April 8, 2023

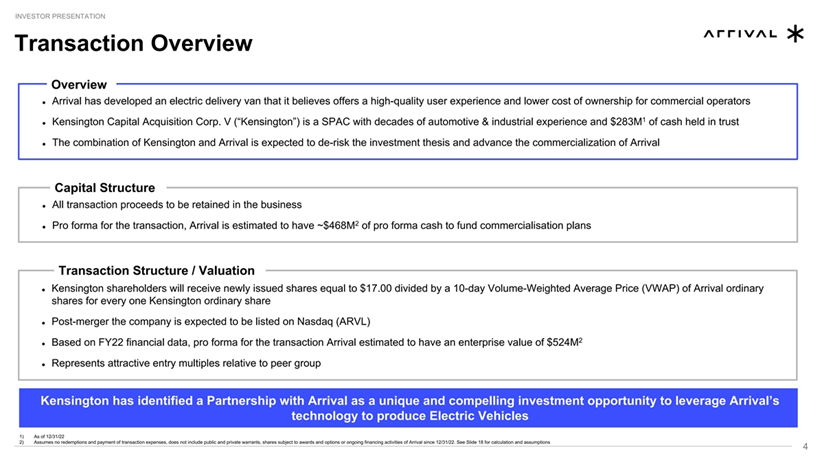

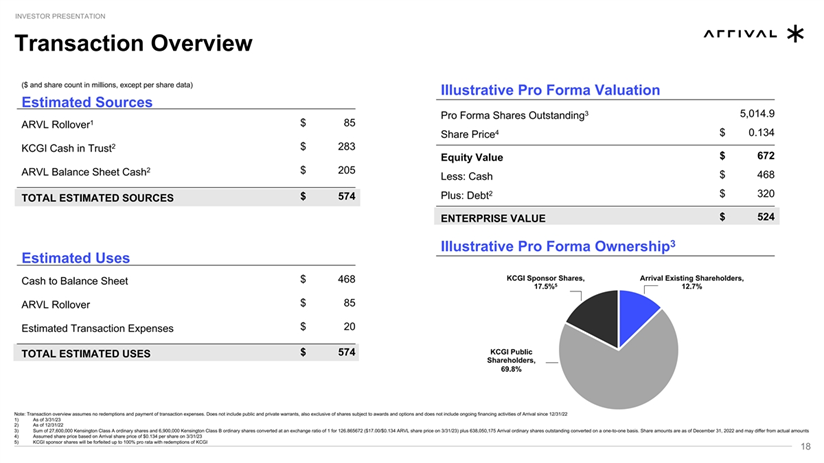

- Kensington Capital Acquisition Corp. V (KCGI) to be acquired by Arrival (NASDAQ: ARVL) in a transaction valuing the pro forma entity at $524 million in Enterprise Value ($672 million equity value) assuming zero redemptions.

- Kensington shareholders will receive PubCo ordinary shares equal to $17.0 divided by a 10-day VWAP of Arrival ordinary shares for every 1 Kensington share.

- Arrival shareholders will receive $85.0 million of equity consideration.

- Sponsor shares will be forfeited up to 100% pro rata with redemptions of KCGI.

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in the second half of 2023.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.75 Redeemable Warrant

- #Cash in Trust: $283,042,286 (102.6 % of Public Offering)

- Public Shares Outstanding: 27.60 million shares

- Private Shares Outstanding: 6.90 million shares

- Reported Trust Value/Share: $10.26

- Liquidation Date: August 17, 2022

- Outside Liquidation Date: August 17, 2023

- Name of Target: Arrival

- Target Description: Arrival’s mission is to master a radically more efficient New Method to design, produce, sell and service purpose-built electric vehicles, to support a world where cities are free from fossil fuel vehicles. Arrival’s in-house technologies enable a unique approach to producing vehicles using rapidly-scalable, local Microfactories. Arrival (Nasdaq: ARVL) is a joint stock company governed by Luxembourg law.

- Announced Date: April 06, 2023

- Expected Close: “Second Half of 2023”

- Press Release: https://www.globenewswire.com/news-release/2023/04/06/2643004/0/en/Arrival-Advances-U-S-Commercialization-Plans-Through-Business-Combination-with-Kensington-Capital-Acquisition-Corp-V.html

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1835059/000119312523094182/g495017425p5g1.jpg & https://www.sec.gov/Archives/edgar/data/1835059/000119312523094182/g495017425p19g1.jpg):

| Redemption Rate | 0% |

| Share Price | $0.134 per share |

| Enterprise Value | $524 million |

| Market Cap Value | $672 million |

- SPAC Shareholders Receive:

- Pubco Ordinary Shares = ER*Kensington Class A ordinary shares (including after conversion)

- Pubco Ordinary Shares = ER*27.60 million shares

- ER = $17.00/10-day VWAP of Arrival ordinary shares for every 1 Kensington share.

- Target Shareholders Receive (~12.7%):

- Equity consideration of $85 million (PubCo Ordinary shares)

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Sponsor agreed to forfeit up to 6.90 million founder shares (or 100%) in proportion to the number of public shares are redeemed in connection with closing:

- Number of founder shares forfeited = (Founder Shares*Redeemed shares)/ (27.60 million*ER)

- Number of founder shares forfeited = (6.90 million*Redeemed shares)/ [27.60 million*($17.0/Daily VWAP)]

- Lock-up:

- SPAC Sponsors and Key Target Shareholders: 1-year post-closing

- Early Release: If the price equals or exceeds $12.00 per share after 150 days post-closing

- SPAC Sponsors and Key Target Shareholders: 1-year post-closing

- Closing Conditions:

- Termination date: August 27, 2023

- No minimum cash condition

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- Target Financial Advisor: Teneo Securities LLC

- SPAC Legal Advisors: Hughes Hubbard & Reed LLP

- Target Legal Advisors: Linklaters LLP

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- No information provided

*Denotes estimated figures by CPC

#Reported as on December 31, 2022