March 17, 2023

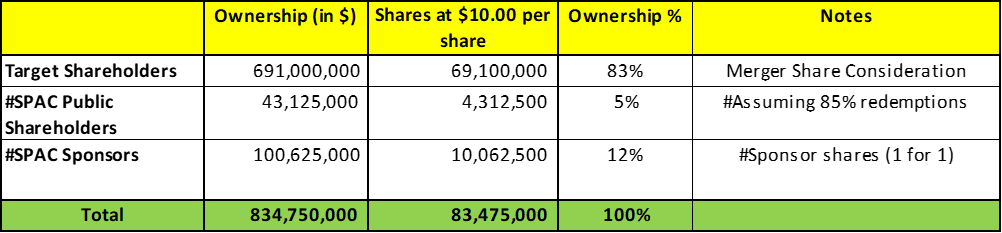

- HCM Acquisition Corp. (HCMA) to merge with Murano (Private) in a transaction valuing the pro forma entity at $810 million in Enterprise Value (*$835 million equity value) assuming 85% redemptions.

- Murano shareholders will receive an equity consideration of $691 million at $10.0 per share.

- Deferred Underwriting fee reduced to $3.00 million.

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in the third quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.50 Redeemable Warrant

- #Cash in Trust: $293,250,000 (102.0 % of Public Offering)

- Public Shares Outstanding: 28.75 million shares

- Private Shares Outstanding: 10,062,500 shares

- Reported Trust Value/Share: $10.20

- Liquidation Date: April 25, 2023 (can be extended to January 25, 2024 if HCMA takes necessary actions to extend the deadline comprising of 9 successive 1-month extensions and Sponsor has agreed to allocate up to 0.20 million Sponsor Shares to one or more holders of HCMA Class A Ordinary Shares as consideration)

- Name of Target: Murano

- Target Description: Murano PV, S.A. DE C.V. is a Mexican development company with extensive experience in the structuring, development and assessment of industrial, residential, corporate office, and hotel projects in Mexico. The Company also provides comprehensive services, including the execution, construction, management, and operation of a wide variety of industrial, business, and tourism real estate projects, among others. Grupo Murano has a national footprint and international outreach aimed at institutional real estate investors.

- Announced Date: March 14, 2023

- Expected Close: “Third Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1845368/000114036123011739/brhc10049755_ex99-1.htm

- Transaction Terms (N/A):

| Redemption Rate | 85% |

| Share Price | $10.0 per share |

| Enterprise Value | $810 million |

| Market Cap Value | *$834.75 million |

- SPAC Public Shareholders Receive:

- *4,312,500 PubCo Ordinary Shares (1 for 1)

- SPAC Sponsors Receive:

- *10,062,500 PubCo Ordinary Shares (1 for 1)

- Target Shareholders Receive (~*83%):

- Equity consideration of $691 million at $10.0 per share (69,100,000 PubCo Ordinary shares)

- PIPE / Financing:

- Nil

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors and Key Target Shareholders: 1-year post-closing

- Early Release: If the price equals or exceeds $12.00 per share after 150 days post-closing

- SPAC Sponsors and Key Target Shareholders: 1-year post-closing

- Closing Conditions:

- Termination date: December 31, 2023 (January 25, 2024 with extension)

- No minimum cash condition

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- SPAC Financial Advisor: Cohen & Co. Capital Markets, a division of J.V.B. Financial Group, LLC

- SPAC Legal Advisors: King & Spalding LLP and Galicia Abogados

- Target Legal Advisors: Clifford Chance US LLP and Nader, Hayaux & Goebel

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- No information provided

- Deferred Underwriting Fee:

- Deferred Underwriting fee reduced to $3.0 million

*Denotes estimated figures by CPC

#Reported as on November 25, 2022 (in Definitive Proxy for charter extension)