April 5, 2023

- Insight Acquisition Corporation (INAQ) to acquire Avila Energy (CSE: VIK) in a transaction valuing the combined company at an equity value of $192.6 million assuming 95% redemptions from current level.

- Avila shareholders will receive 12,580,000 shares of AB PubCo Common stock at $10.3 per share in exchange for 150,540,414 common shares of Avila.

- Transaction includes 0.70 million earnout shares to certain directors, officers, employees, and consultants of Avila vesting at $15.0 (48- months after closing).

- Simultaneously, Insight and Avila entered into a prepaid forward purchase agreement with certain affiliates of Meteora Capital Partners where Meteora has committed to purchase up to 2.50 million Class A common Insight Shares at $10.0 per share totaling $25.0 million (the “Backstop”) in advance of closing.

- Avila and Insight are also expected to raise $35.0 million in Avila’s convertible debentures before closing which will be priced within the context of the redemption price of the Insight shares in trust of $10.0.

- Gross minimum cash condition of 25.0 million.

- Agreement includes termination fee of $5.0 million payable by Avila to Insight if agreement is terminated by either party if Avila’s BOD withdraws the recommendation or enters into a superior proposal or on termination by Insight in the event of a breach of any representation & warranties on the part of Avila or if there has been a target material adverse event which is not cured within 30 days after the receipt of written notice.

- Underwriters agreed to reduce their deferred underwriting fee by $5.40 million from $8.40 million (down by *64.29%) and the remaining amount of $3.00 million shall be payable in cash.

- Business combination transaction is targeted to close in the fourth quarter of 2023.

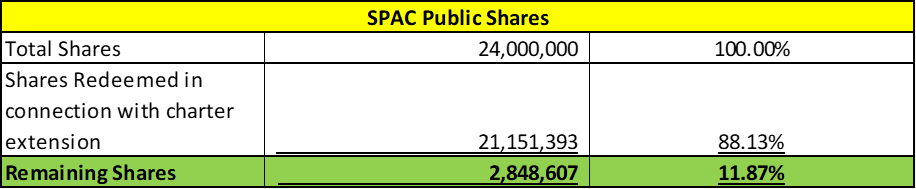

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.50 Redeemable Warrant

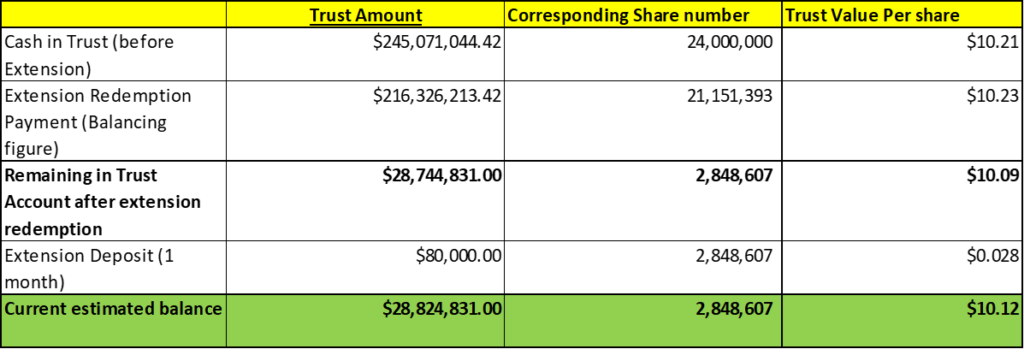

- #Cash in Trust: $28,824,831 (101.2 % of Public Offering)

- Public Shares Outstanding: 2,848,607 shares

- Private Shares Outstanding: 6.0 million shares

- Estimated Trust Value/Share: $10.12

- Liquidation Date: March 7, 2023

- Outside Liquidation Date: September 7, 2023 (extension successful on March 8, 2023)

- Name of Target: Avila Energy

- Target Description: The Company is an emerging CSE listed corporation trading under the symbol VIK, and in combination with an expanding portfolio of 100% Owned and Operated oil and natural gas production, pipelines and facilities is a licensed producer, explorer, and developer of energy in Canada. The Company, through the implementation of a closed system of carbon capture and sequestration and an established path underway towards the material reduction of Tier 1, Tier 2, and Tier 3 emissions, continues to work towards becoming a Vertically Integrated low-cost Carbon Neutral Energy Producer. The Company continues to grow and achieve its results by focusing on the application of a combination of proven geological, geophysical, engineering, and production techniques.

