February 20, 2023

- Nubia Brand International Corporation (NUBI) to acquire Honeycomb Battery Company (private) in a transaction.

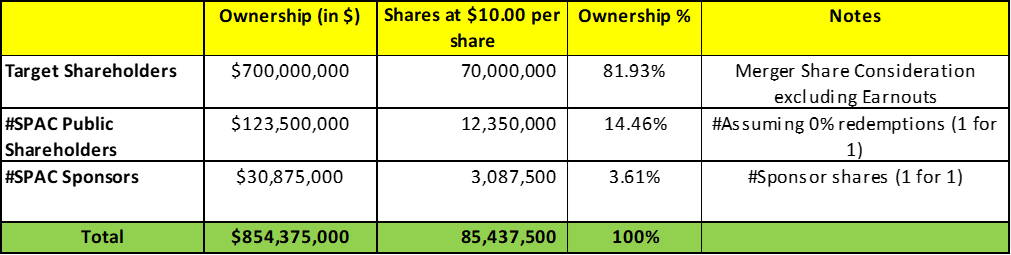

- Pro forma equity value of *$854 million assuming zero redemptions.Honeycomb Battery shareholders will receive an equity consideration of $700 million at $10.0 per share along with 22.5 million earnout shares vesting in three tranches at $12.5, $15.0, and $25.0 respectively.

- No minimum cash condition.

- Business combination transaction is targeted to close in the second quarter of 2023.

- SPAC Details:

- Unit Structure: 1 ordinary share of common stock + ½ warrant

- #Cash in Trust: $126,717,311 (102.6% of Public Offering)

- Public Shares Outstanding: 12.35 million shares

- Private Shares Outstanding: 3.0875 million shares

- Reported Trust Value/Share: $10.26

- Liquidation Date: March 15, 2023

- Name of Target: Honeycomb Battery Company

- Description of Target: Honeycomb Battery Co. (“Honeycomb” or “HBC”), formerly the energy solutions division of Global Graphene Group, Inc. (G3), is a Dayton, Ohio, USA-based advanced battery technology company focused on the development and commercialization of battery materials, components, cells, and selected module/pack technologies.

- Announced Date: February 16, 2023

- Expected Close: “Second Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1881551/000121390023012602/ea173325ex99-1_nubiabrand.htm

- Transaction Terms (N/A):

- Market Value: *$854 million

- Target Shareholders Receive:

- Equity consideration of $700 million (70.0 million shares of NUBI Class A Common Stock)

- Earn-Out: 22.5 million shares of NUBI Class A Common Stock (4 years after closing)

- 5.00 million shares @ $12.5 per share during a period starting from 30 days after closing & ending 2 years after closing

- 7.50 million shares @ $15.0 per share during a period starting from 180 days after closing & ending 42 months after closing

- 10.0 million shares @ $25.0 per share during a period starting from 180 days after closing & ending 4 years after closing

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- Target shareholders: 6 months post-closing

- SPAC Sponsor: 6 months post-closing

- Early Release: If price equals or exceeds $12.0 per share after closing

- Closing Conditions:

- No minimum cash condition

- Termination date: September 15, 2023

- Other customary closing conditions

- Termination:

- Standard termination clauses

- Advisors:

- Target Legal Advisors: Benesch, Friedlander, Coplan & Aronoff LLP

- Target Consultants: Arbor Lake Capital Inc.

- SPAC Legal Advisors: Loeb & Loeb LLP

- SPAC Capital Markets Advisors: EF Hutton, division of Benchmark Investments, LLC

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Management Equity Incentive Plan

- 10.0% of shares outstanding post-closing

- Includes 5% evergreen provision for annual automatic increase

*Denotes estimated figures by CPC

#Reported as on September 30, 2022