November 3, 2022

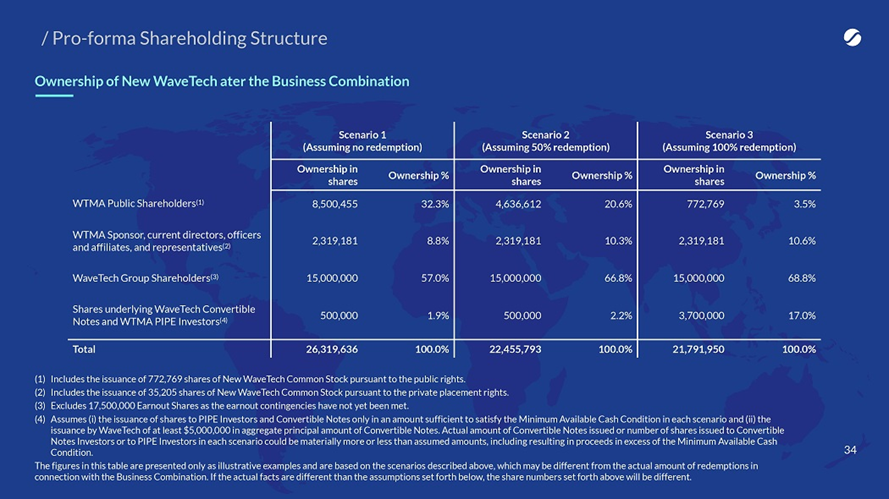

- Welsbach Technology Metals Acquisition Corp (WTMA) to acquire WaveTech Group (private) in a transaction valuing the pro forma entity at $228 million in Enterprise Value ($263.20 million equity value).

- WaveTech Group shareholders will receive 15 million shares of WTMAas merger consideration along with 17.5 million earnout shares.

- Transaction conditioned on WaveTech Group (not WMTA) raising at least $5,000,000 before the later of December 31, 2023, and the definitive S-4 filing.

- Minimum net cash condition of $25 million.

- Business combination transaction is targeted to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 ordinary share + 1 right to receive 1/10 of a share of common stock

- #Cash in Trust: $77,388,998 (100.1% of Public Offering)

- Public Shares Outstanding: 7,727,686 shares

- Private Shares Outstanding: 2,283,976 shares (including 352,054 shares contained in Private Units)

- Reported Trust Value/Share: $10.01

- Liquidation Date: September 30, 2022

- Outside Liquidation Date: March 30, 2022

- Name of Target: WaveTech Group

- Description of Target: WaveTech is a technology company specializing in next-generation battery-enhancing technologies. WaveTech has a strong portfolio of technologies and a robust scientific foundation that allows the Company to substantially enhance all aspects of a battery’s life cycle; from production, use and maintenance, to its eventual recycling — improving overall performance, quality and costs. A perfect solution for energy storage applications. WaveTech is a Delaware corporation with operations in the U.S., Germany, Bulgaria and Turkey.

- Announced Date: November 1, 2022

- Expected Close: “First Quarter of 2023”

- Press Release: https://www.bamsec.com/filing/121390022067955/6

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1866226/000121390022075496/ex99-1_033.jpg and https://www.sec.gov/Archives/edgar/data/1866226/000121390022075496/ex99-1_034.jpg ):

- Enterprise Value: $228 million

- Equity Value Value: $263.20 million

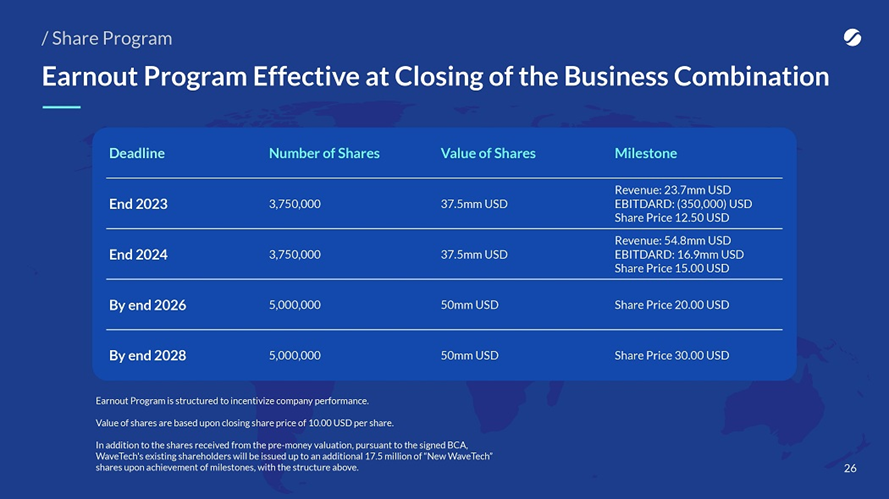

- Target Shareholders Receive (https://www.sec.gov/Archives/edgar/data/1866226/000121390022075496/ex99-1_026.jpg):

