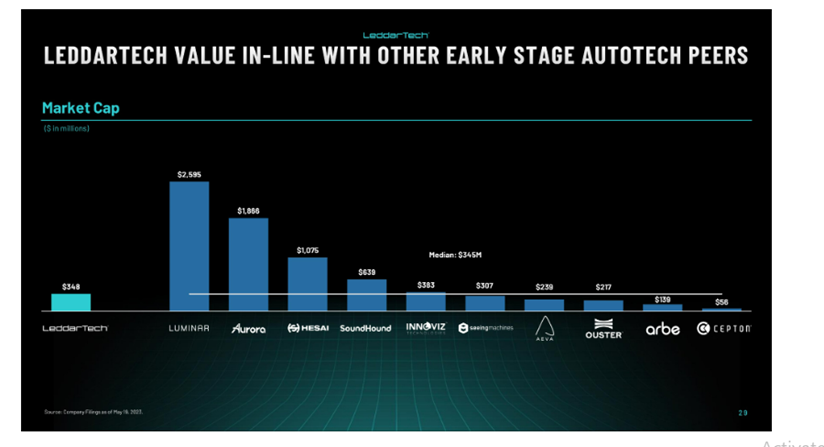

- Prospector Capital Corp (PRSR) to acquire LeddarTech (Private) in a transaction valuing the pro forma entity at $330 million in Enterprise Value ($348 million equity value) assuming zero redemptions from the current level of 93.2%.

- LeddarTech shareholders will receive an equity consideration of $200 million at $10.0 per share and 5.00 million earnout shares in five equal tranches at $12.0, $14.0 and $16.0 and the rest based on operational achievements respectively over a period of 7 years post-closing commencing 150 days after closing.

- Sponsor will subject *2,031,250 sponsor shares (or 25%) and 25% of privates warrants (1,416,666) to earnout provisions vesting in three equal tranches at $12.0, $14.0, and $16.0 respectively over a period of 7 years post-closing commencing 150 days after closing.

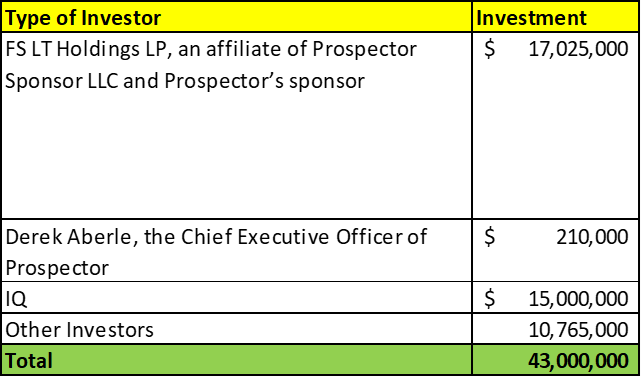

- Sponsor and its affiliates will make a $43.0 million PIPE investment in convertible securities.

- Minimum gross cash condition of $43.0 million.

- No termination fees.

- Business combination transaction is targeted to close in the fourth quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 1/3 Redeemable Warrant

- #Cash in Trust: $23,188,982 (105.7 % of Public Offering)

- Public Shares Outstanding: 2,194,056 shares

- Private Shares Outstanding: 8,125,000 shares

- Trust Value/Share: $10.57

- Current Liquidation Date: December 31, 2023

- Outside Liquidation Date: December 31, 2023

- Name of Target: Leddar Tech

- Target Description: LeddarTech, a global software company founded in 2007, is headquartered in Québec City, Canada with other major R&D centers in Montreal, Toronto and Tel Aviv. LeddarTech develops and provides comprehensive perception software solutions that enable the deployment of ADAS and autonomous driving (“AD”) applications. LeddarTech’s automotive-grade software applies advanced AI and computer vision algorithms to generate accurate 3D models of the environment, allowing for better decision-making and safer navigation. This high-performance, scalable, cost-effective technology is available to OEMs and Tier 1-2 suppliers to efficiently implement automotive and off-road vehicle ADAS solutions. LeddarTech is responsible for several remote-sensing innovations, with over 150 patents granted or applied for that enhance ADAS and AD capabilities. Better awareness around the vehicle is critical in making global mobility safer, more efficient, sustainable and affordable: this is what drives LeddarTech to seek to become the most widely adopted sensor fusion and perception software solution.

