November 20, 2022

- Quantum FinTech Acquisition Corp (QFTA) to acquire AtlasClear, Inc. (private) in a transaction.

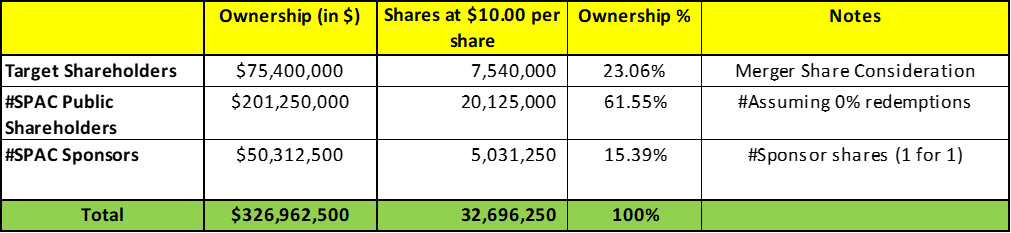

- Estimated pro-forma equity value of *$326.96 million.

- QFTA public shareholders will receive 20.125 million shares of New Pubco (1 for 1).

- QFTA sponsor will receive 5,031,250 shares of New Pubco (1 for 1).

- AtlasClear shareholders will receive equity consideration of $75.4 million (7.54 million shares of New Pubco at $10.0 per share) and 5,944,444 earnout shares to AtlasClear shareholders vesting in three tranches at $12.50, $15.00 and $17.50 per share respectively.

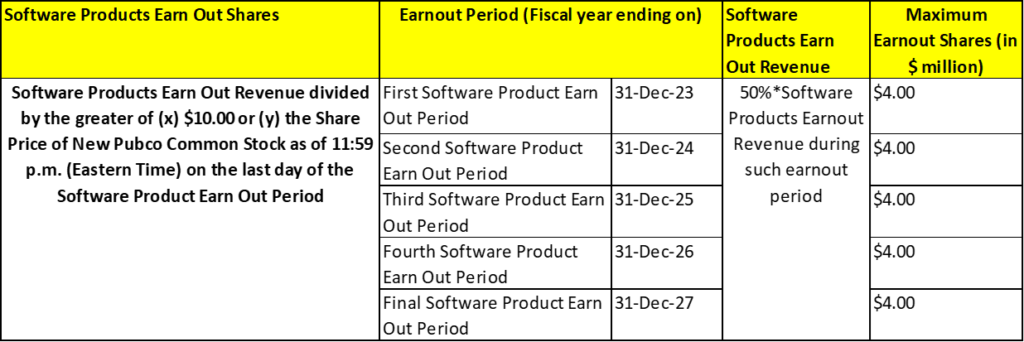

- Transaction also includes Earnout Consideration (Software Products Earnout Shares) for Atlas FinTech of up to $20 million (5 years after closing).

- 1,279,426.82 sponsor shares and 1,657,578.65 Private Placement Warrants are subject to forfeit.

- Minimum gross cash condition of $40.0 million.

- Business combination transaction is targeted to close in first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 warrant

- #Cash in Trust: $201,569,500 (100.2% of Public Offering)

- Public Shares Outstanding: 20.125 million shares

- Private Shares Outstanding: 5,031,250 shares

- Reported Trust Value/Share: $10.02

- Liquidation Date: February 9, 2023

- Name of Target: AtlasClear, Inc.

- Description of Target: AtlasClear plans to build a cutting-edge technology enabled financial services firm that would create a more efficient platform for trading, clearing, settlement and banking of evolving and innovative financial products with a focus on the small and middle market financial services firms. The team that will lead AtlasClear are respected financial services industry veterans that have founded and led other companies in the industry including Penson Clearing, Southwest Securities, NexTrade, and Anderen Bank.

- Announced Date: November 16, 2022

- Expected Close: “First quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1830795/000121390022073255/ea168828ex99-1_quantum.htm

- Transaction Terms (N/A):

- Enterprise Value: Not Provided

- Market Cap Value: *$326.9625million

- SPAC Public Shareholders Receive:

- 20.125 million shares of New Pubco Common Stock (1 for 1)

- SPAC Sponsor Receive:

- 5,031,250 shares of New Pubco Common Stock (1 for 1)

- Target Shareholders (AtlasClear) Receive:

- Equity consideration of $75.4 million in shares of New Pubco Common Stock (7.54 million shares at $10.00 per share) subject to following adjustments:

- Purchase prices for WDCO and CB

- Before closing, AtlasClear will receive certain assets from Atlas FinTech

- and

- Atlas Financial Technologies Corp. will complete the acquisition of broker-dealer Wilson-Davis & Co., Inc. (WDCO) and will consummate the transaction with Pacsquare Technologies, LLC (Pacsquare)

- At Closing, the definitive agreement pursuant to which AtlasClear has agreed to acquire Commercial Bancorp, a Wyoming corporation (CB) shall continue to be in full force and effect (the CB Merger Agreement)

- Purchase prices for WDCO and CB

- Earn-Out consideration of 5,944,444 shares of New Pubco Common Stock (18 months after closing)

- 2,333,333 shares @ $12.50 per share

- 1,944,444 shares @ $15.00 per share

- 1,666,667 shares @ $17.50 per share

- Atlas FinTech Earnout Consideration (Software Products Earnout Shares) of up to $20 million (5 years after closing)

- Equity consideration of $75.4 million in shares of New Pubco Common Stock (7.54 million shares at $10.00 per share) subject to following adjustments:

- PIPE / Financing:

- No PIPE/ Financing

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Sponsor agreed to transfer up to 1,279,426.82 Sponsor shares (or *25.43%) and up to 1,657,578.65 of the Private Warrants (or *26.94%) held directly or indirectly by Atlas FinTech to potential sources of debt, equity or financing if SPAC pursues financing between signing and closing and that any of such sponsor shares (or *74.57%) or Private Warrants remaining (or *73.06%) following any transfers for potential financing will be forfeited for no consideration at closing

- Lock-up:

- SPAC Sponsors:

- 6 months post-closing

- Early Release: If price equals or exceeds $12.50 per share after closing

- 50% shares of New Pubco common stock: 6-month post-closing

- Private Warrant: 30 days post-closing

- 6 months post-closing

- Target stockholders (including Atlas FinTech): 1 year post-closing

- Early Release: If price equals or exceeds $12.50 per share after closing

- SPAC Sponsors:

- Closing Conditions:

- Termination date: February 9, 2023 (maximum extension possible up to 6 additional months)

- Minimum gross cash condition: $40 Million

- Completion of Contribution of certain specified assets from Atlas FinTech and Atlas Financial Technologies Corp. to AtlasClear

- Remaining effect of the CB Merger Agreement

- Other customary closing conditions

- Termination:

- Standard termination clauses

- Advisors:

- Target Legal Advisors: Greenberg Traurig, LLPSPAC Legal Advisors: Winston & Strawn LLP

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- 10.0% of shares outstanding post-closing

*Denotes estimated figures by CPC

#Reported as on June 30, 2022