November 23, 2022

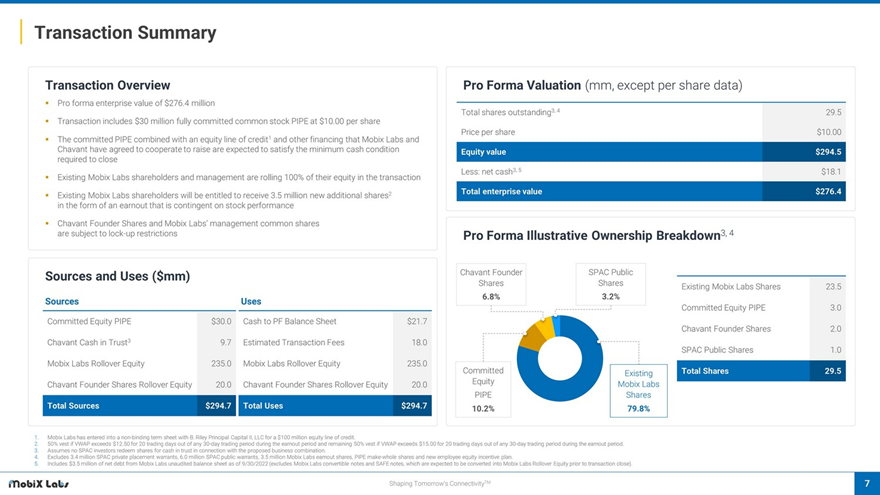

- Chavant Capital Acquisition Corp. (CLAY) to acquire Mobix Labs (private) in a transaction valuing the combined company at an enterprise value of $276.40 million ($294.5 million of equity value).

- Mobix shareholders will receive $235 million of equity consideration at $10.0/share.

- Transaction includes 3.50 million earnout shares to Mobix shareholders at $12.5 and $15.0/share.

- ACE SO4 Holdings Limited agreed to purchase 3.00 million shares of Class A Common Stock at a price of $10.0/share. PIPE investor is eligible to receive up to 1,285,714 earnout shares subject to conditions.

- Mobix has signed a non-binding term sheet with B. Riley Principal Capital II, LLC for a $100 million equity line of credit.

- Minimum gross cash condition of $50.0 million.

- The business combination transaction is targeted to close in the first half of 2023.

- SPAC Details:

- Unit Structure: 1 ordinary share + 0.75 redeemable warrant

- #Cash in Trust: $9,672,901 (101.5% of Public Issue)

- Public Shares outstanding: 953,033 shares (11.91% of original)

- Private Shares Outstanding: 2,000,000 shares

- Reported Trust Value/ Share: $10.15

- Liquidation Date: July 22, 2022

- Outside Liquidation Date: January 22, 2023 (Intending to extend from 1/22/2023 7/22/2023)

- Name of Target: Mobix Labs

- Description of Target: Based in Irvine, California, Mobix Labs is a fabless semiconductor company delivering disruptive next generation wireless and connected solutions for a broad range of applications in markets including 5G infrastructure, automotive, consumer electronics, e-mobility, healthcare, infrastructure and defense. The Company has a robust pipeline of current and potential customers and strategic partnerships leading to a large and rapidly growing addressable market. Its extensive portfolio of intellectual property is protected by extensive trade secrets and over 90 issued and pending patents.

- Announced Date: November 16, 2022

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1855467/000110465922119356/tm2230576d1_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1855467/000110465922119356/tm2230576d1_ex99-2img007.jpg):

- Enterprise Value: $276.4 million

- Equity Value:$294.5 million

- Target Shareholders Receive (~79.8%):

- Aggregate Merger consideration includes:

- Equity Consideration: $235 million at $10.00/share (23.5 million shares of SPAC Class A and SPAC Class B Common Stock)

- Earnout: 3.50 million shares of SPAC Class A Common Stock (7 years starting after 1 year of closing)

- 1.75 million shares at $12.50 per share

- 1.75 million shares at $15.00 per share

- Aggregate Merger consideration includes:

- PIPE / Financing:

- Forward Purchase Agreement: $30.0 million of common stock PIPE (3.00 million shares of Class A Common Stock at $10.0 per share)

- Investor: ACE SO4 Holdings Limited

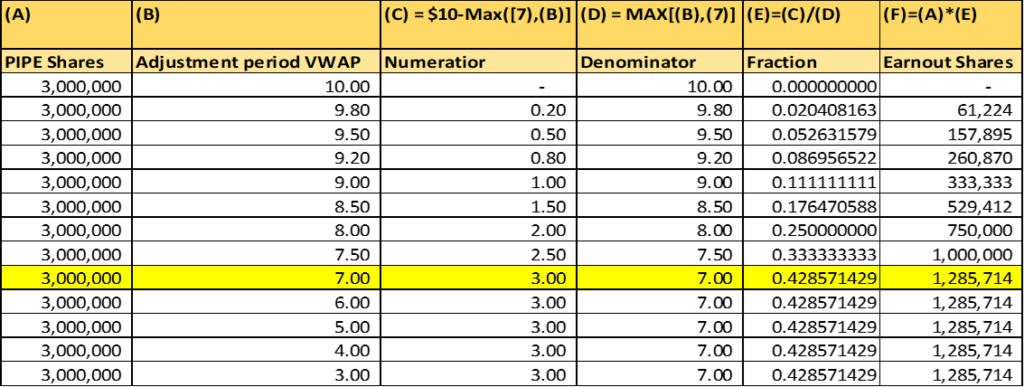

- Earnout Shares: Up to 1,285,714 shares of SPAC Class A Common Stock if Adjusted Period VWAP < $10.0 per share

- Earnout Shares = PIPE Shares*Fraction

- PIPE Shares = Class A Common Stock issued to Investor at subscription closing

- Fraction = ($10.0 – Adjusted Period VWAP)/Adjusted Period VWAP (If Adjustment Period VWAP < $7.00, then Adjustment Period VWAP shall be deemed to be $7.00)

- Measurement Period: 30-day period starting 30 days after the date on which the PIPE Resale Registration Statement is declared effective

- Forward Purchase Agreement: $30.0 million of common stock PIPE (3.00 million shares of Class A Common Stock at $10.0 per share)

- Non-Binding Term Sheet: Target has signed a non-binding term sheet with B. Riley Principal Capital II, LLC for $100 million equity line of credit

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsor and Key Target Shareholders:

| Lock-Up Shares | Lock-Up Period | Early Release |

| 50% | 1-year post-closing | If price equals or exceeds $12.00 per share after closing |

| 50% | 1-year post-closing | If price equals or exceeds $15.00 per share after closing |

- Closing Conditions:

- Termination date: January 22, 2023 (July 22, 2023 if extended)

- PCAOB Financials by December 15, 2022

- Minimum gross cash condition of $50 million

- Cash includes:

| Cash in Trust | ||

| Less: | Redemptions | |

| Add: | PIPE | ≥ $30.0 million |

| Add: | Target Line of Credit | ≤ $10.0 million |

| Less: | Reduction Amount (-) Amount committed to be funded before closing | $5.00 million – Amount committed to be funded before closing |

- Completion of Domestication

- Other customary closing conditions

- Termination:

- No termination fees

- Filing fee for the Notification & Report Forms filed under the HSR Act will be paid equally by SPAC and Target

- Other standard termination clauses

- Advisors:

- Target Financial Advisor: B. Riley Securities

- SPAC Financial Advisor: Needham & Company, LLC

- Target Legal Advisor: Greenberg Traurig, LLP

- SPAC Legal Advisors: Simpson Thacher & Bartlett LLP

- B. Riley Securities and Needham & Company, LLC Legal Advisor: DLA Piper LLP (US)

- Target Investor Relations Advisor: Blueshirt Capital

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No Valuations Provided

- Company Incentive Plan:

- 10% Shares outstanding post-closing

- Annual automatic increase of lesser of:

- 5% OR Shares as determined by Board

*Denotes estimated figures by CPC

#Reported as on September 30, 2022