November 26, 20223

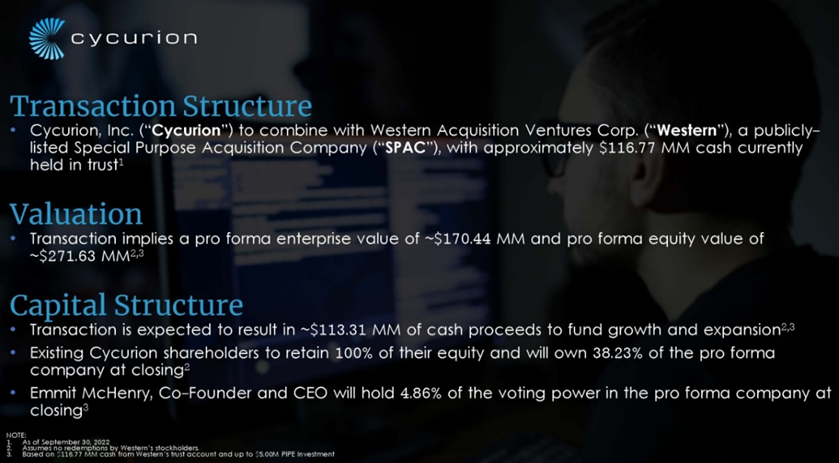

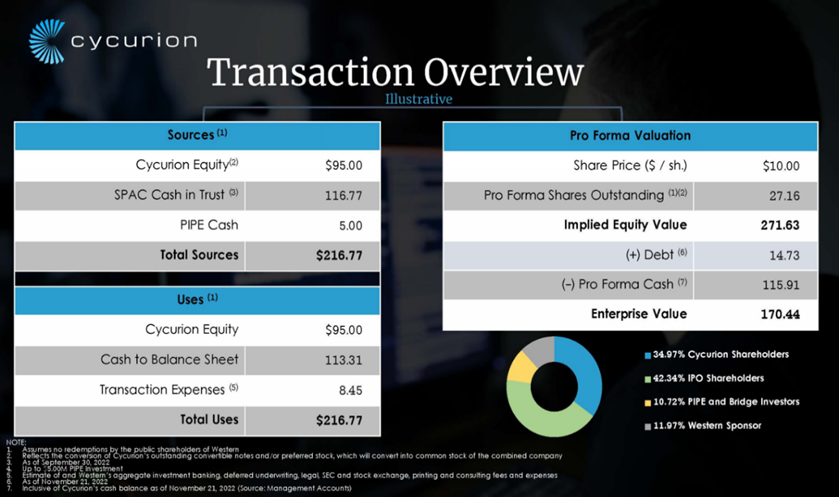

- Western Acquisition Ventures Corp. (WAVS) to acquire Cycurion, Inc. (private) in a transaction valuing the pro forma entity at $170.44 million in Enterprise Value ($271.63 million equity value assuming PIPE raise of $5.0 million).

- Cycurion shareholders will receive equity consideration of $95 million (9.50 million shares of WAVS Common Stock at $10.0 per share).

- Transaction is expected to be supported by $5.0 million of PIPE investment.

- Minimum gross cash condition of $3.50 million.

- Business combination transaction is targeted to close in the first quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 warrant

- #Cash in Trust: $116,765,936 (101.5% of Public Offering)

- Public Shares Outstanding: 11.50 million shares

- Private Shares Outstanding: 3.251 million shares (including 376,000 private shares contained in Private Placement Units)

- Reported Trust Value/Share: $10.15

- Liquidation Date: January 13, 2023

- Name of Target: Cycurion, Inc.

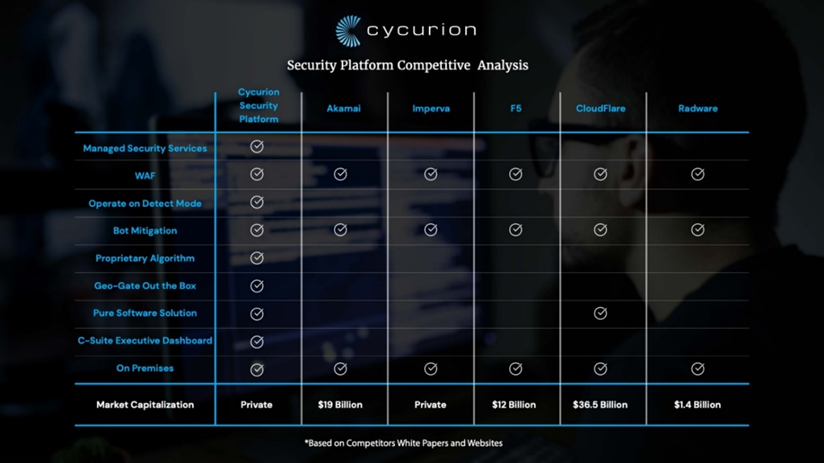

- Description of Target: Cycurion is a McLean, Virginia-based technology enabled cybersecurity company, providing proprietary innovative solutions to Federal, State and Local government agencies and commercial partners. The Company’s software-based technology provides multiple layers of defense to stop penetrations on the front end, as well as monitors and detections on the back end. Leveraging its team of deeply skilled technology veterans with high-level security clearances, Cycurion combines its unique platform with a suite of services for Government agencies, C-Suite executives and Boards of Directors to access and process information allowing them to monitor the security profile of their network.

- Announced Date: November 22, 2022

- Expected Close: “First Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1868419/000110465922121819/tm2231315d1_ex99-1.htm

- Transaction Terms (https://content.bamsec.com/0001104659-22-121819/tm2231315d1_ex99-2img04.jpg & https://content.bamsec.com/0001104659-22-121819/tm2231315d1_ex99-2img05.jpg):

- Enterprise Value: $170.44 million

- Market Cap Value: $271.63 million (assuming up to $5.0 million PIPE Investment)

- Target Shareholders Receive (~34.97%):

- Equity consideration of $95 million (9.50 million shares of WAVS Common Stock at $10.0 per share)

- Enterprise Value: $170.44 million

- PIPE / Financing:

- $5.0 million of PIPE investment is expected to be raised from institutional investors

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors, Other holders of founder shares and Key Target Shareholders: 6 months post-closing

- Closing Conditions:

- Termination date: May 31, 2023

- Gross Cash Condition: $3.50 million

- Cash includes:

- Cash in Trust + Equity/Debt Financing (if any) – Redemptions

- Cash includes:

- Other customary closing conditions

- Termination:

- Standard termination clauses

- Advisors:

- SPAC Financial Advisors: A.G.P./Alliance Global Partners

- Target Legal Advisors: Clark Hill LLP

- SPAC Legal Advisors: J.P. Galda & Co.

- SPAC and Target Investor Relations Advisors: Financial Profiles, Inc.

- Financials (N/A):

- No historical or projected financials provided

- Management Equity Incentive Plan

- No information provided

*Denotes estimated figures by CPC

#Reported as on September 30, 2022