- Announced Date: April 4, 2023

- Expected Close: “Fourth Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1862463/000119312523090971/d484638dex991.htm

- Transaction Terms (N/A):

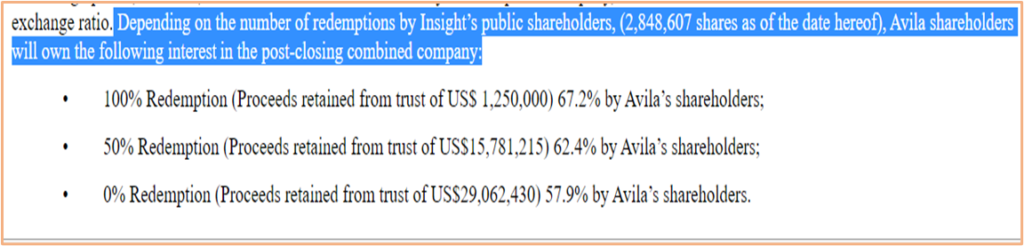

| Redemption Rate | 95% from current level of 2,848,607 public shares |

| Share Price | $10.3 per share |

| Enterprise Value | Not Available |

| Market Cap Value | $192.6 million |

- Target Securityholders Receive (~67.2%):

- 150,540,414 common shares of Avila will be exchanged for 12,580,000 AB PubCo common shares at $10.3 per share

- Earnout consideration of 700,000 AB PubCo Common Shares (48 months after closing) at $15.0 per share to certain directors, officers, employees, and consultants of Avila

- PIPE / Financing:

- Avila and Insight are expected to raise $35.0 million in Avila’s convertible debentures before closing & will be priced within the context of the redemption price of the Insight shares in trust of $10.0

- Redemption Protections:

| Particulars | Meaning | Notes |

| Date of FPA | March 29, 2023 | INAQ and Avila entered into an OTC Equity Prepaid Forward Transaction agreement with certain funds managed by Meteora Capital, LLC |

| FPA Seller (collectively as “Seller”) | (i) Meteora Special Opportunity Fund I, LP (ii) Meteora Capital Partners, LP (iii) Meteora Select Trading Opportunities Master, LP | Entities and funds managed by Meteora own equity interests in the Sponsor |

| Recycled Shares | Number of Shares purchased by Seller from third parties in the open market & Seller shall have irrevocably waived all redemption rights with respect to such Shares (but not in respect of any IPO Shares) | FPA seller can purchase (no obligation) INAQ Class A ordinary shares from holders (other than SPAC or its affiliates) who have elected to redeem such shares in connection with the proposed transactions through brokers in the open market after the redemption deadline at a price no higher than the redemption price to be paid by INAQ in connection with closing (Initial Price) |

| Prepayment Amount | Cash Amount = Redemption Price Per share (Initial Price) *(IPO Shares + Recycled shares) – Prepayment Shortfall OR Cash Amount = Redemption Price Per share (Initial Price) *(IPO Shares + Recycled shares) *95% | INAQ will pay to FPA Seller a prepayment amount from the trust account on the date that is after 1-business day of closing |

| Prepayment Shortfall | 5% of [Redemption Price Per share (Initial Price) *(IPO Shares + Recycled shares)] | |

| IPO Shares | 2,376,000 | Subject Shares should not exceed 7.70 million (beneficial ownership ≤ 9.9%) |

