- BYTE Acquisition Corporation (BYTS) to acquire Airship AI holding (Private) in a transaction valuing the pro forma entity at $303 million in Enterprise Value ($322 million equity value) assuming zero redemptions from the current level of 93.7%.

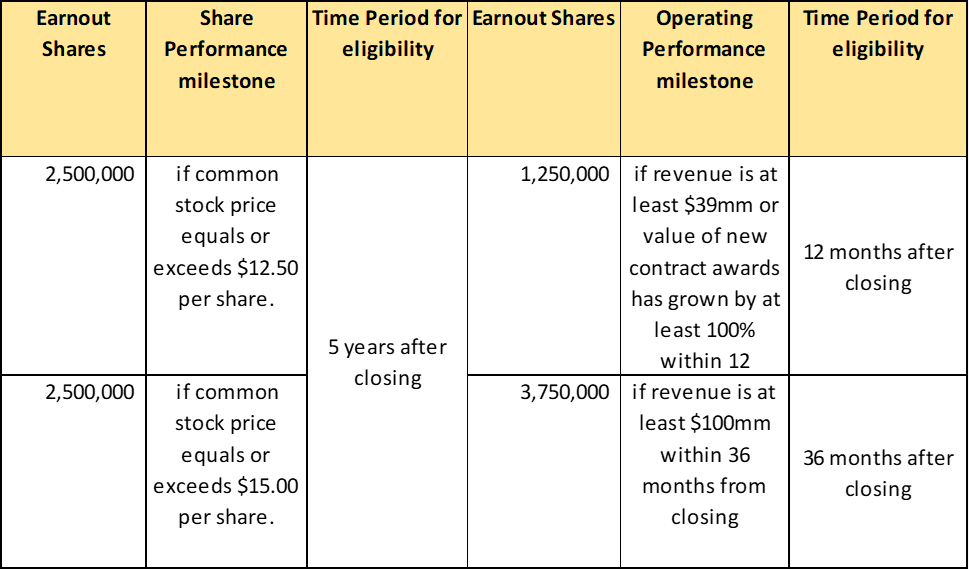

- Airship AI shareholders will receive an equity consideration of $225 million at $10.0 per share and 5.00 million earnout shares in two equal tranches based on post-closing trading prices or in two different tranches of 1.75 million and 3.75 million based on operating performance.

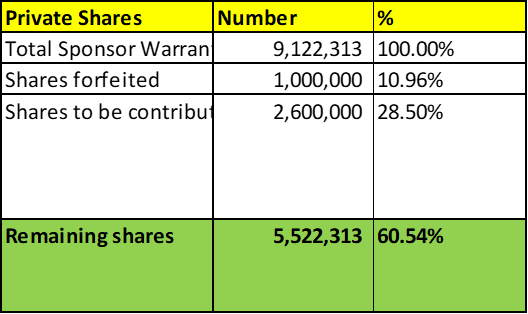

- The Sponsor agrees to forfeit 1.00 (10.9%) million Class A shares and reserve 2.60 (28.5%) million Class A shares to secure the non-redemption agreements and/or the PIPE Financing.

- The Sponsor will enter into a non-redemption agreement with certain Class A shareholders for $7.00 million.

- Minimum gross cash condition of $7.00 million.

- No termination fees.

- Business combination transaction is targeted to close in the third quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.5 Redeemable Warrant

- #Cash in Trust: $25,117,794 (106.3 % of Public Offering)

- Public Shares Outstanding: 2,363,217 shares

- Private Shares Outstanding: 9,122,313 shares (including 1.03 million Private Shares contained in Private Units)

- Trust Value/Share: $10.63

- Current Liquidation Date: September 25, 2023

- Outside Liquidation Date: December 26, 2023

- Name of Target: Airship AI Holdings

- Target Description: Founded in 2006, Airship AI is a U.S. owned and operated technology company headquartered in Redmond, Washington. Airship AI is an AI-driven video, sensor and data management surveillance platform that improves public safety and operational efficiency for public sector and commercial customers by providing predictive analysis of events before they occur and meaningful intelligence to decision makers. Airship AI’s product suite includes Outpost edge hardware and software offerings, Acropolis enterprise software stack, and Command family of viewing clients.

