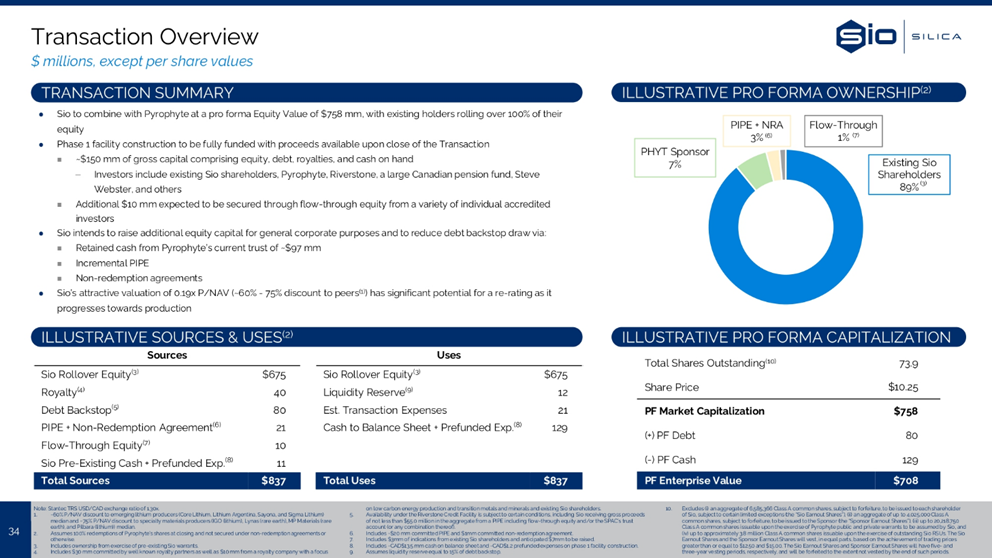

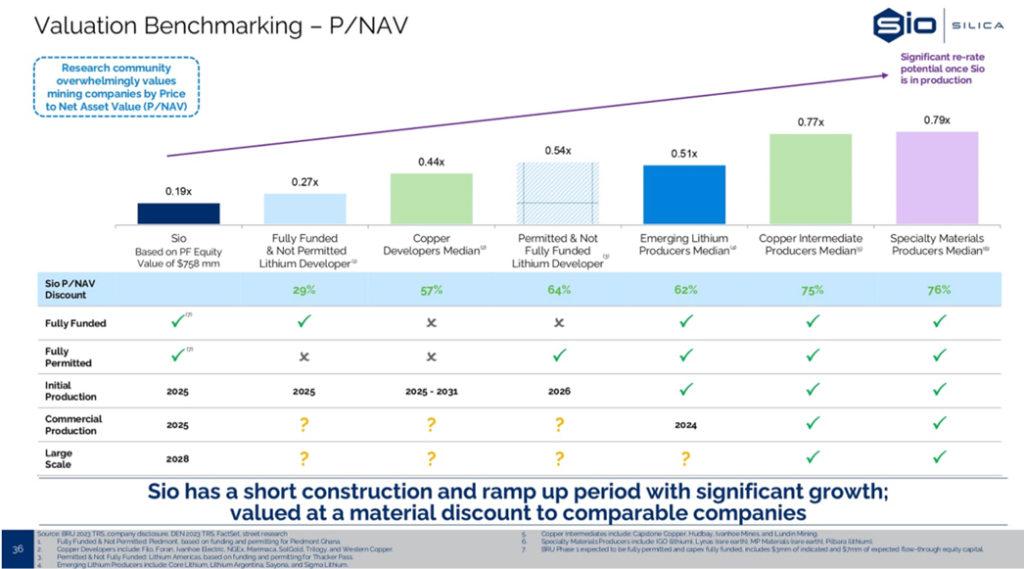

- Pyrophyte Acquisition Corp (PHYT) to merge with Sio Silica Corporation (Private) in a transaction valuing the pro forma entity at $708 million in Enterprise Value ($758 million equity value) assuming 100% redemptions (excluding shares under non-redemption agreement) from the current level of 44.5%.

