November 10, 2022

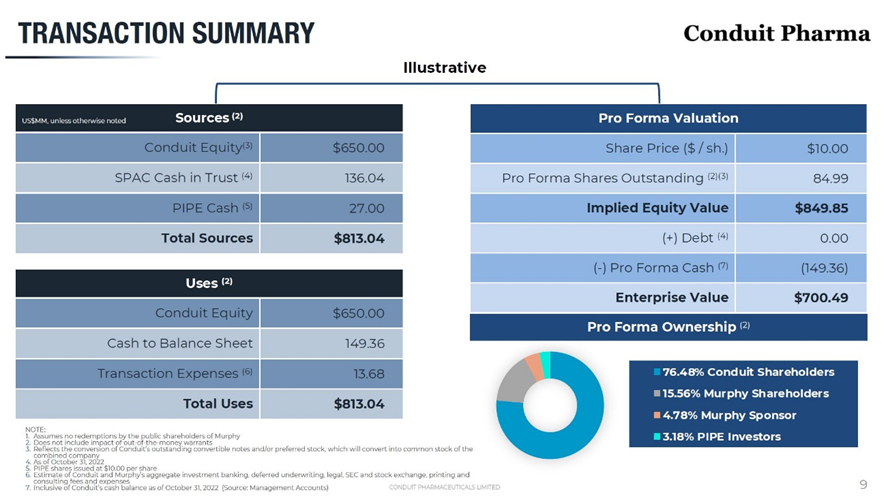

- Murphy Canyon Acquisition Corp. (MURF) to acquire Conduit Pharmaceuticals (private) in a transaction valuing the combined company at an enterprise value of $700.49 million ($849.85 million of equity value).

- Conduit shareholders will receive $650 million of equity consideration at $10.0/share.

- Transaction is supported by $27.0 million PIPE (MURF Units at $10.0/share).

- Minimum gross cash condition of $27.0 million.

- No termination fee or expense reimbursement.

- The business combination transaction is targeted to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 1 redeemable warrant

- #Cash in Trust: $135,706,687 (102.6% of Public Issue)

- Public Shares outstanding: 13,225,000 shares

- Private Shares Outstanding: 4,060,250 shares (including 754,000 shares contained in Units)

- Reported Trust Value/ Share: $10.26

- Liquidation Date: February 7, 2023

- Outside Liquidation Date: August 7, 2023

- Name of Target: Conduit Pharmaceuticals Limited

- Description of Target: Conduit is a clinical stage specialty biopharmaceutical company, addressing unmet medical needs in the areas of autoimmune disease and idiopathic male infertility. The development pipeline includes a glucokinase inhibitor in a number of Phase 2 ready autoimmune diseases including uveitis, Hashimoto’s Thyroiditis, preterm labor and renal transplant. Conduit’s development pipeline also includes a potent, irreversible inhibitor of human Myeloperoxidase (MPO) that has the potential to treat idiopathic male infertility.

- Announced Date: November 8, 2022

- Expected Close: “First Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1896212/000149315222030981/ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1896212/000149315222030981/ex99-2_009.jpg):

- Enterprise Value: $700.49 million

- Equity Value:$849.85 million

- Target Shareholders Receive (~76.48%):

- $650 million of Equity consideration (65 million shares of MURF Class A Common Stock at $10.0/share)

- PIPE / Financing:

- $27 million of PIPE (Units of MURF at $10.0/share)

- 1 Unit = 1 share of Common Stock + 1 redeemable warrant

- Exercise Price of Warrant = $11.5/share

- Exercise Period of Warrant = 5 Years post-closing

- Investor agreed to restrict its ability to exercise the Warrants such that the number of shares held by Investor (and its affiliates) after such exercise does not exceed 4.99% of issued & outstanding shares of MURF Common Stock at that time

- $27 million of PIPE (Units of MURF at $10.0/share)

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors: 180 days post-closing

- Early Release: If price equals or exceeds $12.00 per share after 90 days post-closing

- Key Target Shareholders: 180 days post-closing

- SPAC Sponsors: 180 days post-closing

- Closing Conditions:

- Minimum gross cash condition of $27 million

- Cash includes:

- Minimum gross cash condition of $27 million

| Cash in Trust | |

| Less: | Redemptions |

| Add: | PIPE Financing |

- Termination date: May 31, 2023

- SPAC must agree to a new equity incentive plan with an initial share reserve ≤ 10% of MURF fully diluted common stock post-closing

- Other customary closing conditions

- Termination:

- No termination fees or expense reimbursement

- Standard termination clauses

- Advisors:

- Target Legal Advisors: Thompson Hine LLP

- SPAC Legal Advisors: Sichenzia Ross Ference LLP

- SPAC and Target Financial Advisor: Alliance Global Partners

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No Valuations Provided

- Company Incentive Plan:

- Initial share reserve ≤ 10% of MURF fully diluted common stock post-closing

*Denotes estimated figures by CPC

#Reported as on September 30, 2022