February 17, 2023

- A SPAC Acquisition I Corp. (ASCA) to acquire NewGenIvf (Private) in a transaction valuing the pro forma entity at *$66.23 million in Enterprise Value (*$103.53 million equity value) assuming redemption rate of 47.42%.

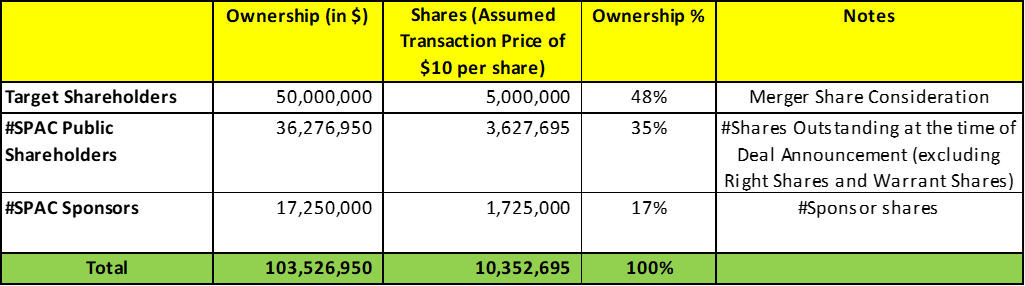

- NewGenIvf shareholders will receive equity consideration of $50.0 million at $10.0 per share.

- No minimum cash condition.

- Agreement includes a Target Breakup fee of (a) 2.0 million on failure to deliver financial statements by February 28, 2023 or on any breach occurring before 5 months after initial filing of preliminary proxy (Milestone Date) OR (b) $1.00 million if breach occurs after Milestone Date.

- Business combination transaction is targeted to close in the third quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.75 Redeemable Warrant +1 Right

- #Cash in Trust: $37.30 million (102.8 % of Public Offering)

- Public Shares Outstanding: 3,627,695 shares (3,272,305 shares tendered for redemption in connection with charter extension)

- Private Shares Outstanding: 1,725,000 shares

- Reported Trust Value/Share: $10.28

- Liquidation Date: February 17, 2022

- Outside Liquidation Date: October 17, 2023 (On 2/13/2023, charter amendment proposal was approved giving SPAC the right to extend up to 8 times for an additional 1 month each time, from February 17, 2023 to October 17, 2023)

- Name of Target: NewGenIvf

- Target Description: NewGen Group and its management have over a decade of experience in the fertility industry. With a mission to aid couples and individuals, regardless of fertility challenges, to build families and to increase their access to infertility treatment. NewGen has dedicated itself to providing comprehensive fertility services for its customers. NewGen’s clinics are located in Thailand, Cambodia, and Kyrgyzstan, and present a full suite of services for its patients, including comprehensive infertility and assisted reproductive technology treatments, egg and sperm donation, and surrogacy, in the appropriate jurisdictions, respectively.

- Announced Date: February 16, 2023

- Expected Close: “Third Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1868775/000121390023012495/ea173753ex99-1_aspac1acq.htm

- Transaction Terms (N/A):

| Redemption Rate | 47.42% (Shares redeemed in connection with Charter Extension) |

| Assumed Transaction Price | $10.00 per share |

| Enterprise Value | *$66.23 million [Market Cap (-) Cash in Trust OR *$103.53 million (-) $37.3 million] |

| Market Cap Value | *$103.53 million |

- Target Shareholders Receive (*~48%):

- $50.0 million of Equity Consideration at $10.0 per share (5.0 million Purchaser Class A ordinary shares)

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors: 6 months post-closing

- Early Release: If the price equals or exceeds $12.00 per share after closing

- Key Target shareholders: 1-year post-closing (if earnout shares are issued, then 1-year after the issuance of such Earnout Shares)

- Early Release (20%): If the price equals or exceeds $15.00 per share after 6 months post-closing

- SPAC Sponsors: 6 months post-closing

- Closing Conditions:

- Termination date: October 17, 2023

- No minimum cash condition

- Financial statements by February 28, 2023

- Other customary closing conditions

- Termination:

- Break-up fee payable by Target & Principal shareholders of:

- $2.0 million

- if Target fails to deliver financial statements by February 28, 2023

- on any breach or failure occurring before 5 months after initial filing of preliminary proxy (Milestone Date)

- $1.0 million

- any breach or failure occurring after Milestone Date

- Other standard termination clauses

- $2.0 million

- Break-up fee payable by Target & Principal shareholders of:

- Advisors:

- Target Legal Advisors: Jun He Law Offices

- SPAC Legal Advisors: Loeb & Loeb LLP, Haiwen & Partners, DFDL (Thailand) Limited, Kalikova & Associates law firm and Ogier

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No Valuations provided

- Equity Incentive Plan:

- Initial Share Reserve: 1.35 million Purchaser Class A Ordinary shares post-closing

| Participant | Agents/Other Business Partners of Purchasers and its subsidiaries | Other Participants |

| Initial Grants | Not more than 1.00 million | Not Applicable |

| Vesting Period commencement | Not earlier than January 1, 2025 | Not earlier than 3 years of closing |

| Lock-up Period | Commencing from the vesting date until the later of: (A) December 31, 2025 AND (B) the date that is no earlier than the 1 year of the relevant vesting date as may be agreed | Not Applicable |

*Denotes estimated figures by CPC

#Reported as on February 16, 2022