- Sio Silica Corporation will receive an equity consideration of $650 million at $10.25 per share. They are also eligible to receive 6,585,366 shares in two equal tranches at $12.50 and $15.00 over a period of 5 years post closing.

- Target will raise $40 million pursuant to the Royalty Purchase and Sale Agreements with certain royalty partners and royalty company in exchange for which target will give them overriding royalty in the form of an undivided percentage interest in and to all marketable naturally occurring minerals or mineral bearing material mined or otherwise recovered from Target’s BRU Property.

- Target will also have access to additional debt financing from Riverstone Credit Facility which will be conditioned on combined company having closing cash of more than $55.0 million from other PIPE investments and SPAC trust balance.

- Additionally, the transaction also includes PIPE investment from certain investors and insiders for an aggregate amount of $20,122,474 by issuing 3,114,258 Combined Company Class A Common Shares at $6.46 per share.

- SPAC entered in a non-redemption agreement with a shareholder holding 100,000 shares pursuant to which SPAC agreed to issue 58,570 SPAC Class A Ordinary Shares.

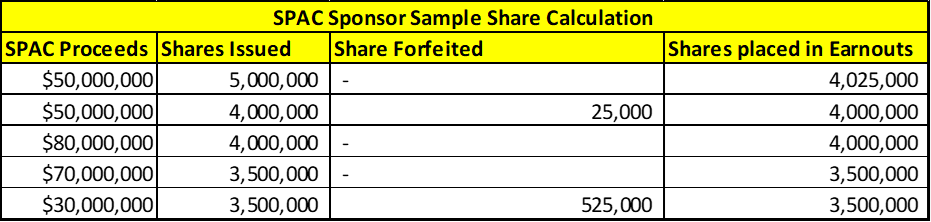

- The Sponsor agrees to forfeit up to 4,025,000 or (80%) shares to secure additional financing. If less than $70 million is raised ,then any shares not used to raise additional financing will be forfeited and any shares used to raise additional financing will be placed in a 3 year earn-out ($12.50 & $15.00). If more than $70 million is raised ,then any shares used to raise additional financing will be placed in a 3 year earn-out and remaining shares are kept by the SPAC sponsor.

- Minimum net cash condition of $130 million.

- No termination fees.

- Business combination transaction is targeted to close in 2024.

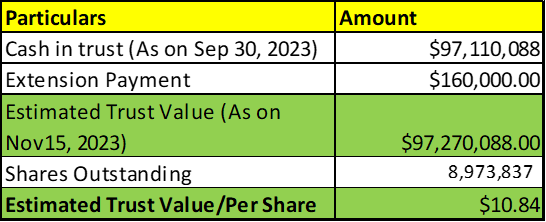

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.5 Redeemable Warrant

- #Cash in Trust: $97,270,088 (108.4 % of Public Offering)

- Public Shares Outstanding: 8,973,837 shares

- Private Shares Outstanding: 5,031,250 shares

- Estimated Trust Value/Share: $10.84

- Current Liquidation Date: November 29, 2023

- Outside Liquidation Date: April 29, 2024

- Name of Target: Sio Silica Corporation

- Target Description: Sio Silica is a Canadian-based high-purity quartz silica producer committed to offering superior products and practicing sustainable development. The Company’s extraction of silica will not require truck traffic, surface mining, tunneling, dust generation or chemical cleansing. Combined with its facility using renewable electricity, natural gas, and efficient processing, Sio Silica expects to contribute to a low-carbon future

- Announced Date: November 13, 2023

- Expected Close: No information provided

- Press Release: https://www.sec.gov/Archives/edgar/data/1848756/000121390023085565/ea186711ex99-1_pyrophyte.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1848756/000121390023085565/ex99-2_034.jpg):

| Redemption Rate | 100% from current level of 44.5% |

| Share Price | $10.25 per share |

| Enterprise Value | $708 million |

| Market Cap Value | $758 million |

- Target Shareholders Receive (~89%):

