March 9, 2023

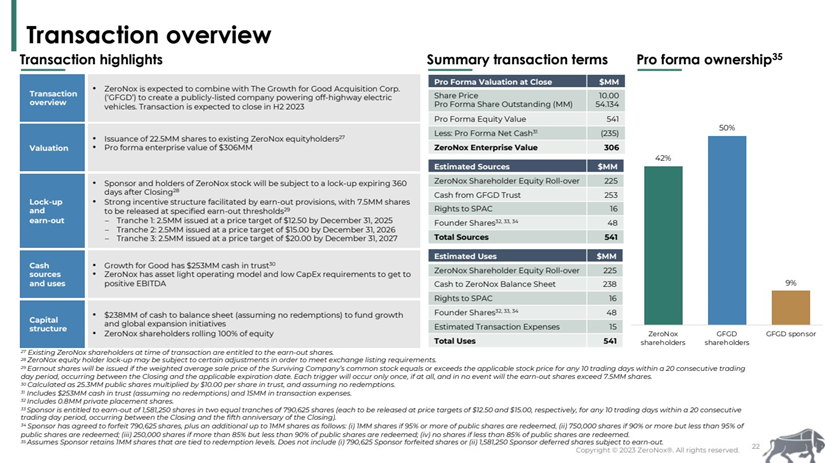

- The Growth for Good Acquisition Corporation (GFGD) to acquire ZeroNox (Private) in a transaction valuing the pro forma entity at $306 million in Enterprise Value ($541 million equity value) assuming zero redemptions.

- ZeroNox shareholders will receive an equity consideration of $225 million at $10.0 per share.

- Transaction includes 7.50 million earnout shares vesting equally at $12.5, $15.0, and $20.0 per share by December 31, 2025, 2026 and 2027 respectively.

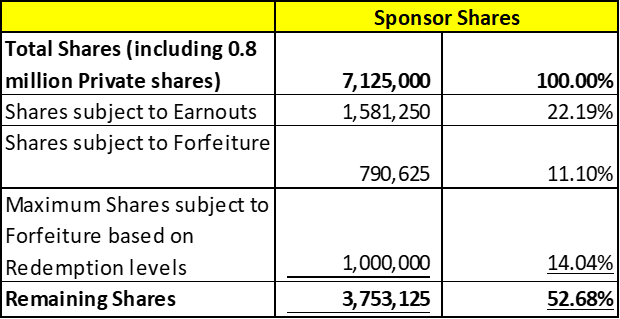

- Sponsor agreed to defer 1,581,250 shares (or *22.19%) subject to earnout, vesting in two equal tranches of 790,625 shares at $12.5 and $15.0 per share (5 years after closing).

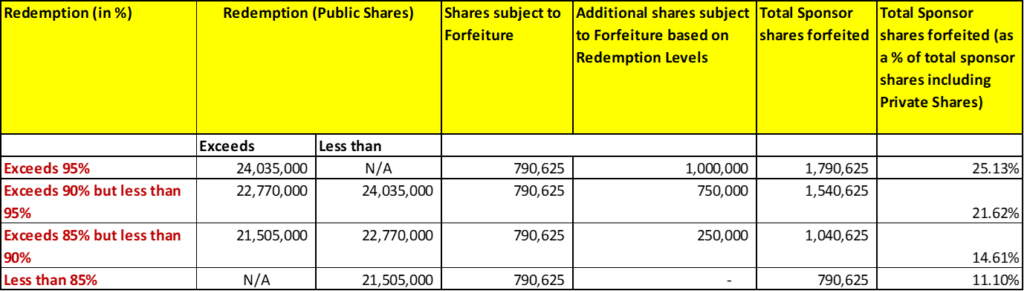

- Sponsor agreed to forfeit 790,625 shares (or *11.10%), plus additional shares up to 1,000,000 shares (or *14.04%) based on redemption levels.

