February 9, 2023

- Financial Strategies Acquisition Corporation (FXCO) to acquire Austin Biosciences (private) in a transaction valuing the pro forma entity at $166.3 million in Market Value (assuming zero redemptions from current level of 6.17% public shares).

- Austin Biosciences shareholders will receive 12.5 million shares of common stockas merger consideration.

- No minimum cash condition.

- Business combination transaction is targeted to close in the second quarter of 2023.

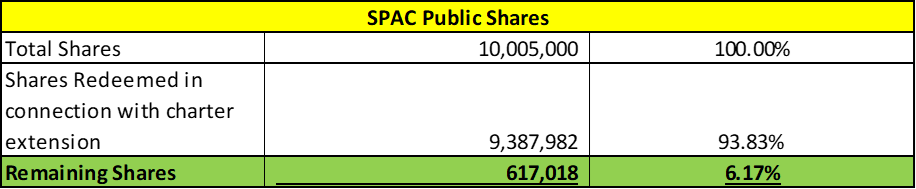

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 1 warrant + 1 right (to receive 1/10 shares)

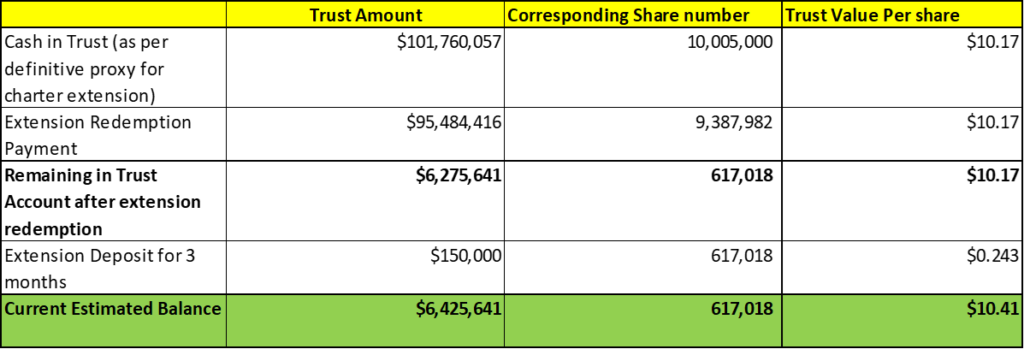

- #Cash in Trust: $6,425,641 (104.1% of Public Offering)

- Public Shares Outstanding: 617,018 shares

- Private Shares Outstanding: 3.0062 million shares (with 504,950 in units)

- Estimated Trust Value/Share: *$10.41

- Liquidation Date: December 14, 2022

- Current Liquidation Date: March 14, 2023

- Outside Liquidation Date: December 14, 2023

- Name of Target: Austin Biosciences

- Description of Target: Austin Biosciences is a dynamic Texas-based pharmaceutical company, improving the potency and safety of existing FDA approved pharmaceutical products used for treatment of various cancers, including breast, lung, prostate, gastric, head and neck, and ovarian cancer. Their advanced R&D facilities in Texas foster a prime environment for scientists to create cutting-edge treatments. The Company expects to initiate a Phase 1 trial for its leading candidate Austin Biosciences-1103 in Q1, 2024 or earlier. Pre-clinical development is also underway for multiple product candidates in their pipeline.

- Announced Date: February 13, 2023

- Expected Close: “Second Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1817565/000110465923023001/tm237173d1_ex99-1.htm

- Transaction Terms (N/A):

- Enterprise Value: Not Provided

- Market Cap: $166.3 million

- Target Shareholders Receive (~75%):

- Equity consideration of $125 million at $10.0 per share (12.5 million shares of FXCO Class A common stock)

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors: 12 months post-closing

- Early Release: If the price equals or exceeds $12.0 per share after 150 days post-closing

- Key Target Shareholders: 12 months post-closing

- SPAC Sponsors: 12 months post-closing

- Closing Conditions:

- Termination date: December 31, 2024 (subject to a maximum 3-month extension)

- No Minimum Cash Condition

- Other customary closing conditions

- Termination:

- Standard termination clauses

- Advisors:

- No information provided

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- In the form to be mutually agreed upon by both parties

*Denotes estimated figures by CPC

#Reported as on February 9, 2023 (Date of Form 8-K announcing sponsor contribution to Trust)