December 8, 2022

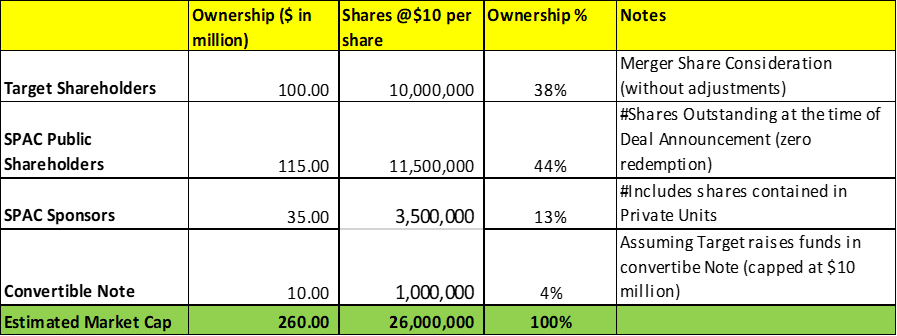

- SportsMap Tech Acquisition Corp. (SMAP) to acquire Infrared Cameras Holdings, Inc. (Private) in a transaction valuing the combined company at an enterprise value of *$142 million (*$260 million of equity value) assuming zero redemptions.

- ICH shareholders will receive $100 million of equity consideration at $10.0 per share (subject to adjustments).

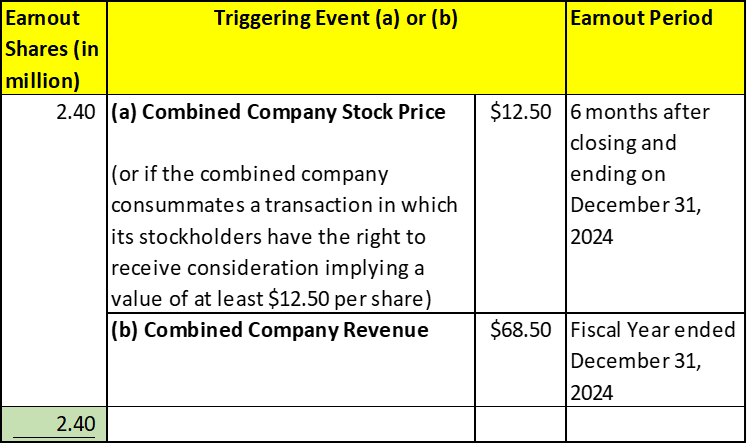

- Transaction includes 2.40 million earnout shares to ICH shareholders if either the stock price reaches $12.5 per share or if 2024 revenue reaches $68.5 million.

- Minimum net cash condition of $10.0 million.

- The business combination transaction is targeted to close in the first half of 2023.

- SPAC Details:

- Unit Structure: 1 Share Common Stock + 0.75 Redeemable Warrant

- #Cash in Trust: $118,088,738 (102.7% of Public Issue)

- Public Shares outstanding: 11.50 million shares

- Private Shares Outstanding: 3.55 million shares (including 675,000 shares included in Private Units)

- Reported Trust Value/ Share: $10.27

- Liquidation Date: April 21, 2023

- Name of Target: Infrared Cameras Holdings, Inc.

- Description of Target: Founded in 1995, ICI develops and manufactures infrared-sensor systems. It offers handheld and fixed hardware, complemented by on-device and cloud-based software. The Company’s solutions are deployed across a wide range of industries, including oil & gas, distribution & logistics, manufacturing and utilities. ICI’s thermal cameras and infrared technology are used to protect critical assets across a wide range of industries. The company designs and develops powerful infrared and sensing hardware, as well as a proprietary subscription software used to analyze thermal data points. ICI’s products are sold across the industrial sector, with key sub-verticals that include distribution & logistics, oil & gas, manufacturing and utilities. Commercial applications for the technology include detection of methane leaks in wells and pipelines across the oil & gas industry and the monitoring of conveyer belt equipment in warehouses. ICI’s solutions are used to monitor the performance of crucial assets and optimize predictive maintenance strategies to reduce unplanned downtime and increase operator efficiency.

- Announced Date: December 06, 2022

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1863990/000110465922124911/tm2232010d1_ex99-1.htm

- Transaction Terms (N/A):

- Enterprise Value: *$142 million [Market Cap (-) Cash in Trust OR *$260 million (-) $118 million]

- Equity Value: *$260 million

- Target Shareholders Receive (~*38%):

- Equity consideration: $100 million (10.0 million shares of SPAC Common Stock at $10.0 per share)

- Subject to following adjustments:

- Equity consideration: $100 million (10.0 million shares of SPAC Common Stock at $10.0 per share)

| $100 million | |

| Less: | Target Closing Indebtedness |

| Add: | Aggregate Exercise Price |

| Add: | Target Closing Cash |

| Add: | Aggregate Principal of any convertible promissory notes entered into by Target (on or after the date of the Business Combination Agreement but before closing) |

| Adjusted Equity Value | |

- Earnout consideration: 2.40 million shares of SPAC Common Stock

Note: If Target raises additional capital by the issuance of convertible promissory notes before closing (up to $10.0 million), such convertible notes will convert into Target Class A Common Stock before closing and will convert in the Merger in the same manner.

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsor and Target Shareholders: 6 months post-closing

- Early Release (50%): If the price equals or exceeds $12.5 per share after closing

- SPAC Sponsor and Target Shareholders: 6 months post-closing

- Closing Conditions:

- Termination date: June 30, 2023 (may be extended by Target by an additional 60 days)

- SPAC aggregate transaction proceeds post-closing ≥ $10 million

- Aggregate Transaction Proceeds (~Minimum Net Cash Condition):

| Cash in Trust | ||

| Less: | Redemptions | – |

| Add: | Closing PIPE | – |

| Add: | Target Convertible Loan Amount (Up to $10 million) | To the extent facilitated by (a) or (b) or (c): SPACSPAC Sponsor Any of their respective Affiliates |

| Add: | Aggregate Principal of any Indebtedness of Target incurred after agreement but before closing & convertible into Equity Securities of Target | |

| Less: | SPAC Transaction Expenses | – |

- Target Note Conversion shall have occurred

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- SPAC Financial Advisors: Craig-Hallum Capital Group LLC and Roth Capital Partners LLC

- Target Legal Advisor: Latham & Watkins LLP

- SPAC Legal Advisor: ArentFox Schiff LLP

- Financials (N/A):

- None

- Comparables (N/A):

- None

- Equity Incentive Plan:

- No information provided

- Fees and Expenses:

| Payment by | Closing Occurs | Closing doesn’t occur |

| Target | – | All Unpaid Target Expenses |

| SPAC | All Unpaid Target Expenses and All Unpaid SPAC Expenses | All SPAC Target Expenses |

*Denotes estimated figures by CPC

#Reported as on September 30, 2022