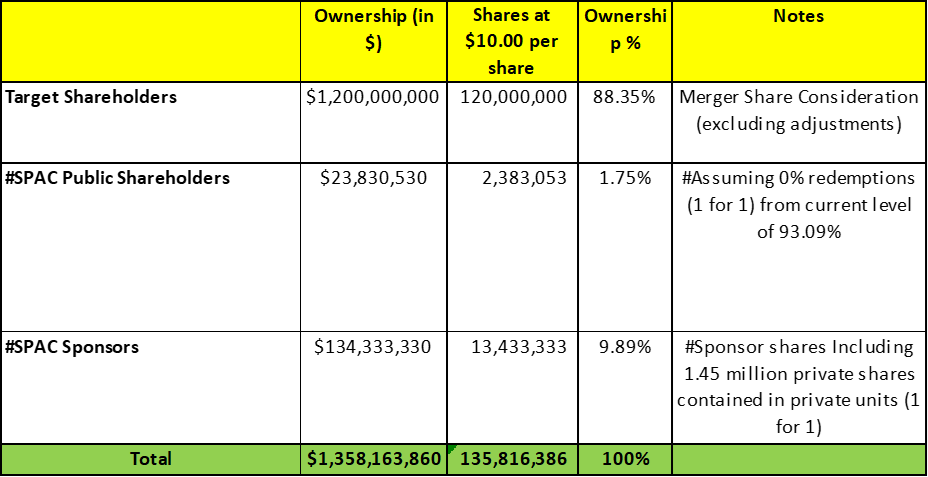

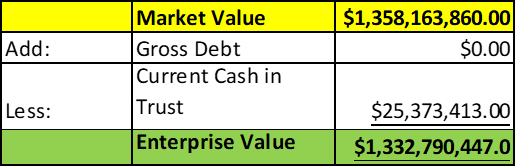

- Semper Paratus Acquisition Corp (LGST) to acquire Tevogen Bio (Private) in a transaction valuing the pro forma entity at $1.33 billion in Enterprise Value ($1.35 billion equity value) assuming zero redemptions from the current level of 93%.

- Tevogen Bio shareholders will receive an equity consideration of $1.20 billion at $10.0 per share and 20.0 million earnout shares in three equal tranches at $15.0, $17.5 and $20.0 respectively over a period of 36 months post-closing.

- Sponsor will receive 4.50 million shares in earnout subject to conditions similar to Tevogen.

- Minimum net cash condition of $25.0 million.

- No termination fees.

- Business combination transaction is targeted to close in the fourth quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.5 Redeemable Warrant

- #Cash in Trust: $ 25,373,413 (106.5 % of Public Offering)

- Public Shares Outstanding: 2,383,053 shares

- Private Shares Outstanding: 13,433,333 shares (including 1.45 million private shares contained in Private Units)

- Trust Value/Share: $10.65

- Current Liquidation Date: December 15, 2023

- Outside Liquidation Date: December 15, 2023

- Name of Target: Tevogen Bio

- Target Description: Tevogen Bio’s next generation precision T cell platform is designed to provide increased immunologic specificity to eliminate malignant and virally infected cells, while allowing healthy cells to remain intact. Multiple, precise candidate targets on viral or malignant cells are selected in advance for T cell sensitization and effector functions with the goal of overcoming the mutational escape capacity of cancer cells and viruses while limiting cross-reactivity. Tevogen Bio is investigating its technology’s potential to overcome the primary barriers to the broad application of personalized T cell therapies: potency, purity, production-at-scale, and patient-pairing, without the limitations of current approaches. Tevogen Bio’s goal is to provide access to the vast and unprecedented potential of developing personalized immunotherapies for large patient populations impacted by common cancers and viral infections. The ability to administer TVGN-489 in the outpatient setting and the ongoing work by Tevogen scientists to use this product in diverse patient populations, highlights Tevogen Bio’s commitment to patient accessibility.

- Announced Date: June 27, 2023

- Expected Close: “Fourth Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1860871/000149315223022852/ex99-1.htm

- Transaction Terms:

| Redemption Rate | 0% from current level of 93% |

| Share Price | $10.0 per share |

| Enterprise Value | *$1,332 million |

| Market Cap Value | *$1,358 million |

- Target Shareholders Receive (~*88.35%):

- Equity consideration of $1,200 million at $10.0 per share (120 million SPAC Class A shares)

- Earnout consideration of $200 million at $10.0 per share (36-months after closing):

- 6.67 million shares @$15.0 per share

- 6.67 million shares @$17.5 per share

- 6.66 million shares @$20.0 per share

- PIPE / Financing:

- ELOC: Sponsor will make reasonable efforts to raise between $35.0 million & $60.0 million through the issuance of SPAC Class A shares at a price of $10.0 per share

- Redemption Protections:

- No information provided

- Support Agreement:

- Standard voting support

- Sponsor earnout shares (36-months after closing):

- 1.50 million shares @$15.0 per share

- 1.50 million shares @$17.5 per share

- 1.50 million shares @$20.0 per share

- Lock-up:

- SPAC Sponsor: 1 year post closing

- Early release: If price ≥ $12.0 after 150 days post-closing

- Target Key shareholder: will be decided by closing

- SPAC Sponsor: 1 year post closing

- Closing Conditions:

- Termination date: December 5, 2023

- Minimum net cash condition of $25 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

| Less: | Unpaid Expenses or Liabilities |

| Less: | All Transaction Expenses |

- PCAOB financials by July 15, 2023

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- SPAC Legal Advisors: Nelson Mullins Riley & Scarborough LLP

- Target Legal Advisors: Hogan Lovells US LLP

- SPAC Auditors: Marcum LLP

- Target Auditors: KPMG LLP

- SPAC Capital Market Advisors: Cohen & Company Capital Markets

- Equity Incentive Plan:

- 10% of SPAC shares outstanding post-closing

*Denotes estimated figures by CPC

#Reported as on 31st March 2023