January 10, 2023

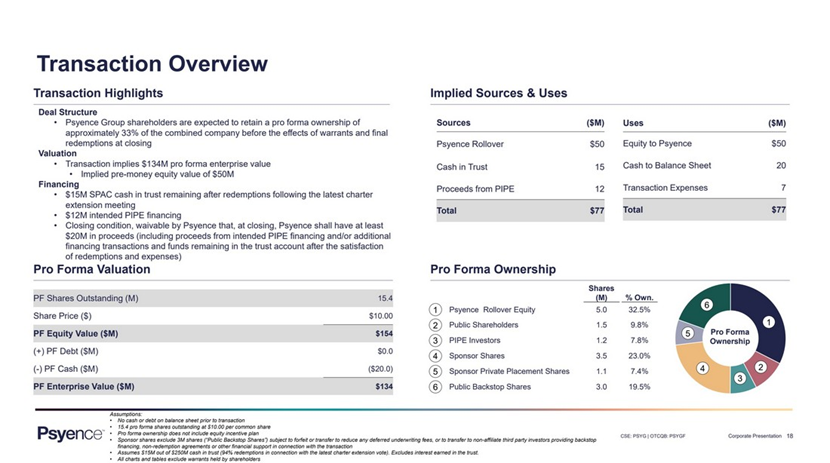

- Newcourt Acquisition Corp. (NCAC) to merge with Psyence Biomed Corp (CSE:PSYG | OTCQB: PSYGF) in a transaction valuing the pro forma entity at $134 million in Enterprise Value ($154 million equity value).

- Psyence shareholders will receive 5.00 million shares of common stock at $10.0 per shareas merger consideration.

- Transaction is expected to be supported by $12.0 million in PIPE Investment.

- Sponsor agreed to subject up to 3.00 million sponsor shares (or *46%) for reduction of any deferred underwriting fees or for forfeiture or for transfer to non-affiliate third party investors providing backstop (Public Backstop Shares).

- Minimum net cash condition of $20.0 million.

- Business combination transaction is targeted to close in the first half of 2023.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 1/2 warrant

- #Cash in Trust: $15,550,000 (103.5% of Public Offering)

- Public Shares Outstanding: 1,502,532 shares

- Private Shares Outstanding: 7.675 million shares (include 1,140,000 in units)

