November 16, 2022

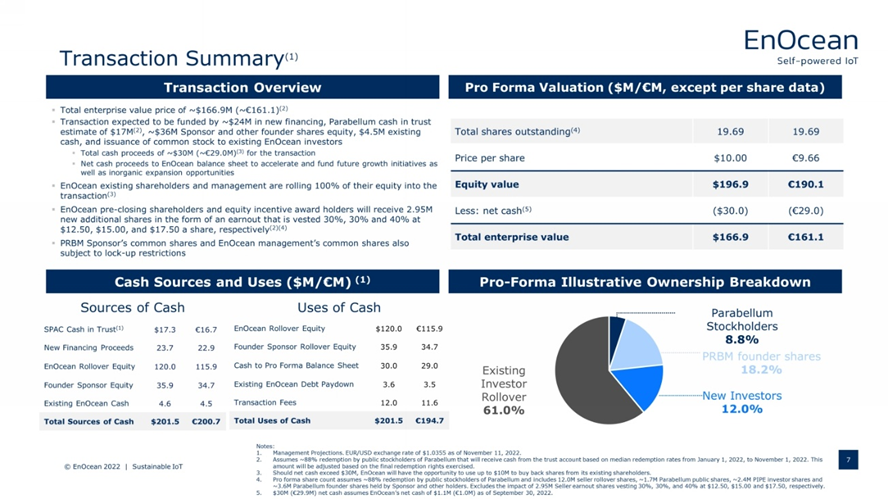

- Parabellum Acquisition Corp. (PRBM) to merge with EnOcean GmbH (private) in a transaction valuing the combined company at an enterprise value of $166.9 million ($196.9 million of equity value).

- EnOcean shareholders will receive $120 million of equity consideration at $10.0/share.

- Transaction includes 15% earnout shares (or 2,953,500 shares) to EnOcean shareholders at $12.5, $15. 0 and $17.5/share.

- Parabellum is intending to raise PIPE investment up to $40.0 million. In the event, the aggregate of PIPE and Cash in Trust (net of redemptions and Parabellum expenses) exceeds $30.0 million, Holdco will have the opportunity to use up to $10.0 million to buy back shares from certain former EnOcean shareholders.

- Sponsors agreed to pay transaction expenses (including deferred underwriting fees) in excess of $12.5 million.

- Minimum net cash condition of $30.0 million.

- No termination fees.

- The business combination transaction is targeted to close in the first half of 2023.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.75 redeemable warrant

- #Cash in Trust: $145,447,559 (101.2% of Public Issue)

- Public Shares outstanding: 14,375,000 shares

- Private Shares Outstanding: 3,593,750 shares

- Reported Trust Value/ Share: $10.12

- Liquidation Date: March 30, 2023

- Name of Target: EnOcean

- Description of Target: EnOcean GmbH is the pioneer of energy harvesting. Headquartered in Oberhaching, near Munich, with its subsidiary in Salt Lake City, UT, the company delivers valuable data for the Internet of Things (IoT) with its resource-saving technology. For more than 20 years, EnOcean has been producing maintenance-free wireless switches and sensors, which gain their energy from the surroundings – from movement, light or temperature. The combination of miniaturized energy converters, ultra-low power electronics and robust radio technology based on open standards (EnOcean, Zigbee and Bluetooth®) forms the foundation for digitized buildings, services and production processes in the IoT. The self-powered solutions are used in building automation, smart homes, LED lighting control and industrial applications. As an innovation driver, EnOcean is a strong partner for more than 350 leading product manufacturers and has already completed more than a million buildings worldwide with energy harvesting solutions.

- Announced Date: November 14, 2022

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1848165/000110465922117709/tm2229247d1_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1848165/000110465922117709/tm2229247d1_ex99-2img007.jpg):

Assuming 88% redemptions

- Enterprise Value: $166.9 million

- Equity Value:$196.9 million

- SPAC Public Shareholders (~8.8%):

- *14.28 million Holdco Ordinary Share (1 share for 1 Parabellum Class A Common Stock)

- SPAC Sponsor (~18.2%):

- *3.59 million Holdco Ordinary Share (1 share for 1 founder share)

- Target Shareholders Receive (~61%):

- Equity consideration of $120 million (12.0 million Holdco Ordinary Shares at $10.00/share

- Holdco options in exchange of EnOcean Options

- Earnout shares = 15%*Total Holdco Ordinary Shares after closing (5 years after closing) = 2,953,500 shares

- 30% Earnout Shares (or 886,050 shares) at $12.50 per share

- 30% Earnout Shares (or 886,050 shares) at $15.00 per share

- 40% Earnout Shares (or 1,181,400 shares) at $17.50 per share

- PIPE / Financing:

- PIPE Investment: Intending to raise in PIPE not exceeding $40 million:

- Such amount to be increased by any fees paid by EnOcean, Holdco or Parabellum

- Secondary Sale: Holdco will use excess proceeds not exceeding $10 million for direct secondary purchases of Holdco Ordinary Shares from certain former EnOcean Shareholders if:

- PIPE (+) CIT (-) Redemptions (-) Parabellum Transaction expenses > $30 million

- PIPE Investment: Intending to raise in PIPE not exceeding $40 million:

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsor, Anchor Investors and Key Target Shareholders (~83%): Earlier of (a), (b) or (c):

- (a) December 15, 2023

- (b) 180 days post-closing

- (c) If price equals or exceeds $12.00 per share after 150 days post-closing

- Note: Not applicable on shares obtained through an earn out or public market

- Closing Conditions:

- Termination date: August 13, 2023

- Holdco Equity Plan adopted & approved by Holdco shareholders

- Parabellum must deliver PIPE Subscription agreement ≥ $30 million by February 28, 2023

- Minimum net cash condition of $30 million

- Cash includes:

| Cash in Trust | |

| Add: | PIPE |

| Less: | Redemptions |

| Less: | Transaction Expenses (Parabellum and EnOcean) |

| Less: | Deferred Underwriting Fee (Payable by Parabellum) |

- Other customary closing conditions

- Termination:

- No termination fees

- Filing fee for the Notification & Report Forms filed under the HSR Act will be paid equally by Parabellum and EnOcean

- Other standard termination clauses

- Advisors:

- SPAC Legal Advisor: DLA Piper, LLP (US) and Ashurst LLP

- Target Legal Advisor: Dentons

- SPAC Financial Advisor and Sole Placement Agent: B. Riley Securities

- Target Financial Advisor: Acuity Advisors

- B. Riley Securities Legal Advisor: Kirkland & Ellis LLP

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Company Incentive Plan:

- Award Pool = 10% outstanding shares of Holdco post-closing (on fully diluted basis)

- Includes an evergreen provision with an automatic increase of 5% (each year for a period of 10 years)

*Denotes estimated figures by CPC

#Reported as on June 30, 2022