March 7, 2023

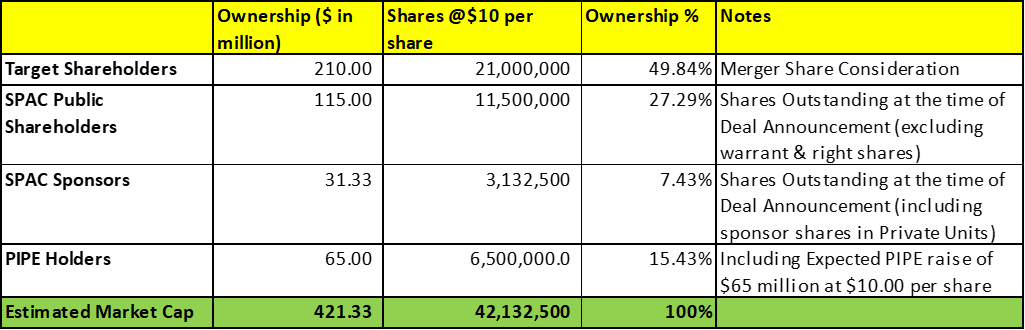

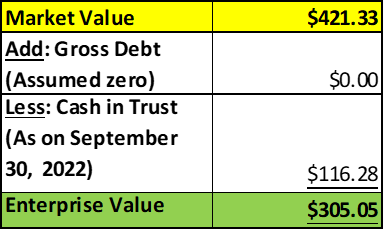

- EF Hutton Acquisition Corporation I (EFHT) to acquire E.C.D. Auto Design (Private) in a transaction valuing the pro forma entity at *$305. million in Enterprise Value (*$421 million equity value) assuming zero redemptions & PIPE of $65.0 million.

- E.C.D shareholders will receive an equity consideration of $210 million at $10.0 per share and cash consideration of $15.0 million.

- EFHT and E.C.D shall use reasonable efforts to raise $65.0 million in Common Stock PIPE.

- Minimum gross cash condition of $65.0 million.

- No termination fees.

- Business combination transaction is targeted to close in the third quarter of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 Redeemable Warrant + 1 Right

- #Cash in Trust: $116,276,881 (101.1 % of Public Offering)

- Public Shares Outstanding: 11,500,000 shares

- Private Shares Outstanding: 3,132,500 shares (including 257,500 shares contained in Private Units)

- Reported Trust Value/Share: $10.11

- Liquidation Date: June 13, 2023

- Outside Liquidation Date: March 13, 2024

- Name of Target: E.C.D. Auto Design

- Target Description: E.C.D. is a creator of restored luxury vehicles that combines classic English beauty with modern performance. Currently, E.C.D. restores Land Rovers Defenders, Land Rover Series IIA, the Range Rover Classic and the Jaguar E-Type. Each vehicle produced by E.C.D. is fully bespoke, a one-off that is designed by the client through an immersive luxury design experience and hand-built from the ground up in 2,200 hours by master-certified Automotive Service Excellence (“ASE”) craftsmen. The Company was founded in 2013 by three British ”petrol heads’’ whose passion for classic vehicles is the driving force behind exceptionally high standards for quality, custom luxury vehicles. E.C.D.’s global headquarters, known as the ”Rover Dome,” is a 100,000-square-foot facility located in Kissimmee, Florida that is home to 70 talented craftsmen and technicians, who hold a combined 61 ASE and five master level certifications. E.C.D. has an affiliated logistics center in the U.K. where its seven employees work to source and transport 25-year-old work vehicles back to the U.S. for restoration.

- Announced Date: March 6, 2023

- Expected Close: “Third Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1922858/000149315223006781/ex99-1.htm

- Transaction Terms (N/A):

| Redemption Rate | 0% |

| Share Price | $10.00 per share |

| Enterprise Value | *$305.05 million |

| Market Cap Value | *$421.33 million |

- Target Shareholders Receive (~*49.84%):

- Cash payment of $15.00 million

- Equity consideration of $210.0 million at $10.00 per share (21.00 million shares of common stock EFHT)

- PIPE / Financing:

- Expected to raise $65.00 million of Common Stock PIPE

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors and Key Target Shareholders: 6 months post-closing

- Closing Conditions:

- Termination date: September 13, 2023

- 2022 Audited Financial Statements by March 31, 2023

- Not more than 5% of the issued and outstanding shares of Target Capital Stock shall constitute Dissenting Shares

- Minimum gross cash condition of $65 million

- Cash includes: CIT – Redemptions + Actual PIPE Proceeds

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- SPAC Capital Market Advisor: EF Hutton, division of Benchmark Investments, LLC

- SPAC Legal Advisors: Loeb & Loeb LLP

- Target Legal Advisors: Shuffled, Lowman & Wilson PA

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- No information provided

*Denotes estimated figures by CPC

#Reported as on September 30, 2022