November 2, 2022

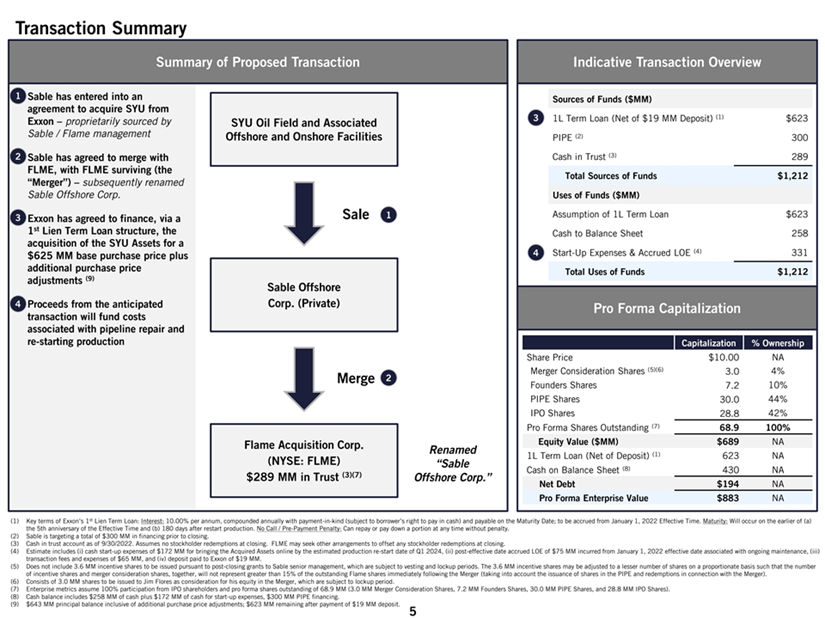

- Flame Acquisition Corp. (FLME) to acquire Sable Offshore (private) in a transaction valuing the pro forma entity at $883 million in Enterprise Value ($689 million equity value assuming no redemptions and $300 million PIPE successfully raised).

- Sable Offshore has already raised $71.5 million that will convert into the FLME PIPE at closing (the “Sable PIPE Investment”).

- In connection with the merger with FLME, Sable Offshore will use proceeds from a 1st Lien loan provided by ExxonMobil to purchase the Santa Ynez Field assets from ExxonMobil.

- Jim Flores, Flame Acquisition CEO and sole owner of Sable Offshore (the target), will receive 3.0 million shares of FLME as consideration for the sale of Sable to Flame.

- Merger agreement does include any cash closing condition.

- No closing timeline provided for the Business combination.

- SPAC Details:

- Unit Structure: 1 ordinary share+ ½ warrant

- #Cash in Trust: $287,703,046 (100.0% of Public Offering)

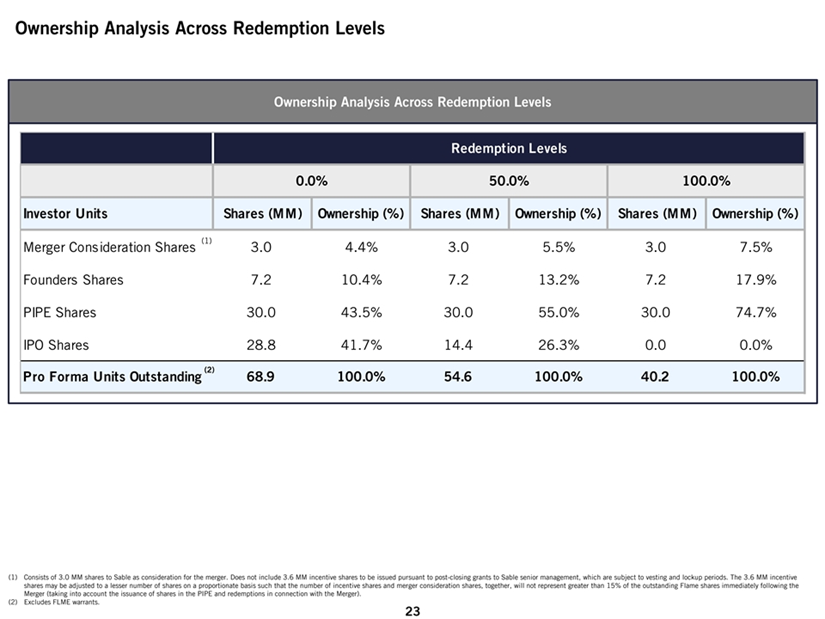

- Public Shares Outstanding: 28.75 million shares

- Private Shares Outstanding: 7.1875 million shares

- Reported Trust Value/Share: $10.01

- Liquidation Date: March 1, 2023

- Name of Target: Sable Offshore

- Description of Target: Sable Offshore is an oil & gas company that has agreed to acquire the Santa Ynez Field and associated assets from ExxonMobil. The Santa Ynez Field is an oil-weighed resource comprising of three offshore platforms located in federal waters off of Santa Barbara, California. The associated assets include wholly owned onshore production treatment facilities.

