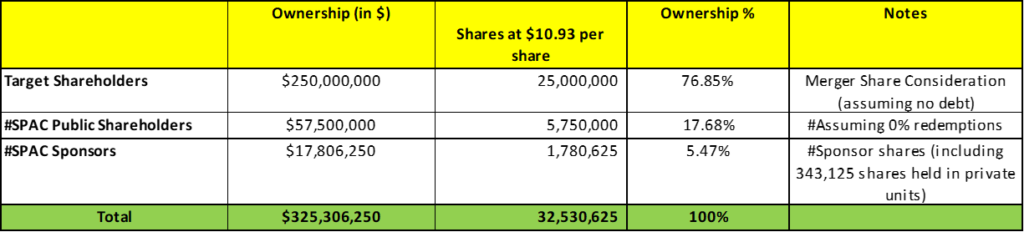

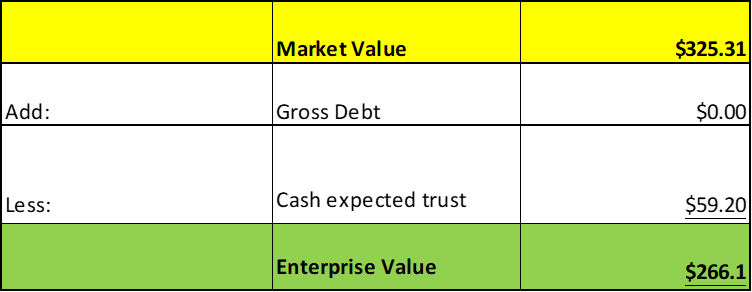

- Oak Woods Acquisition Corporation (OAKU) to acquire Huajin (China) Holdings Limited (Private) in a transaction valuing the pro forma entity at *$266 million in Enterprise Value (*$325 million equity value) assuming zero redemptions.

- Huajin (China) Holdings Limited shareholders will receive an equity consideration of $250 million (excluding debt adjustment) at $10.0 per share.

- Minimum gross cash condition of $5.00 million.

- Sponsor agreed to place 5% shares (or *71,875 shares) that they will receive at the time of closing in escrow account to indemnify SPAC if aggregate amount of losses caused due to breach in Target’s representations and warranties equals or exceeds $200,000.

- Target will pay a break-up fee of $2.00 million if the Closing does not take place by March 23, 2024 because of delay caused by Target.

- Business combination transaction is targeted to close 2024.

- SPAC Details:

- Unit Structure: 1 share of Common Stock + 1 Redeemable Warrant + 1 Right

- #Cash in Trust: $59,201,636 (102.9 % of Public Offering)

- Public Shares Outstanding: 5,750,000 shares

- Private Shares Outstanding: 1,780,625 shares (including 343,125 shares held in private units)

- Trust Value/Share: $10.30

- Current Liquidation Date: March 28, 2024

- Outside Liquidation Date: September 28, 2024

- Name of Target: Huajin (China) Holdings Limited

- Target Description: Huajin (China) Holdings Limited provides healthcare and home care services.

- Announced Date: August 14, 2023

- Expected Close: No information provided

- Press Release: Not Available

- Transaction Terms (N/A):

| Redemption Rate | 0% |

| Share Price | $10.0 per share |

| Enterprise Value | *$266 million |

| Market Cap Value | *$325 million |

- Target Shareholders Receive (~*76.85%):

- Equity consideration of $250 million – Closing Net Debt (25.0 million of Purchaser Ordinary Shares at $10.0 per share assuming no debt at closing)

- Company Deposit:

- Target will a make a payment of $330,000 to SPAC which will partially be used to fund extension

- The above amount shall reduce the amount of break-up fee if SPAC becomes entitled to receive the break-up fee as a result of valid termination of agreement

- Target will a make a payment of $330,000 to SPAC which will partially be used to fund extension

- PIPE / Financing:

- SPAC and Target will use their efforts to consummate a PIPE Investment

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Sponsor agreed to place 5% shares (or *71,875 shares) in escrow account (maximum liability cannot exceed Escrow Share Value equal to the value obtained by multiplying $10.0 with Indemnification Escrow Shares) to indemnify SPAC if aggregate amount of losses caused due to breach in Target’s representations and warranties (or covenants or obligations) equals or exceeds $200,000

- Lock-up:

- SPAC Sponsor: 1 year post closing (30 days after we consummate a liquidation, merger, share exchange or other similar transaction)

- Early release: If price ≥ $12.0 after 150 days post-closing

- Target Key shareholder: Will be decided

- SPAC Sponsor: 1 year post closing (30 days after we consummate a liquidation, merger, share exchange or other similar transaction)

- Closing Conditions:

- Termination date: March 23, 2024

- Minimum Gross Cash Condition of $5.00 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

- Target shall deliver:

- Audited Financial Statements for two fiscal years ended December 31, 2022

- executed payoff letters for all indebtedness of Target that remain unpaid before closing

- Other customary closing conditions

- Termination:

- Target will pay a break-up fee of $2.00 million if the merger agreement is terminated because of the following reasons:

- Target breached any representation, warranty, agreement, or covenant that was to be performed before the Closing Date

- Material Adverse Effect on Target post-merger agreement which is uncured and continuing

- Target changed its financial statements that are to be delivered to the SPAC because of Material Adverse Effect

- Delay in closing because of any reason caused by Target which will include failure of target to deliver Target’s Audited Financials

- Other standard termination clauses

- Target will pay a break-up fee of $2.00 million if the merger agreement is terminated because of the following reasons:

- Advisors:

- SPAC Legal Advisors: Raiti PLLC

- Target Legal Advisors: Ortoli Rosenstadt, LLP

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- No information provided

*Denotes estimated figures by CPC

#Reported as on 30th June 2023