- $150 million of equity consideration at $10.00/share

- 17.5 million Earnout Shares of Combined Company

| Number of WTMA Common Stock | Earnout Milestone | Earnout Period |

| 3.75 million shares | (a) 2023 Revenue ≥ $23.7 million and 2023 EBITDARD≥$(0.35) million; or (b)Price ≥ $12.50/share | (a) For the year ended 2023; or (b) Post-closing till December 31, 2023 |

| 3.75 million shares | (a) 2023 Revenue ≥ $54.8 million and 2023 EBITDARD≥$16.9 million; or (b)Price ≥ $15.00/share | (a) For the year ended 2024; or (b) From January 1, 2024 to December 31, 2024 |

| 5.00 million shares | Price ≥ $20.00/share | Post-closing till December 31, 2026 |

| 5.00 million shares | Price ≥ $30.00/share | Post-closing till December 31, 2028 |

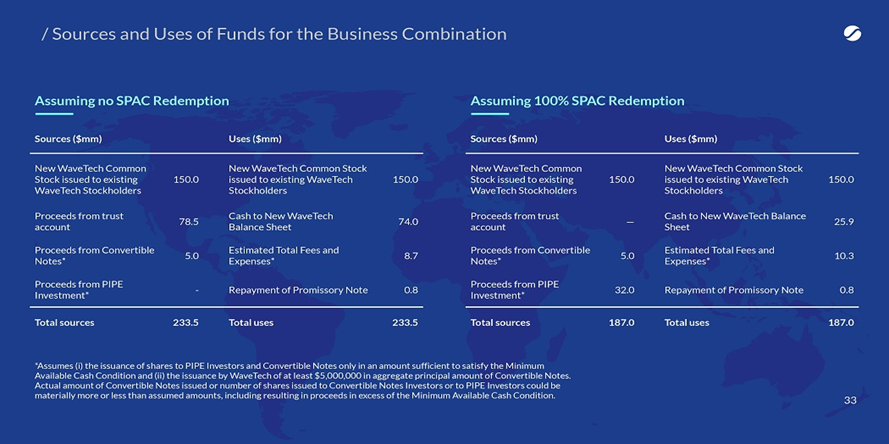

- PIPE / Financing:

- Expected to raise:

- Target to raise $5 million in Series B convertible Notes

- PIPE to be raised only if necessary to satisfy minimum cash condition

- Expected to raise:

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors:180 days post-closing

- Early Release: If equals or exceeds $12.50 after closing

- Key Target Shareholders: Same as above

- SPAC Sponsors:180 days post-closing

- Closing Conditions:

- Termination date: March 31, 2023

- Target has not raised at least $5 million in Series B Company Convertible Notes before (a) or (b) whichever is later:

- (a) December 31, 2022 or (b) Date declaring Form S-4 as effective

- Target has not raised at least $5 million in Series B Company Convertible Notes before (a) or (b) whichever is later:

- Net Cash Condition: $25 Million

- Cash includes:

- Termination date: March 31, 2023

| Cash in Trust | |

| Less: | Redemptions |

| Less: | Unpaid SPAC Expenses |

| Less: | Unpaid Target Transaction Expenses (excluding those that requires SPAC consent) |

| Add: | PIPE Financing (if any) |

| Add: | Convertible Promissory Note Financing |

- Other customary closing conditions

- Termination:

- No Termination fees

- Other standard termination clauses

- Advisors:

- SPAC Financial Advisors: Chardan

- Target Legal Advisors: Pryor Cashman LLP

- SPAC Legal Advisors: Cooley LLP

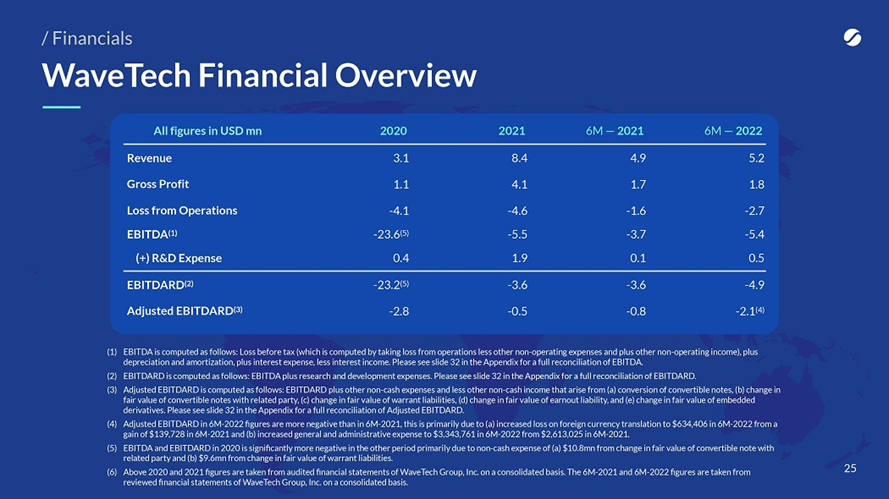

- Financials https://content.bamsec.com/0001213900-22-075496/ex99-1_025.jpg):

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- No information provided

*Denotes estimated figures by CPC

#Reported as on November 21, 2022