million (assuming min cash condition met)

- Target Shareholders Receive:

- Intrinsic Medicine common stock = $136 million = 13.6 million PBAX shares

- No earn-out

- PIPE / Financing:

- No PIPE financing

- Redemption Protections:

- No redemption protections

- Support Agreement:

- Standard voting support

- Forfeiture: None

- Lock-up:

- SPAC Sponsors (Founder shares only): 6 months post-closing, early release 1-month if over $12.50/share

- Target Security holders: Same as SPAC sponsor

- Closing Conditions:

- Net Minimum Cash Condition: $15 Million

- Cash includes: Cash From Trust + PIPE financing – Redemptions – expenses

- Termination date: June 30, 2023

- Other customary closing conditions

- Net Minimum Cash Condition: $15 Million

- Termination:

- Standard termination clauses

- Advisors:

- SPAC Lead Placement Agent: Spartan Capital Securities LLC

- Target Financial Advisors: Revere Securities LLC

- SPAC Financial Advisors Cohen and Company Capital Markets .

- Target Legal Advisors: Ropes & Gray LLP

- SPAC Legal Advisors: Goodwin Procter LLP

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- Reserved 3,000,000 shares outstanding post-closing

- Includes evergreen provision for annual automatic increase of 5% (for a period of 10 years)

*Denotes estimated figures by CPC

#Reported as on November 10, 2022