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in the second half of 2023.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.50 Redeemable Warrant + 1 Right

- #Cash in Trust: $254,080,534 (100.4 % of Public Offering)

- Public Shares Outstanding: 25,300,000 shares

- Private Shares Outstanding: 7,125,000 shares (including 800,000 shares contained in Private Units)

- Reported Trust Value/Share: $10.04

- Liquidation Date: June 14, 2023

- Outside Liquidation Date: September 14, 2023

- Name of Target: ZeroNox

- Target Description: ZeroNox is leading the electrification of off-highway commercial and industrial vehicles, with best-in-class LFP batteries and an electric powertrain (“ZEPP”) that is cleaner, high performing, and cost effective. As a first mover in the advanced off-highway electric vehicle (OHEV) powertrain market, ZeroNox is proudly designed and engineered in America, with offices in Porterville, California.

- Announced Date: March 8, 2023

- Expected Close: “Second Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1876714/000110465923029820/tm238584d1_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1876714/000110465923029820/tm238584d1_ex99-2img025.jpg):

| Redemption Rate | 0% |

| Share Price | $10.00 per share |

| Enterprise Value | $306 million |

| Market Cap Value | $541 million |

- Target Shareholders Receive (~42%):

- Equity consideration of $225 million at $10.00 per share (22.50 million shares)

- 7.50 million Earnout Shares as follows:

- 2.50 million shares at $12.50 per share by December 31, 2025

- 2.50 million shares at $15.00 per share by December 31, 2026

- 2.50 million shares at $20.00 per share by December 31, 2027

- PIPE / Financing:

- Nil

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Sponsor agreed to defer 1,581,250 shares (*22.19%) subject to earnout (5 years post-closing):

- 790,625 shares at $12.50 per share

- 790,625 shares at $15.00 per share

- Measurement Period: 10 trading days within 20 consecutive trading day period

- Sponsor agreed to forfeit 790,625 shares (or *11.10%), plus additional shares up to 1,000,000 shares (or *14.04%) as follows:

- Lock-up:

- SPAC Sponsors: 360 days post-closing

- Key Target Shareholders: 360 days post-closing (may be subject to certain adjustments to meet exchange listing requirements)

- Closing Conditions:

- Termination date: June 14, 2023 (With extension: September 14, 2023)

- No minimum cash condition

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- Lead Financial Advisor: Chardan Capital Markets, LLC

- SPAC Legal Advisors: Skadden, Arps, Slate, Meagher & Flom LLP

- Target Legal Advisors: Loeb & Loeb LLP

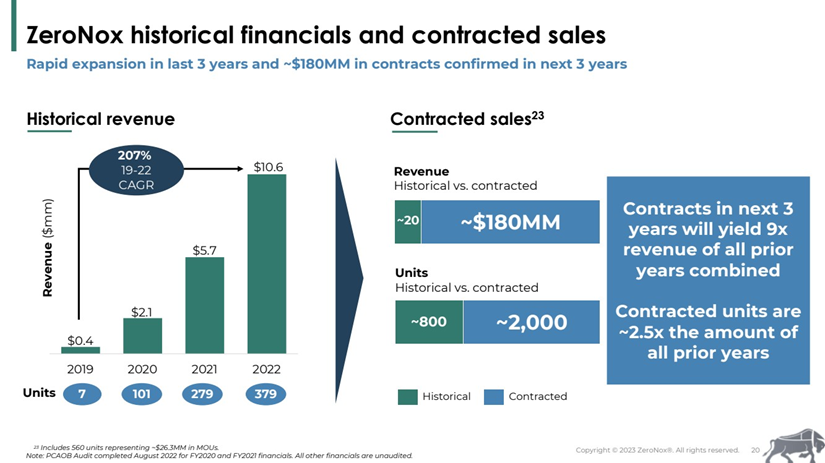

- Financials (https://www.sec.gov/Archives/edgar/data/1876714/000110465923029820/tm238584d1_ex99-2img023.jpg):

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- No information provided

*Denotes estimated figures by CPC

#Reported as on September 30, 2022