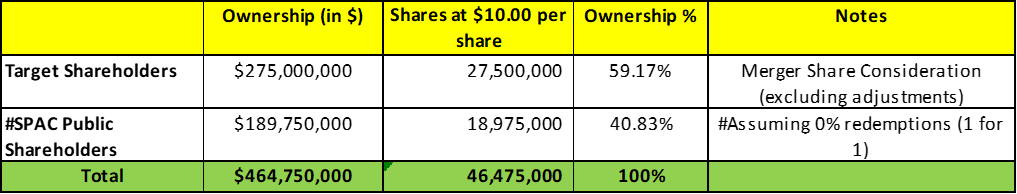

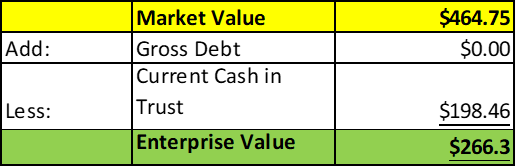

- Blue Ocean Acquisition Corp (BOCN) to merge with TNL Mediagene (Private) in a transaction valuing the pro forma entity at *$266 million in Enterprise Value (*$465 million equity value) assuming zero redemptions.

- TNL Mediagene shareholders will receive an equity consideration of $275 million at $10.0 per share.

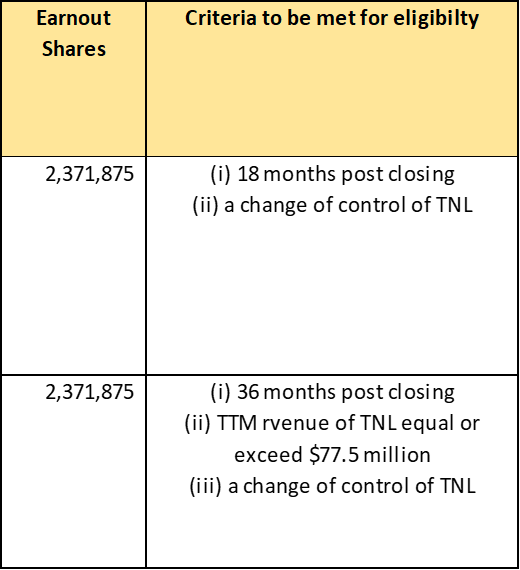

- Sponsor agreed to receive all its 4.74 million shares in earnout in two equal tranches subject to certain time condition and operational milestone. Simultaneously Sponsor agreed to forfeit 750,000 (or *8.13%) private placement warrants.

- Minimum net cash condition of $20.0 million.

- No termination fees.

- Business combination transaction is targeted to close in the first quarter of 2024.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.5 Redeemable Warrant

- #Cash in Trust: $199,237,500 (105.0 % of Public Offering)

- Public Shares Outstanding: 18,975,000 shares

- Private Shares Outstanding: 4,743,750 shares

- Trust Value/Share: $10.50

- Current Liquidation Date: September 07, 2023

- Outside Liquidation Date: September 07, 2023

- Name of Target: TNL Mediagene

- Target Description: TNL Mediagene, a Cayman Islands-registered company, is the product of the May 2023 merger of Taiwan’s The News Lens Co. and Japan’s Mediagene Inc., two leading, independent digital-media groups. Its business includes original and licensed media brands in Chinese, Japanese and English, across a range of subjects, including news, business, technology, science, food, sports and lifestyle; AI-powered advertising and marketing technology platforms in demand by agencies; and e-commerce and creative solutions. It takes pride in its political neutrality, its reach with younger audiences, and its quality. The company has 550 employees across Asia, with offices in Japan, Taiwan and Hong Kong

- Announced Date: June 06, 2023

- Expected Close: “First Quarter of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1856961/000121390023046570/ea179807ex99-1_blueocean.htm

- Transaction Terms (N/A):

| Redemption Rate | 0% |

| Share Price | $10.0 per share |

| Enterprise Value | *$266 million |

| Market Cap Value | *$465 million |

- Target Shareholders Receive (~*59.17%):

- Equity consideration of $275 million at $10.0 per share (27.5 million TNL ordinary shares)

- SPAC Public Shareholders Receive (~*40.83%):

- Equity consideration of *$189 million at $10.0 per share (18.9 million TNL ordinary shares) (Assuming no redemptions)

- SPAC Sponsors Receive:

- Sponsor agreed to receive all its 4,743,750 shares in earnouts in two equal tranches

- PIPE / Financing:

- Sponsor will make reasonable efforts to private investments in the Company in the form of the purchase of equity or the purchase of other securities of the Company or indebtedness including convertible indebtedness.

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Sponsor agreed to receive all its 4,743,750 shares in earnouts in two equal tranches subject to certain time condition and operational milestone which are as follows:

- Sponsor also agreed to forfeit 750,000 or (*8.13%) private placement warrant

- Lock-up:

- SPAC Sponsor (Earn-out Shares):

- 50% shares: 1 year post closing

- Early release: If price ≥ $12.0 after 150 days post-closing

- 50% shares: 2 years post-closing

- 50% shares: 1 year post closing

- Target Key shareholder: 180 days post-closing

- SPAC Sponsor (Earn-out Shares):

- Closing Conditions:

- Termination date: June 7, 2024

- Minimum net cash condition of $20.0 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

| Add: | PIPE Financing |

| Add: | TNL Cash in excess of $4.60 million |

| Less: | All Transaction Expenses |

- Other customary closing conditions

- Termination:

- No termination fees

- SPAC shareholder approval to extend the time by which it should be able to consummate business

- Other standard termination clauses

- Advisors:

- SPAC Legal Advisors: Sidley Austin LLP

- Target Legal Advisors: Morrison & Foerster LLP

- SPAC Capital Market Advisors Needham & Company, LLC

- Equity Incentive Plan:

- No information provided

*Denotes estimated figures by CPC

#Calculated as on May 04, 2023