February 17, 2023

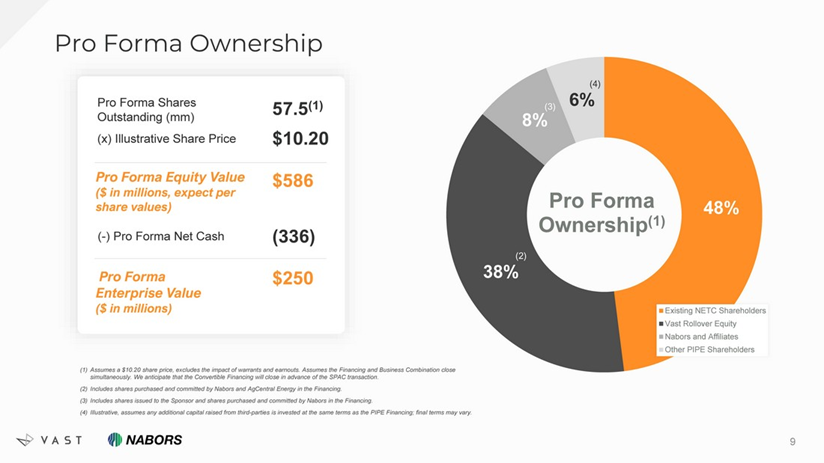

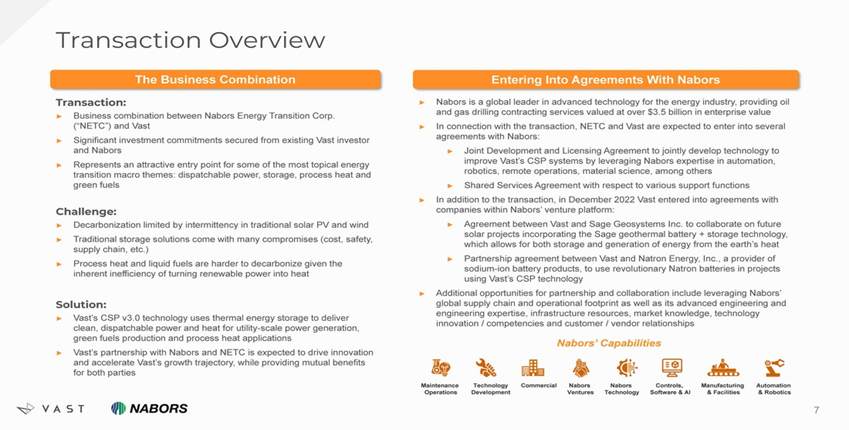

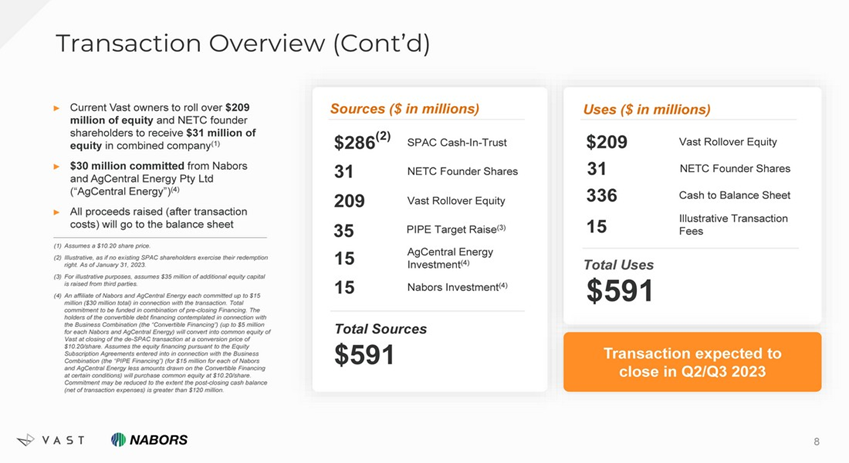

- Nabors Energy Transition Corp. (NETC) to merge with Vast Solar (Private) in a transaction valuing the pro forma entity at $250 million in Enterprise Value ($586 million equity value) assuming zero redemptions.

- Vast shareholders will receive equity consideration of $209 million at $10.2 per share.