- Equity consideration of $650 million at $10.25 per share (63.4 million New SPAC class A common share)

- They are also eligible to receive 6,585,366 shares in two equal tranches over a period of 5 years post-closing as following:

- 50% shares if price per share equal or exceeds $12.50 per share

- 50% shares if price per share equal or exceeds $15.00 per share

- PIPE / Financing:

- Pursuant to Royalty Purchase and Sale Agreements Target will raise $40.0 million from a royalty investor and a royalty company in exchange for overriding royalty in the form of an undivided percentage interest in and to all marketable naturally occurring minerals or mineral bearing material mined or otherwise recovered from Target’s BRU Property

- SPAC and Target pursuant to Subscription Agreement will raise an aggregate of $20,122,474 by issuing 3,114,258 New SPAC Class A Common Shares at a per share price of $6.46

- Target will also enter in Credit agreement with Riverstone to raise debt financing for up to $80.0 million, availability of debt financing will be subject to certain conditions pertaining to available closing cash

- It will only be available if aggregate from any PIPE financing + any remaining cash in SPAC Trust post redemption > $55.0 million

- Target also expects to raise $10.0 million of additional flow through equity

- Redemption Protections:

- The SPAC have entered in non-redemption agreement with a shareholder holding 100,000 SPAC class A shares pursuant to which SPAC will issue 58,570 SPAC Class A Ordinary Shares to such shareholder in consideration of such shareholder’s commitment not to redeem shares

- Support Agreement:

- Standard voting support

- Sponsor agreed to forfeit up to 4,025,000 or (80%) shares to secure additional financing, of these share the shares which are not used as incentives for financing will be further subject to forfeiture and will be given as earnouts

- The number of shares that will be given as earnouts and the number of shares that will be forfeited will depend on SPAC Proceeds and will be calculated as follows:

- If SPAC Proceeds is less than $70.0 million, then

- Earnout shares = Number of shares issued to secure SPAC Proceeds

- Share forfeited = 4,025,000 shares – Shares placed in earnouts (up to 4,025,000)

- If SPAC proceeds is greater than or equal to $70.0 million, then

- Earnout Shares = Number of shares issued to secure SPAC Proceeds

- No shares will be forfeited

- If SPAC Proceeds is less than $70.0 million, then

- Note: SPAC Proceeds = Available Closing Cash (defined in closing condition below) – the Royalty Agreement Proceeds – proceeds received from any flow-through common shares- any indebtedness

- Sponsor earnout shares will vest over a period of three years in two equal tranches with conditions similar to Target

- Lock-up:

- SPAC Sponsors: 1-year post-closing

- Early Release: If the price equals or exceeds $12.00 per share after 150 days post-closing

- Key Target Shareholders (owning more than 1%):

- Merger shares: 180 days post-closing

- Early Release: If the price equals or exceeds $12.00 per share

- Lock-up does not apply to 10% of the aggregate amount of securities held by such shareholders at closing

- SPAC Sponsors: 1-year post-closing

- Closing Conditions:

- Termination date: November 13, 2024

- Minimum net cash condition of $130 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

| Add: | all other cash and cash equivalents of SPAC |

| Add: | Royalty Agreement Proceeds |

| Add: | proceeds received from PIPE Financing |

| Add: | proceeds received because of the issuance of any Interim Company Shares or Flow-Through Shares |

| Add: | available amount under the Credit Agreement |

| Less: | All Transaction Expenses |

- Debt-to-Other Cash Ratio should be less than or equal to 0.5882

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- SPAC Legal Advisors: White & Case LLP

- Target Legal Advisors: DLA Piper (Canada) LLP and DLA Piper (US)

- Target financial advisor in procuring and negotiating royalty financing: Integral Wealth Securities Limited

- SPAC capital market advisor: UBS Securities LLC

- Target financial advisor: BMO Nesbitt Burns Inc

- Equity Incentive Plan:

- 10% of the combined company

*Denotes estimated figures by CPC

#Estimated as on November 15, 2023 (Date of depositing extension funds to extend to October 29, 2023)