- Announced Date: June 13, 2023

- Expected Close: “Fourth Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1825473/000121390023048399/ea180274ex99-1_prospect.htm

- Transaction Terms: (https://www.sec.gov/Archives/edgar/data/1825473/000121390023048399/ex99-2_008.jpg)

| Redemption Rate | 0% from current level of 93.2% |

| Share Price | $10.0 per share |

| Enterprise Value | $330 million |

| Market Cap Value | $348 million |

- Target Shareholders Receive (~57.5%):

- Equity consideration of $200 million at $10.0 per share (20 million Newco shares)

- Earnout consideration of $50 million at $10.0 per share (7 years after closing):

- 1 million shares @$12.0 per share

- 1 million shares @$14.0 per share

- 1 million shares @$16.0 per share

- first customer contract with an that represents a design win for the Surviving Company for an OEM series production vehicle that will create at least 150,000 units a year in volume for its fusion and perception products

- sends out its first undisputed invoice for payment for product delivery for OEM installation against a contract with an OEM needing more than 150,000 units a year in volume for its fusion and perception product

- PIPE / Financing:

- Sponsor and its affiliates will make a $43.0 million PIPE investment in convertible securities:

- Tranche A Investors received (was conditioned on execution of BCA):

- A secured convertible note issued by LeddarTech in a principal amount equal to such Investor’s Tranche A investment

- Which is convertible into

- Class D-1 preferred shares of LeddarTech (before closing or if the closing does not occur)

- OR

- into combined company common shares after closing

- Which is convertible into

- A warrant certificate entitling them to purchase Class D-1 Preferred Shares at an exercise price of $0.01 per share before the date that is 14 calendar days after the conditions of LeddarTech & the Investors to consummate the Tranche A transaction have been met

- A secured convertible note issued by LeddarTech in a principal amount equal to such Investor’s Tranche A investment

- Tranche A Investors received (was conditioned on execution of BCA):

- Tranche B Investor will receive (conditioned on closing):

- A secured convertible note issued by LeddarTech in a principal amount equal to such Investor’s Tranche B investment

- Which is convertible into combined company common shares at an initial conversion price of $10.00 per share

- A secured convertible note issued by LeddarTech in a principal amount equal to such Investor’s Tranche B investment

- Sponsor and its affiliates will make a $43.0 million PIPE investment in convertible securities:

- Redemption Protections:

- Prospector will issue on the Closing Date, as a share capitalization (dividend), to each holder of Prospector Class A Shares that elects not to participate in the redemption one additional Prospector Class A Share for each non-redeemed Prospector Class A Share held by such Non- Redeeming Shareholder

- Support Agreement:

- Standard voting support

- Sponsor will subject *2,031,250 sponsor shares (or 25%) AND 25% of privates warrants (or 1,416,666) to earnout provisions which will vest in three equal tranches as follows during 7-years commencing 150 days after closing:

| Vesting Event – Share Price | Vesting Sponsor Shares | Vesting Private Warrants |

| $12.0 per share | 677,083 shares | 4,722,222 Warrants |

| $14.0 per share | 677,083 shares | 4,722,222 Warrants |

| $16.0 per share | 677,083 shares | 4,722,222 Warrants |

Note: Remaining 75% of shares & private placement warrants will convert into common shares and warrants of the combined company on a 1 for 1 basis

- For a period of 3 years post-closing, the Sponsor and its members managers and officers will not be held responsible for any expenses incurred by the Sponsor up to $3.50 million

- Lock-up:

- SPAC Sponsor: 6 months post-closing

- Target Key shareholder: 4 years post-closing

- LeddarTech Private Shareholder who invested, together with its Affiliates, an amount in the Financing 6 months post-closing

- Closing Conditions:

- Termination date: December 31, 2023

- Minimum gross cash condition of $43.0 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

| Add: | PIPE Financing |

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clauses

- Advisors:

- Target Legal Advisors: Stikeman Elliot LLP and Vedder Price LLP

- SPAC Legal Advisors: Osler, Hoskin and Harcourt LLP and White & Case LLP

- SPAC Financial Advisors: TD Cowen

- TD Cowen Legal Advisor: Goodwin Procter LLP

- Financials (N/A):

- No financials provided

- Equity Incentive Plan:

- 10% of fully diluted equity of combined company post-closing

*Estimated figures by CPC

#Reported as on 31st March 2023