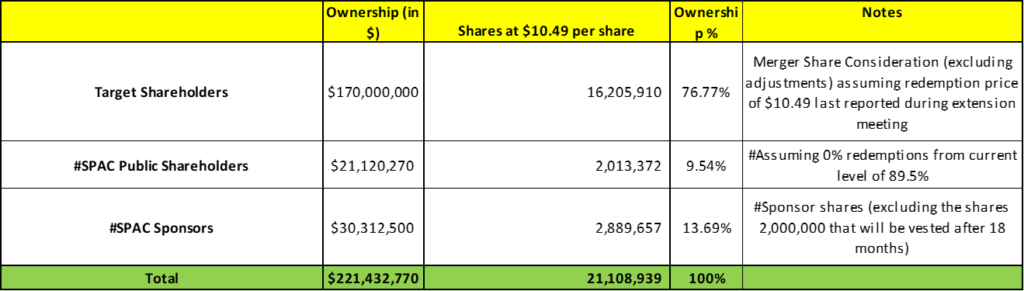

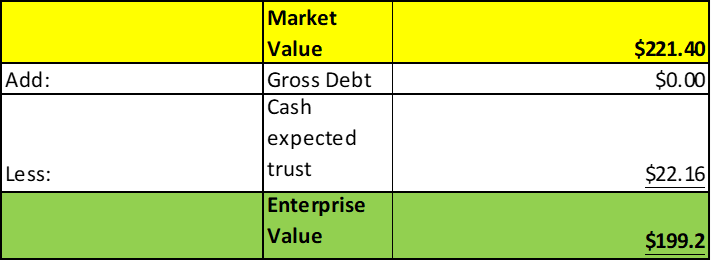

- Artemis Strategic Investment Corporation (ARTE) to acquire Danam Health, Inc (Private) in a transaction valuing the pro forma entity at $200 million in Enterprise Value (*$221 million equity value) assuming zero redemption from current level of 89.5%.

- Danam Health shareholders will receive an equity consideration of $170 million at the price per share which is equal to the redemption price subject to adjustments. They are also eligible to receive 3.00 million earnout shares based on certain revenue milestones.

- Sponsor agreed to receive 2.00 million or (39.75%) shares on expiry of a period of 18 months post-closing or if the price equals or exceeds $10.0 per share during such period.

- As part of the transaction ARTE may issue up to 2 million shares to satisfy working capital costs and to provide incentives for investors to enter into non-redemption agreements.

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in the fourth quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.5 Redeemable Warrant

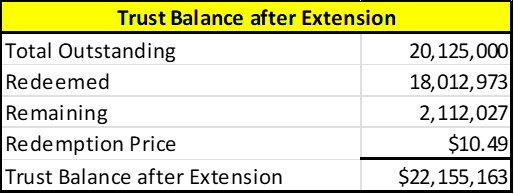

- #Cash in Trust: $22,155,163 (104.9 % of Public Offering)

- Public Shares Outstanding: 2,112,027 shares

- Private Shares Outstanding: 5,031,250 shares

- Trust Value/Share: $10.49

- Current Liquidation Date: October 4, 2023

- Outside Liquidation Date: April 4, 2024

- Name of Target: Danam Health, Inc

- Target Description: Danam is driven by a team of highly experienced and distinguished industry leaders with healthcare technology and integrated product launch experience. Danam’s leadership believes that accessible personalized last mile delivery of medications and channel optimization of pharmaceutical distribution are the next frontier of patient care, and that disruptive business models are required to empower innovation in the post-pandemic world

- Announced Date: August 7, 2023

- Expected Close: “Fourth Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1839990/000110465923088100/tm2322794d2_ex99-1.htm

- Transaction Terms (N/A):

| Redemption Rate | 0% from current level of 89.5% |

| Share Price | Share price at which shares will be redeemed |

| Enterprise Value | *$200 million |

| Market Cap Value | *$221 million |

- Target Shareholders Receive (~*76.77%):

- Equity consideration of $170 million (Shares of Artemis Class A Common Stock at Redemption Price) subject to following adjustments:

- Target’s closing Net Debt

- Unpaid Transaction Expenses

- 3.00 million earnout shares as follows:

- 1.00 million shares if gross revenue > $50.0 million at any point during the calendar year ending December 31, 2024

- 2.00 million shares if gross revenue > $85 million at any point during the calendar year ending December 31, 2025

- Equity consideration of $170 million (Shares of Artemis Class A Common Stock at Redemption Price) subject to following adjustments:

- PIPE / Financing:

- SPAC may enter into PIPE Agreements

- Redemption Protections:

- Up to 2.00 million SPAC shares may be issued to satisfy working capital costs and to provide incentives for investors to enter into non-redemption agreements or other backstop financing arrangements

- Support Agreement:

- Standard voting support

- Sponsor agreed to receive 2.00 million (or *39.75%) shares (18- months post-closing):

- Expiry of earnout period

- OR

- If price equals or exceeds $10.0 per share

- Lock-up:

- SPAC Sponsor: 1-year post-closing

- Early release: If price ≥ $12.0 after 150 days post-closing

- Key Target Shareholder: 6 months post-closing

- Early release: If price ≥ $12.0

- SPAC Sponsor: 1-year post-closing

- Closing Conditions:

- Termination date: December 26, 2023

- No minimum cash condition

- Target has completed the acquisitions of Wellgistics, LLC & Wood Sage, LLC

- Other customary closing conditions

- Termination:

- If closing does not occur by December 31, 2023, Target shall pay to SPAC all excise taxes payable under the Inflation Reduction Act resulting from any redemptions in connection with an extension to close business combination if such extension occurs in calendar year 2023:

- provided that the amount of such payment shall accordingly increase the merger consideration payable to Target

- Other standard termination clauses

- If closing does not occur by December 31, 2023, Target shall pay to SPAC all excise taxes payable under the Inflation Reduction Act resulting from any redemptions in connection with an extension to close business combination if such extension occurs in calendar year 2023:

- Advisors:

- SPAC Legal Advisors: Ellenoff Grossman & Schole LLP

- Target Legal Advisors: Nelson Mullins Riley & Scarborough LLP

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- 10% shares post-closing

*Denotes estimated figures by CPC

#Reported as on 6th July 2023 (Extension Meeting Results Filing)