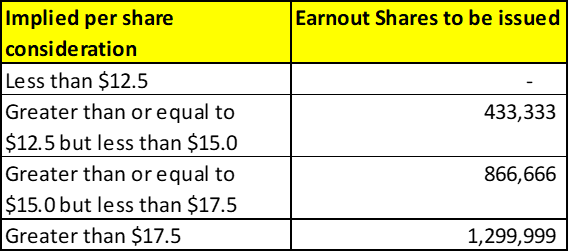

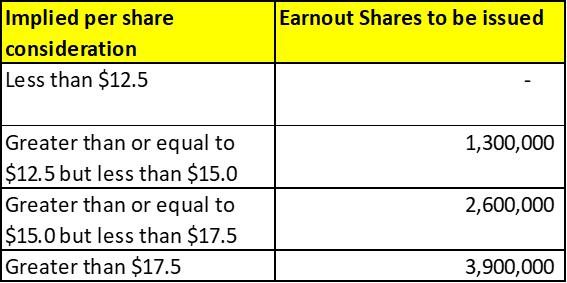

- Transaction includes 2,799,999 earnout shares to Vast shareholders, 433,333 shares incrementally vesting at $12.5, $15.0, $17.5 and remaining 1.50 million shares upon procurement of a certain contract.

- NETC Public shareholders will receive *27.60 million Vast ordinary shares (1 for 1).

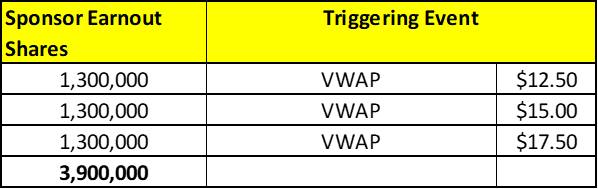

- NETC Sponsor will receive 2.825 million shares as merger consideration & 3.90 million shares as earnout consideration (or 58%).

- Affiliates of Nabors and AgCentral Energy each committed up to $15.0 million of capital in a combination of a pre-closing convertible note financing and a PIPE of ordinary shares of Vast at closing. Vast is targeting a minimum of $35.0 million of additional capital from other third-party investors.

- Minimum net cash condition of $50.0 million.

- No termination fees.

- Business combination transaction is targeted to close in second or third quarter of 2023.

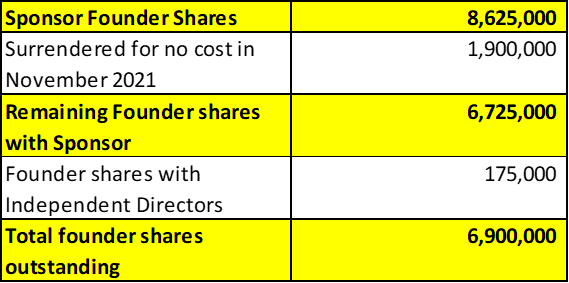

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.50 Redeemable Warrant

- #Cash in Trust: $286 million (*103.6 % of Public Offering)

- Public Shares Outstanding: 27.6 million shares

- Private Shares Outstanding: 6.90 million shares

- Estimated Trust Value/Share: *$10.36

- Liquidation Date: February 18, 2022

- Current Liquidation Date: May 18, 2023 (on 2/17/2023, NETC extended the date by an additional 3-month period from 2/18/2023 to 5/18/2023, as permitted under NETC’s charter)

- Outside Liquidation Date: August 18, 2023

- Name of Target: Vast Solar

- Target Description: Vast is a world-leading renewable energy company that has developed concentrated solar power (CSP) systems to generate, store and dispatch carbon free, utility-scale electricity, industrial heat, and to enable the production of green fuels. Vast’s unique approach to CSP utilizes a proprietary, modular sodium loop to efficiently capture and convert solar heat into these end products. Vast’s “CSP v3.0” system is easier to permit, build and maintain than larger central tower CSP systems, and it is more efficient.

