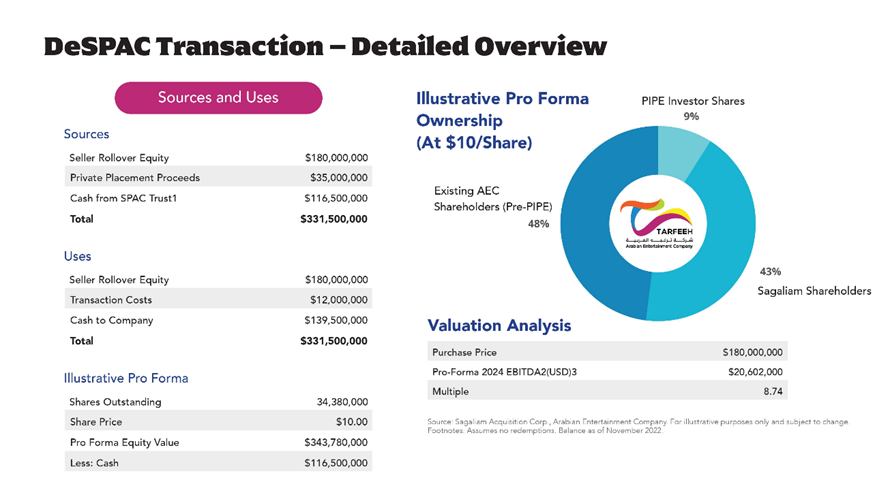

- Sagaliam Acquisition Corp. (SAGA) to acquire Arabian Entertainment Company (private) in a transaction valuing the pro forma entity at $227 million in Enterprise Value ($344 million equity value assuming minimum cash condition met).

- AEC shareholders will receive equity consideration of $180 million at redemption price and 35.0 earnout shares at price triggers of $15.0, $20.0 and $25.0 respectively.

- Minimum net cash condition of $25.0 million.

- The agreement includes a termination fee payable by SAGA of $1.00 million if AEC terminates or $1.50 million if SAGA terminates under certain conditions.

- Business combination transaction is targeted to close in the first half of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 right

- #Cash in Trust: $116,593,288 (101.4% of Public Offering)

- Public Shares Outstanding: 11.50 million shares

- Private Shares Outstanding: 2.875 million shares

- Reported Trust Value/Share: $10.14

- Liquidation Date: December 23, 2022

- Outside Liquidation Date: June 23, 2023

- Name of Target: Arabian Entertainment Company (Private)

- Description of Target: Headquartered in Jeddah, Saudi Arabia, AEC is a premier owner and operator of fast casual restaurant franchises operating under the Applebee’s and Ocean Basket brands. AEC has been in operation since 2001. Together with its parent company, Supraeon, AEC is a portfolio company of GLD Partners, LP., a Los Angeles based private equity firm (“GLD”).

- Announced Date: November 16, 2022

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1855351/000149315222032641/ex99-1.htm

- Transaction Terms (https://content.bamsec.com/0001493152-22-032641/ex99-2_009.jpg):

- Pro Forma Enterprise Value: $227 million

- Pro Forma Equity Value: $344 million

- Target Shareholders Receive:

- Equity consideration of $180 million at redemption price

- 35.0 million earnout shares New Pubco Common Stock (starting after 1st year & ending on the 6th year of closing):

- 20.0 million shares @$15.0 per share

- 10.0 million shares @$20.0 per share

- 5.0 million shares @$25.0 per share

- PIPE / Financing:

- Expected to raise $35.0 million through PIPE to pay transaction-related expenses and fund the expansion of its business platform in Saudi Arabia and the MENA Region

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Lock-up:

- Target Shareholders: 12 months post-closing

- Early Release: if the price equals or exceeds $12.50 per share after 180 days post-closing

- Target Shareholders: 12 months post-closing

- Closing Conditions:

- Termination date: Not available

- Net Cash Condition of $25.0 million

- Cash includes: CIT – Redemptions + PIPE – SPAC Transaction Expenses

- Delivery of a copy of AEC’s license issued by MISA and Commercial Registration Certificate issued by the Saudi Arabian Ministry of Commerce to the SPAC

- Retain of approximately 50% of the ownership at close (assuming no redemptions) by current AEC owners

- Other customary closing conditions

- Termination:

- Termination fee of $1.00 million (where Target terminates) or $1.50 million (where SPAC terminated) shall become payable by SPAC to Target due to the following reasons:

- on failure to receive shareholder approval but only if SPAC Board has made an Adverse Recommendation Change

- where SPAC has not received commitments for at least 50% ($12.5 million) of the Minimum Cash Amount by December 15, 2022

- Non-Approval of Extension proposal

- Extension Fee Limit of $1.0 million by the Sponsor

- Other standard termination clauses

- Termination fee of $1.00 million (where Target terminates) or $1.50 million (where SPAC terminated) shall become payable by SPAC to Target due to the following reasons:

- Advisors:

- Target Legal Advisors: King & Spalding LLP

- SPAC Legal Advisors: Mayer Brown LLP and Al Akeel & Partners

- SPAC Fairness Opinion Advisors: Marshall & Stevens, Inc.

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- 5% of shares outstanding post-closing

*Denotes estimated figures by CPC

#Reported as on September 30, 2022