- Reported Trust Value/Share: $10.35

- Liquidation Date: January 22, 2023

- Current Liquidation date: April 22, 2023

- Outside Liquidation Date: July 22, 2023

- Name of Target: Psyence Biomed Corp

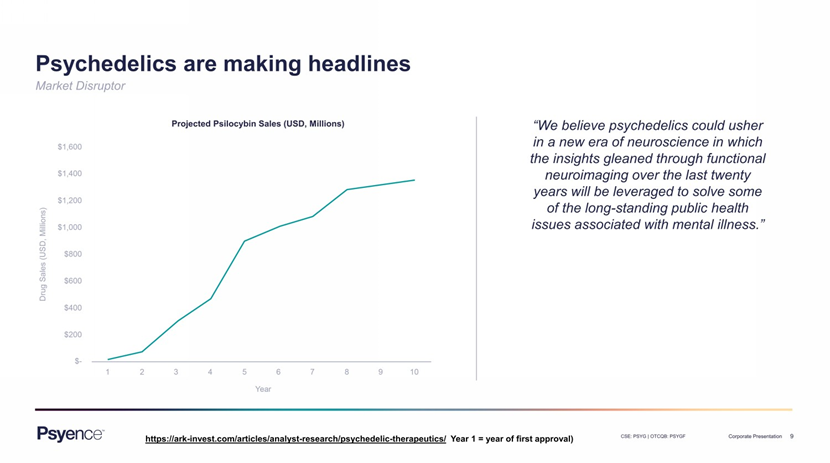

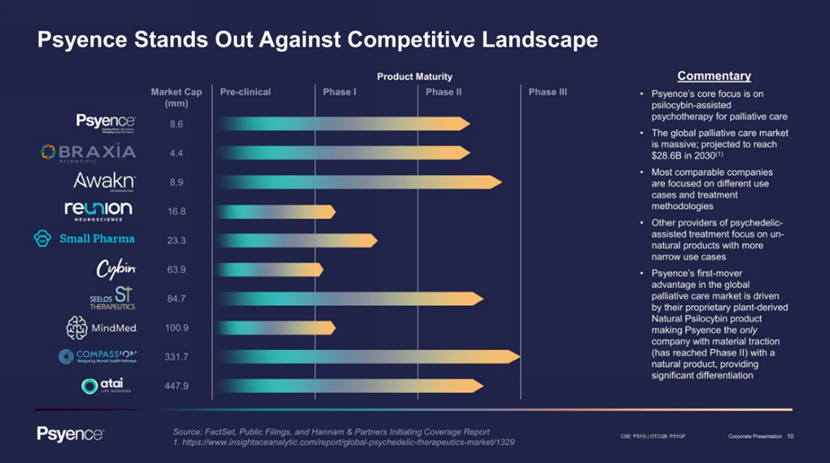

- Description of Target: Psyence is a life science biotechnology company listed on the Canadian Securities Exchange (CSE: PSYG) and quoted on the OTCQB (OTCQB: PSYGF), with a focus on natural psychedelics. The Psyence Biomed Division works with natural psilocybin products for the healing of psychological trauma and its mental health consequences in the context of palliative care. Our name “Psyence” combines the words psychedelic and science to affirm our commitment to producing psychedelic medicines developed through evidence-based research. Informed by nature and guided by science, we built and operate one of the world’s first federally licensed commercial psilocybin mushroom cultivation and production facilities in Southern Africa. Our team brings international experience in both business and science and includes experts in mycology, neurology, palliative care, and drug development. We work to develop advanced natural psilocybin products for clinical research and development. Our key divisions, Psyence Production, Psyence Therapeutics and Psyence Function, anchor an international collaboration, with operations in Canada, the United Kingdom, Southern Africa, and a presence in the United States and Australia.

- Announced Date: January 9, 2023

- Expected Close: “First Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1849475/000110465923002364/tm232749d2_ex99-1.htm

- Transaction Terms (https://content.bamsec.com/0001104659-23-010065/tm235303d1_ex99-1img019.jpg):

- Enterprise Value: $134 million

- Market Cap Value: $154 million

- SPAC Public Shareholders Receive (~9.8%):

- *1,502,532 common shares of Psyence Biomed (1 for 1 SPAC Class A share)

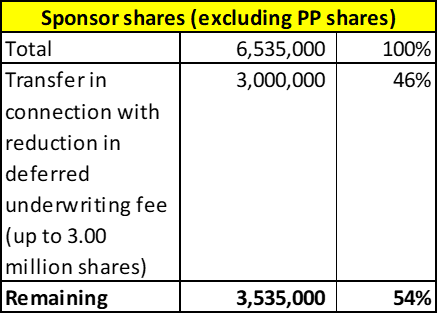

- SPAC Sponsor Receive (~23%+7.4%):

- *3.535 million common shares of Psyence Biomed (1 shares for 1 SPAC Class B share)

- *1.14 million common shares of Psyence Biomed (1 shares for 1 private placement share)

- Target Shareholders Receive (~32.5%):

- Equity consideration of $50.0 million (5.00 million common share of Psyence Biomed @ $10.0 per share)

- PIPE / Financing (~7.8%):

- $12.0 million of intended PIPE Financing at $10.0 per share

- Redemption Protections:

- Public Backstop Shares: Sponsor may forfeit up to 3.00 million sponsor shares to transfer to non-affiliate third party investors providing backstop

- Support Agreement:

- Standard voting support

- Sponsor agreed to subject up to 3.00 million sponsor shares (or *46%) as follows:

- for reduction of any deferred underwriting fees

- for forfeiture

- to transfer to non-affiliate third party investors providing backstop (Public Backstop Shares)

- Lock-up:

- SPAC Sponsors (Insider shares & PP Shares): 6 months post-closing

- Key Target Shareholders: Not provided yet

- Closing Conditions:

- Net Cash Condition: $20.0 Million (including $12.0 million of intended PIPE)

- Termination date: July 22, 2023

- Completion of PIPE Investment

- PCAOB Financials by February 28, 2023

- Other customary closing conditions

- Termination:

- Less than $20.0 million of PIPE and non-redemption agreements received by Target by February 28, 2023

- More than $7.00 million of transaction expenses by SPAC

- Other standard termination clauses

- Advisors:

- Target Legal Advisors: WeirFoulds LLP

- Target US Legal Advisors: Morgan, Lewis & Bockius LLP

- SPAC US Legal Advisors: McDermott Will & Emery LLP

- Target Capital Markets Advisors: Bayline Capital Partners Inc.

- Financials (https://www.sec.gov/Archives/edgar/data/1849475/000110465923002364/tm232749d2_ex99-2img010.jpg):

- Equity Incentive Plan

- 15.0% of fully diluted shares outstanding post-closing

- Includes an annual evergreen increase not exceeding 1% of the shares outstanding as of each December 31

*Denotes estimated figures by CPC

#Reported as on January 10, 2023 (Extension Meeting Results)