- Announced Date: February 14, 2023

- Expected Close: “Second or Third Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1854458/000110465923020607/tm236588d2_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1854458/000110465923021972/tm236588d5_ex99-2img009.jpg, https://www.sec.gov/Archives/edgar/data/1854458/000110465923021972/tm236588d5_ex99-2img007.jpg & https://www.sec.gov/Archives/edgar/data/1854458/000110465923021972/tm236588d5_ex99-2img008.jpg):

| Redemption Rate | 0% |

| Transaction Price (Assumed) | $10.20 per share |

| Enterprise Value | $250 million |

| Market Cap Value | $586 million |

- SPAC Public Shareholders Receive:

- *27.60 million Vast Ordinary Shares (1 for 1)

- SPAC Sponsor Receive: Equity Consideration:

- 2.825 million Vast Ordinary SharesEarnout Consideration: 3.90 million Vast Ordinary Shares

- Target Shareholders Receive (~*38.05%):

- $209 million of Equity Consideration at $10.20 per share (20.9 million Vast ordinary shares)

- Earnout Consideration: 2,799,999 Vast Ordinary Shares (5-years post-closing starting 70 days after closing)

- If there is a change in control during earnout period, following shares will be issued:

- 1,500,000 (-) Earnout shares issued before such change in control

- No further shares will be issued after that

- If there is a change in control during earnout period which entitles the shareholders to receive consideration implying a value per Share of:

- PIPE / Financing:

- Nabors Lux and AgCentral entered into:

- Note Subscription Agreement:

- Agreed to subscribe for up to $5.0 million of principal each (or $10.0 million in aggregate) of Senior Convertible Notes from Vast in a private placement & will convert into common equity shares at closing at a conversion price of $10.20 per share

- Equity Subscription Agreement (PIPE)

- Agreed to subscribe up to $15 million each (or $30 million in aggregate) of Vast Ordinary Shares at $10.20 per share

- Commitments may be reduced to the extent the post-closing net cash balance is more than $120 million

- Note Subscription Agreement:

- Expected to raise additional equity of $35 million from third parties

- Nabors Lux and AgCentral entered into:

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Earnout Consideration: 3.90 million Vast Ordinary Shares or (*58%) [5-years post-closing starting 70 days after closing]

- If there is a change in control during earnout period which entitles the sponsors to receive consideration implying a value per Share of:

- Lock-up:

- SPAC Sponsor: 6 months post-closing

- Key Target shareholders: 6 months post-closing

- Closing Conditions:

- Termination date: February 14, 2024

- Minimum net cash condition of $50 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemption Payments |

| Less: | Any Stock Buyback Tax (Excise Tax) |

| Add: | Proceeds of Convertible Financing |

| Add: | Proceeds of PIPE Financing |

| Less: | SPAC + Target Transaction Expenses |

- Implementation of Vast Split Adjustment and MEP Share Conversion

- Completion of NETC existing Convertible Note Conversion

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clauses

- Advisors:

- Target Legal Advisors: White & Case LLP and Gilbert + Tobin

- SPAC Financial Advisor: Guggenheim Securities, LLC

- SPAC Legal Advisors: Vinson & Elkins L.L.P. and King & Wood Mallesons

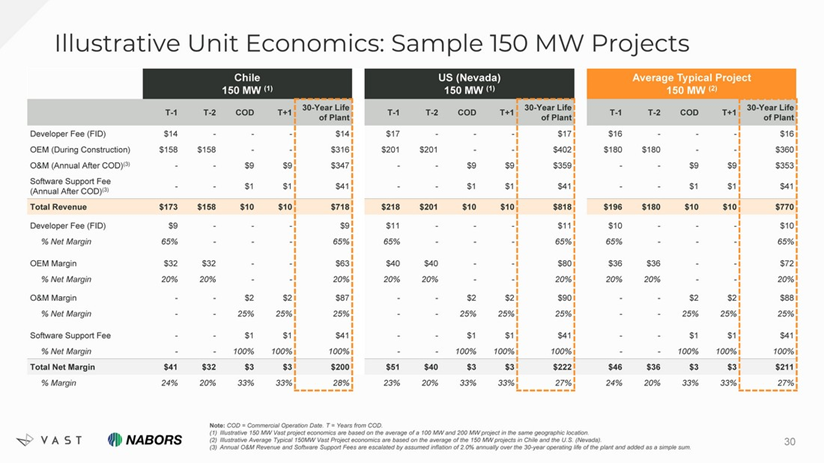

- Financials (https://www.sec.gov/Archives/edgar/data/1854458/000110465923021972/tm236588d5_ex99-2img030.jpg):

- Comparables (N/A):

- No Valuations provided

- Equity Incentive Plan:

- Initial pool expected to be of 7.5% shares of Combined Company post-closing

*Denotes estimated figures by CPC

#Estimated as on February 14, 2023 (From Investor Presentation)