December 21, 2022

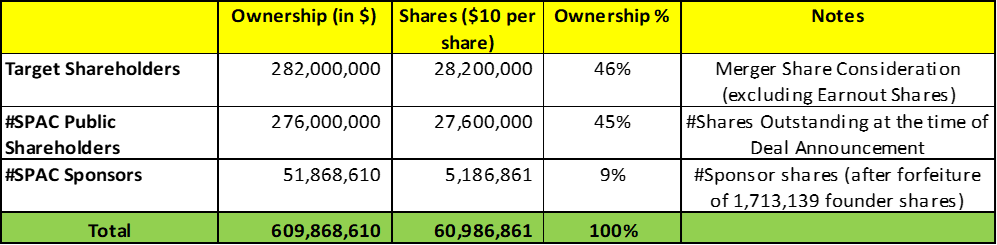

- Edify Acquisition Corp. (EAC) to acquire Unique Logistics International (OTCMKTS: UNQL) in a transaction valuing the combined company at an equity value *$610 million.

- Unique shareholders will receive equity consideration of $282 million at $10.0 per share.

- Transaction includes 2.50 million earnout shares vesting equally at $12.0 and $15.0/share.

- Unique entered into a commitment letter with CB Agent Services LLC for a senior secured financing facility (Debt Facility) of up to $35.0 million which includes Initial Term Loan Facility (up to $25.0 million) and Bridge Loan Facility ($10.0 million).

- Sponsor agreed to forfeit 1,713,139 founder shares (or *24.83%) for no consideration.

- No minimum cash condition.

- SPAC Details:

- Unit Structure: 1 Class A Common Stock Share + 0.50 Redeemable Warrant

- #Cash in Trust: $277,619,893 (100.6% of Public Issue)

- Public Shares outstanding: 27.60 million shares

- Private Shares Outstanding: 6.90 million shares

- Reported Trust Value/ Share: $10.06

- Liquidation Date: January 20, 2023 (filed Preliminary proxy on 11/14/2022 to extend till 4/20/2023 and for an additional 3 times for 1 month each time till 7/20/2023)

- Name of Target: Unique Logistics International

- Description of Target: Unique Logistics International, Inc. (OTCMKTS: UNQL), through its wholly owned operating subsidiaries, is a global logistics and freight forwarding company providing a range of international logistics services that enable its customers to outsource to the Company sections of their supply chain process. The services provided are seamlessly managed by its network of trained employees and integrated information systems. We enable our customers to share data regarding their international vendors and purchase orders with us, execute the flow of goods and information under their operating instructions, provide visibility to the flow of goods from factory to distribution center or store and when required, update their inventory records.

- Announced Date: December 19, 2022

- Expected Close: No information provided

- Press Release: https://www.sec.gov/Archives/edgar/data/1832765/000121390022080651/ea170231ex99-1_edifyacq.htm

- Transaction Terms (N/A):

- Enterprise Value: N/A

- Equity Value: *$609.87 million

- Target Shareholders Receive (~*46%):

- Equity consideration: $282 million at $10.0 per share (SPAC Class A Common Stock)

- Earnout consideration: 2.50 million shares of SPAC Class A Common Stock (7 years starting after 60 days post-closing)

- 1.25 million shares at $12.0 per share

- 1.25 million shares at $15.0 per share

- PIPE / Financing:

- Target entered into a commitment letter with CB Agent Services LLC for a senior secured financing facility (Debt Facility)

- Maximum Amount: $35.0 million

- Includes:

- Initial term loan facility: up to $25.0 million

- Bridge Loan Facility: $10.0 million

- Target entered into a commitment letter with CB Agent Services LLC for a senior secured financing facility (Debt Facility)

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Sponsor agreed to forfeit 1,713,139 founder shares (or *24.83%) for no consideration

- Lock-up:

| Lock-Up Party | Lock-Up Shares | Lock-Up Period | Early Release | ||

| Key Target Shareholders | Preferred Holders | ||||

| Non-Voting Holders | 3a Capital Establishment and Trillium Partners L.P | 94% | 50% – 12 months post-closing 50% – 6 months post-closing | If the price equals or exceeds $12.00 per share after 150 days post-closing | |

| Front Four | Front Four Management LLC | 98.50% | 12 months post-closing | ||

| Other than Preferred Holders | 100% | 12 months post-closing | |||

| SPAC Sponsor | 100% | 12 months post-closing | |||

- Closing Conditions:

- Termination date: July 20, 2023 (further extended by 30 days if any action/performance by Target is commenced/pending before this date)

- No minimum cash condition

- CB Agent Services LLC shall have provided to Target the Debt Facility on terms & conditions similar to/favorable than the commercial T&Cs

- If Target obtains alternative debt financing, the condition shall be deemed to be waived it

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- Target Legal Advisor: Lucosky Brookman LLP

- SPAC Legal Advisor: Weil, Gotshal & Manges LLP

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- No information provided

- Cost & Expenses:

- Target Shall pay:

- All fees, costs & expenses in connection with any competition, antitrust or other regulatory filings up to $13.0 million

- 50% of the Extension Fees:

- By drawing down from the Debt Facility an amount equal to, in the Sponsor’s sole discretion, either

- 50% Extension Fees

- OR

- 100% Extension Fees

- In this case, Sponsor shall forfeit Sponsor shares at $10.00 per share equivalent in value to 50% of the Extension Fees and such forfeited shares shall be cancelled by SPAC

- By drawing down from the Debt Facility an amount equal to, in the Sponsor’s sole discretion, either

- Target Shall pay:

*Denotes estimated figures by CPC

#Reported as on September 30, 2022