- Announced Date: June 27, 2023

- Expected Close: “Third Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1842566/000121390023051861/ea180900ex99-1_byteacq.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1842566/000121390023051861/ex99-2_006.jpg)

| Redemption Rate | 0% from current level of 93.7% |

| Share Price | $10.0 per share |

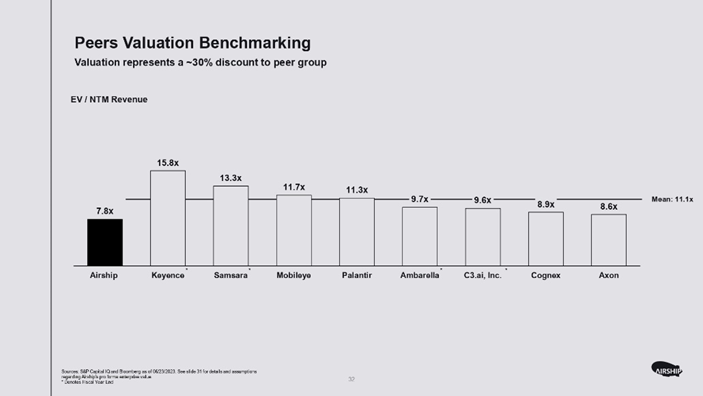

| Enterprise Value | $303 million (EV/NTM Revenue of 7.8x ~30% discount to Peers) |

| Market Cap Value | $322 million |

- Target Shareholders Receive (~69.9%):

- Equity consideration of $225 million at $10.0 per share (22.5 million shares of “Parent Common Share”)

- Earnout consideration of $50 million at $10.0 per share for which either certain share performance milestones or certain operating performance milestones will have to be met

- PIPE / Financing:

- Sponsor will use their commercially reasonable efforts to raise PIPE by issuing SPAC Shares at $10.0

- Redemption Protections:

- Sponsors will enter into a non-redemption agreement with certain investors of Class A shares for $7.00 million

- Pursuant to the Non-Redemption agreement

- Aggregate non-redemption value > $12.0 million

- For 7 months the company shall not raise equity financing where ‘share price’ > $5.00

- Support Agreement:

- Standard voting support

- Sponsor agreed:

- to forfeit 1.00 million or (10.9%) Class A ordinary shares at closing.

- to contribute 2.60 million or (28.5%) Class A ordinary shares to secure the non-redemption agreements and/or PIPE Financing

- Lock-up:

- SPAC Sponsors: 180 days post-closing

- Key Target Shareholders:

- Merger shares: 180 days post-closing

- Earnout Shares: 12 months post issuance

- Closing Conditions:

- Termination date: September 25, 2023 (December 26, 2023, with extension)

- Minimum gross cash condition of $7 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

| Add: | Any Pre-Closing Financing |

- SPAC unpaid legal fees (outside counsel) < $2.00 million.

- Other customary closing conditions

- Termination:

- Termination by Target :

- if Non-Redemption Agreements are not entered into by SPAC

- Other standard termination clauses

- Termination by Target :

- Advisors:

- SPAC Legal Advisors: White & Case LLP

- Target Legal Advisors: Loeb & Loeb LLP

- Target M&A Advisor: Roth Capital Partners

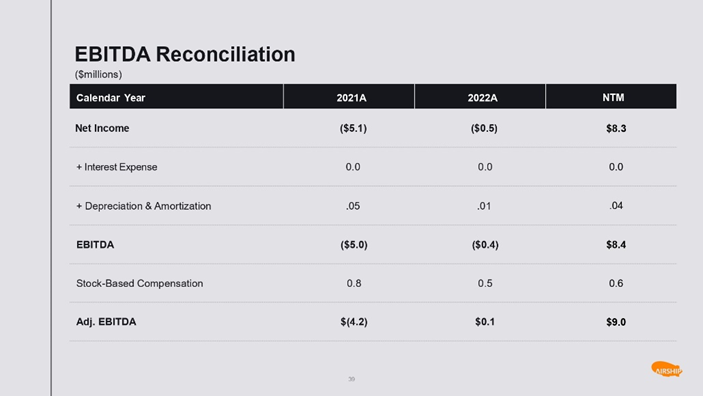

- Financials (https://www.sec.gov/Archives/edgar/data/1842566/000121390023051861/ex99-2_039.jpg):

- Comparable (https://www.sec.gov/Archives/edgar/data/1842566/000121390023051861/ex99-2_032.jpg):

- Equity Incentive Plan:

- 15% shares of combined company at closing

- Includes evergreen provision as mutually decided

*Denotes estimated figures by CPC

#Reported as on 31st March 2023