January 17, 2023

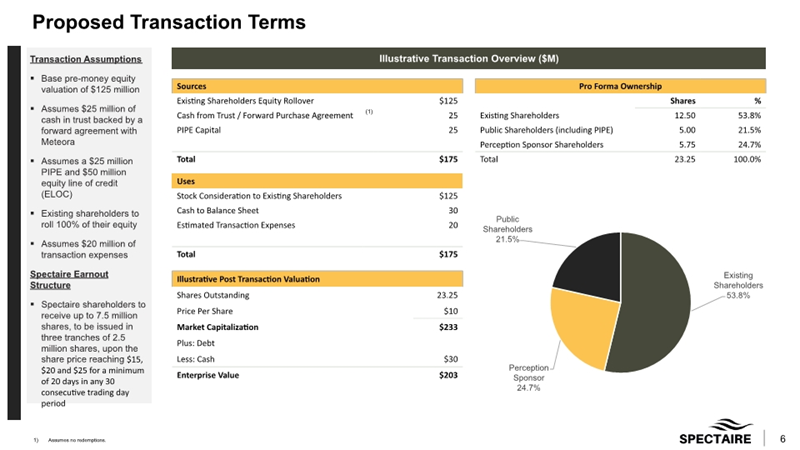

- Perception Capital Corporation II (PCCT) to acquire Spectaire (private) in a transaction valuing the pro forma entity at $203 million in Enterprise Value ($233 million equity value).

- Spectaire shareholders will receive aggregate merger consideration (Cash + Equity) of $125 million.

- Transaction includes 7.50 million earnout shares to Spectaire shareholders vesting in three equal tranches at $15.0, $20.0 and $25.0 per share respectively.

- Transaction is supported by up to 2,457,892 shares of forward purchase agreements.

- No minimum cash condition.

- Business combination transaction is targeted to close in the second quarter of 2023.

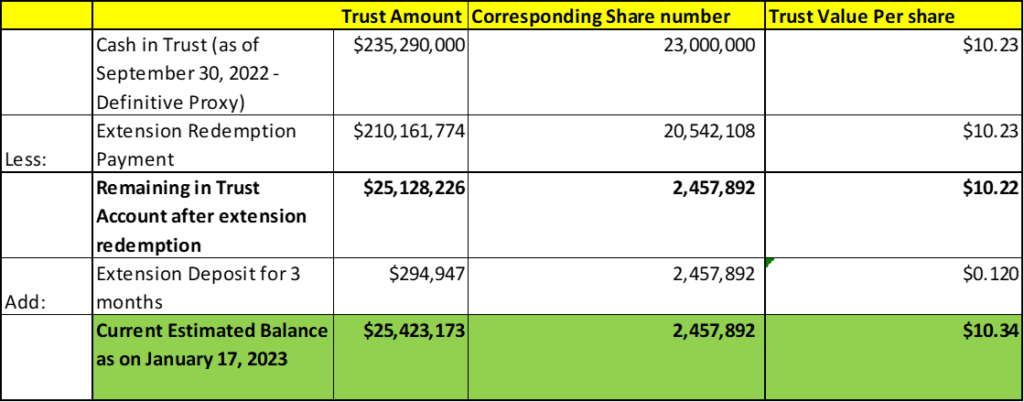

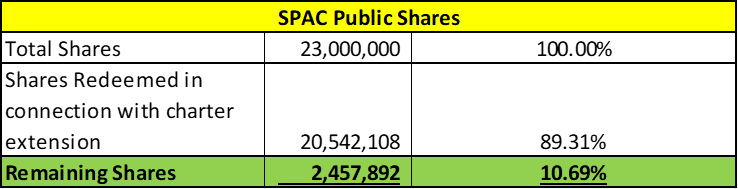

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + ½ Redeemable Warrant

- #Cash in Trust: $25,423,173 (103.4% of Public Offering)

- Public Shares Outstanding: 2,457,892 shares (*10.69% after redemption in connection with charter extension)

- Private Shares Outstanding: 5.75 million shares

- Estimated Trust Value/Share: $10.34

- Liquidation Date: May 1, 2023

- Name of Target: Spectaire

- Description of Target: Spectaire Inc. manufactures, distributes and installs a patented portable mass spectrometry system that pioneers emissions reduction of logistics assets through direct observational measurement.

- Announced Date: January 17, 2023

- Expected Close: “Second Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1844149/000156459023000454/pcct-ex991_30.htm

- Transaction Terms (https://content.bamsec.com/0001564590-23-001474/slide-n01fjwawmxb.jpg):

- Enterprise Value: $203.0 million

- Market Capitalization: $233.0 million

- Target Shareholders Receive (~53.8%):

- Aggregate consideration of $125 million

- Cash Consideration: Lower of:

- $6.25 million

- the amount by which the Available Cash at closing exceeds $5.00 million (Aggregate Cash Consideration will be zero if available cash less than $5,.00 million)

- Available Cash = Aggregate cash proceeds received by Target and SPAC + CIT – Transaction Expenses

- Equity consideration: $125 million – Cash Consideration (shares of PCCT Common Stock at $10.0 per share)

- Cash Consideration: Lower of:

- Aggregate consideration of $125 million

- Earn-Out: 7.50 million PCCT Common Stock (5 years after closing)

- 2.50 million shares @ $15.0 per share

- 2.50 million shares @ $20.0 per share

- 2.50 million shares @ $25.0 per share

- PIPE / Financing:

- $25.0 million of PIPE is expected to be raised at $10.0 per share

- Transaction assumes $50.0 million of ELOC

- Redemption Protections:

- Up to 2,457,892 shares of FPAs by Meteora Capital

- SPAC needs to pay an escrow amount = 99% * (# of Recycled Shares * Initial Price)

- SPAC needs to pay (150,000 Ordinary Shares * Initial Price) directly from the trust account

- Up to 2,457,892 shares of FPAs by Meteora Capital

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors and Key Target Shareholders: 6 months post-closing, 1 month early-release if price ≥ $12.0

- Closing Conditions:

- No Minimum Cash Condition

- Termination date: May 1, 2023

- Other customary closing conditions

- Termination:

- Standard termination clauses

- Advisors:

- Target Legal Advisors: Latham & Watkins LLP

- SPAC Legal Advisors: Skadden, Arps, Slate, Meagher & Flom LLP

- Financials (N/A):

- No historical or projected financials provided

- Equity Incentive Plan

- 12% of fully diluted shares outstanding post-closing

- Includes evergreen provision for annual automatic increase of up to 5%

*Denotes estimated figures by CPC

#Estimated as on January 17, 2023