- Announced Date: November 2, 2022

- Expected Close: None provided

- Press Release: https://www.sec.gov/Archives/edgar/data/1831481/000119312522275898/d403393dex991.htm

- Transaction Terms (https://content.bamsec.com/0001193125-22-275898/g403393ex99_2p6g1.jpg )

- Diluted Enterprise Value: $883 million

- Market Cap Value: $689 million (assuming min cash condition met)

- Target Shareholders Receive:

- Sable common stock = 3 million FLME shares(to Jim Flores) + cash of $623 million (financed by ExxonMobile)

- PIPE / Financing:

- Sable Offshore has raised $71.5 million (7.15 million shares each at $10/share) which will convert to FLME PIPE at closing

- Flame will seek to raise up to $400 million of additional PIPE (inclusive of $71.5 million already raised) on substantially similar terms

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- No Support Agreement

- Lock-up:

- Target shareholders agree to 3-year lock-up (this is the 3 million shares to Jim Flores)

- SPAC sponsor: Standard 1-year post-closing or early release at $12.00 after 150 days

- Closing Conditions:

- No minimum cash condition

- Termination date: June 30, 2023

- Sable-EM Purchase Agreement closes (the asset purchase from ExxonMobil)

- Flame receiving certification from the Bureau of Ocean Energy Management that Flame is qualified to hold offshore oil and gas leases and rights-of-way pursuant to the Outer Continental Shelf Lands Act and applicable regulations

- Other customary closing conditions

- Termination:

- Standard, no termination fee

- Advisors:

- Target Financial Advisors: Cowen and Company, LLC, Intrepid Partners, LLC, and Jefferies LLC

- SPAC Financial Advisors: Petrie Partners Securities, LLC

- Target Legal Advisors: Bracewell LLP

- SPAC Legal Advisors: Latham & Watkins LLP

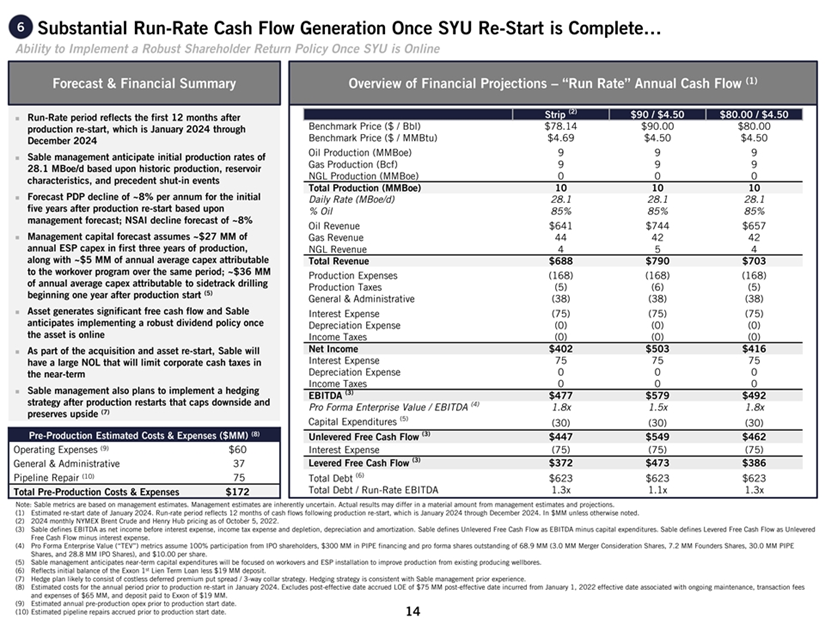

- Financials (https://content.bamsec.com/0001193125-22-275898/g403393ex99_2p15g1.jpg & https://content.bamsec.com/0001193125-22-275898/g403393ex99_2p24g1.jpg ):

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- No Management Equity Incentive Plan

*Denotes estimated figures by CPC

#Reported as on November 14, 2022