January 9, 2023

- StoneBridge Acquisition Corporation (APAC) to acquire DigiAsia (private) in a transaction.

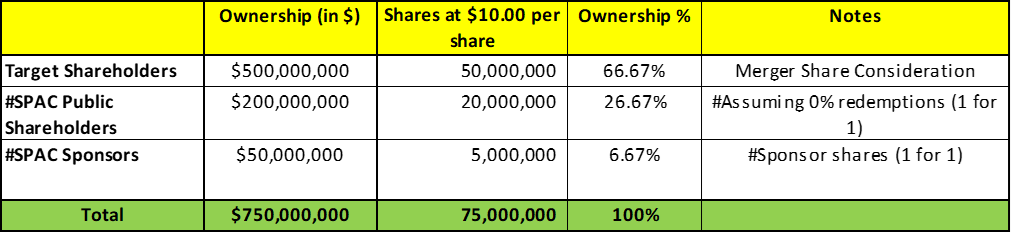

- Estimated pro forma equity value of *$750 million assuming zero redemptions.

- DigiAsia shareholders will receive an equity consideration of $500 million at $10.0 per share along with 5,000,001 earnout shares. 1.50 million earnout shares shall be released after 6 months post-closing and remaining earnout shares shall vest in three equal tranches at $11.5, $12.5, and $15.0 per share respectively during a period of 5 years after closing.

- Transaction is supported by $100 million in total Standby Equity Purchase Agreement.

- APAC to obtain, to DigiAsia’s satisfaction, transaction financing in the form of a firm written commitment to provide equity, convertible debt or equity-linked financing to PubCo in the amount of at least $30.0 million.

- Minimum gross cash condition of $20.0 million.

- Business combination transaction is targeted to close in the second quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.50 warrant

- #Cash in Trust: $206,128,182.43 (103.1% of Public Offering)

- Public Shares Outstanding: 20.0 million shares

- Private Shares Outstanding: 5.0 million shares

- Reported Trust Value/Share: $10.31

- Liquidation Date: January 20, 2023 (Definitive proxy filed on January 12, 2023 to extend the deadline from January 20, 2023 to July 20, 2023)

- Name of Target: DigiAsia

- Description of Target: Established in 2017, DigiAsia Bios is Indonesia’s Embedded Fintech-as-a-Service (FaaS) company in Indonesia. Committed to responding to all kinds of challenges related to the financial sphere, this start-up company, founded by Alexander Rusli and Prashant Gokarn, operates with four licenses; to serve Digital Payment (KasPro), P2P Lending (KreditPro), Remittances (RemitPro), and Digital Financial Services (Digibos). The entire products and services from DigiAsia Bios can be embedded with any application and ecosystem, enabling corporate partners and the public in general to easily utilize fintech solutions to optimize financial management processes, both in terms of business and daily life.

- Announced Date: January 5, 2023

- Expected Close: “Second Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1844981/000110465923001516/tm2232887d2_ex99-1.htm

- Transaction Terms (N/A):

- Market Cap Value: *$750 million

- Target Shareholders Receive (~*66.67%):

- Equity consideration of $500 million common stock at $10.0 per share

- Earn-Out: 5,000,001 Pubco Ordinary Shares

- 1,500,000 shares: 6 months post-closing

- 1,166,667 shares if price ≥ $11.5 per share (5 years post-closing)

- 1,166,667 shares if price ≥ $12.5 per share (5 years post-closing)

- 1,166,667 shares if price ≥ $15.0 per share (5 years post-closing)

- PIPE / Financing:

- $100 million of Equity Financing for a Standby Equity Purchase Agreement with Yorkville Advisors Global, LP ($30.0 million of pre-paid advance in three tranches)

- Transaction Financing of $30.0 million:

- SPAC to obtain, to Target’s satisfaction, transaction financing in the form of a firm written commitment to provide equity, convertible debt or equity-linked financing to PubCo in the amount of at least $30.0 million

- Aggregate amount can be a combination of non-redeemed funds in the Trust Account, equity financing (PIPE) by institutions and family offices, convertible debt and a pre-paid advance on convertible debt (borrowed money)

- At least $20.0 million of such amount shall be funded at the closing and the remaining $10.0 million within 3 months after closing

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors:

- 0.25 million shares: 9 months post-closing

- 4.75 million shares: 6 months post-closing

- Early Release: If the price equals or exceeds $12.0 per share after 150 days post-closing

- Key Target Shareholders and Shareholders holding more than 1%: 9 months post-closing

- Early Release: If the price equals or exceeds $12.0 per share after 150 days post-closing

- SPAC Sponsors:

- Closing Conditions:

- Gross Cash Condition: $20.0 Million

- Cash includes: CIT – Redemptions + Transaction Financing

- Termination date: June 30, 2023

- Other customary closing conditions

- Gross Cash Condition: $20.0 Million

- Termination:

- No Termination fee

- Other standard termination clauses

- Advisors:

- Target Legal Advisors: Norton Rose Fulbright US LLP

- SPAC Legal Advisors: Winston & Strawn LLP

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- 5% of the fully diluted shares outstanding post-closing (subject to annual increase)

*Denotes estimated figures by CPC

#Reported as on January 9, 2023 (on Record date mentioned in Definitive proxy filed for charter extension)