| Subject Shares | Recycled Shares + IPO shares | |

| Maximum Shares | 2,500,000 | |

| After closing but before maturity date, FPA Seller may, at its sole discretion sell some or all of the IPO Shares or Recycled Shares. On the last trading day of each calendar month following the Proposed Transactions, in the event that Seller has sold any IPO Shares or Recycled Shares (other than sales to recover the Shortfall Amount), an amount will be paid to INAQ and Seller from the escrow account as follows: SPAC Amount: (Sold IPO Shares + Sold Recycled Shares) *Reset Price Seller Amount: (Initial Price – Reset Price) * (Sold IPO Share or Sold Recycled Share) | ||

| Reset Price | Lowest of (a), (b) or (c) and subject to a $9.50 floor (a) The then current reset price (b) Initial Price (c) VWAP of INAQ Common Stock or AB PubCo Common Shares during the last 10 trading days during prior calendar month | Note: (a) Reset price shall be set on first scheduled trading day of each month (b) Reset Price may be further reduced pursuant to a Dilutive Offering Reset |

| Maturity Date | Earlier of: (a) 3 years post-closing (b) Seller VWAP Triggering Event (c) Delisting Event | VWAP Triggering Event: If VWAP Price is at or below $7.50 per share for any 10 out of 30 consecutive trading day-period thereafter Delisting Event: the Shares are delisted from a national securities exchange |

| At maturity date, Combined Company will be required to purchase from the FPA Seller Matured Shares [IPO shares or Recycled Shares held by Seller] | ||

| Maturity Consideration | If Consideration is in shares = $2.0*Matured Shares If Consideration is in cash = $1.0*Matured Shares | In the event of registration failure, the consideration will become equal to: $2.50* Matured shares |

| Break-Up Fee (Payable by INAQ and Avila to FPA Seller) | Sum of (a) and (b): (a) All fees (not exceeding $50,000) (b) $500,000 | If agreement if terminated before maturity or INAQ Class A or in case of delisting of INAQ shares |

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors:

- Equity consideration shares (50%): 1-year post-closing

- Early Release: If price equals or exceeds $12.0 per share after 150 days of closing

- Earnout shares (50%): 6 months post-closing

- Equity consideration shares (50%): 1-year post-closing

- Key Target Shareholders:

- Equity consideration shares (50%): 1-year post-closing

- Early Release: If price equals or exceeds $12.0 per share after 150 days of closing

- Earnout shares (50%): 6 months post-closing

- Equity consideration shares (50%): 1-year post-closing

- SPAC Sponsors:

- Closing Conditions:

- Termination date: October 31, 2023 (30-day one-time extension possible)

- Minimum gross cash condition of $25.0 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

| Add: | Financings |

| Add: | FPA/Backstop |

- Other customary closing conditions

- Termination:

- $5.0 million of termination fee payable by Avila to Insight:

- If agreement terminated by:

- Insight or Avila if BOD or any committee withdraws the:

- Recommendation that the Avila Shareholders vote in favor of the Target Shareholder Approval

- Enters into a Superior Proposal

- Insight or Avila if BOD or any committee withdraws the:

- If agreement is terminated by Insight:

- In the event of a breach of any representation & warranties on the part of Avila provided that Insight will not have the right to terminate if it is then in breach of any of its representations, warranties, covenants or agreements or if Avila has filed (and is then pursuing) an action seeking specific performance

- If there has been a Target Material Adverse Event which is not cured by Avila within 30 days after the receipt of written notice

- If agreement terminated by:

- Other standard termination clauses

- $5.0 million of termination fee payable by Avila to Insight:

- Advisors:

- SPAC Legal Advisors: Loeb & Loeb LLP

- Target Legal Advisors: WeirFoulds LLP and Dorsey & Whitney LLP

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- 10% of post-closing AB PubCo Common Shares (after giving effect to the Redemption & assuming full exercise of the Converted Options)

- Underwriting Agreement Amendment:

- Reduction in deferred underwriting fee by $5.40 million from original amount of $8.40 million (or reduction of *64.29%)

- Remaining $3.00 million shall be payable in cash at closing

- Reduction in deferred underwriting fee by $5.40 million from original amount of $8.40 million (or reduction of *64.29%)

*Denotes estimated figures by CPC

#Estimated as on April 5, 2023