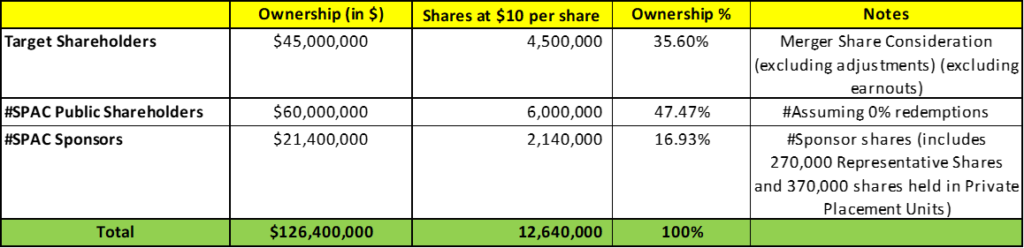

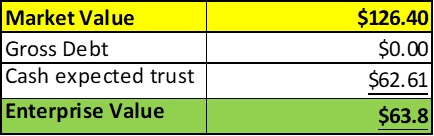

- TMT Acquisition Corp (TMTC) to acquire eLong Power Holding Limited (Private) in a transaction valuing the pro forma entity at *$63.8 million in Enterprise Value (*$126 million equity value) assuming no redemption.

- eLong Power shareholders will receive an equity consideration of $450 million (subject to adjustments) at $10 per share. Majority shareholders are eligible to receive up to 9.00 million earnout shares based on certain revenue milestones.

- Target shareholders agreed to keep 300,000 shares as security and if needed use them to indemnify the SPAC brought in relation to Target’s representations and warranties.

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in the first half of 2024.

- SPAC Details:

- Unit Structure: 1 Ordinary Share + 1 Right

- #Cash in Trust: $62,606,946 (104.3 % of Public Offering)

- Public Shares Outstanding: 6,000,000 shares

- Private Shares Outstanding: 2,140,000 shares (includes 270,000 Representative Shares and 370,000 shares held in Private Placement Units)

- Trust Value/Share: $10.43

- Current Liquidation Date: March 30, 2024

- Outside Liquidation Date: December 30, 2024

- Name of Target: eLong Power Holding Limited

- Target Description: eLong Power Holding Limited, a Cayman Islands exempted company, is a provider of high power battery technologies for commercial and specialty vehicles and energy storage systems, with research and development and production capabilities that span multiple battery cell chemistries, modules and packs. The Company is led by Ms. Xiaodan Liu, eLong Power’s Chairwoman and CEO

- Announced Date: December 4, 2023

- Expected Close: “First Half of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1879851/000149315223043518/ex99-1.htm

- Transaction Terms (N/A):

| Redemption Rate | 0% |

| Share Price | $10.00 per share |

| Enterprise Value | *$63.80 million |

| Market Cap Value | *$126 million |

- Target Shareholders Receive (~*35.6%):

- Equity consideration of $450 million (45 million shares at $10.00 per share):

- 44.70 million SPAC Class A Ordinary Shares + 0.30 million SPAC class B Ordinary Shares (50 votes per share; will be used to indemnify) subject to the following adjustment:

- Assumed Warrants: Target’s Warrants outstanding at the closing which will be converted to SPAC Class A Ordinary Share will be adjusted at the closing by issuing less SPAC Class A ordinary Shares

- 44.70 million SPAC Class A Ordinary Shares + 0.30 million SPAC class B Ordinary Shares (50 votes per share; will be used to indemnify) subject to the following adjustment:

- Earnout consideration (to majority shareholders) of up to 9.00 million SPAC Class B Ordinary Shares based on revenue-based milestones achieved during calendar years 2024 & 2025

- Equity consideration of $450 million (45 million shares at $10.00 per share):

- Indemnification:

- 0.30 million SPAC Class B Ordinary shares will be kept as security to indemnify against certain pending litigations and will be given to the shareholders over a period of 2 years post-closing:

- 50% shares will be released after 1 year post-closing

- 50% shares will be released after 2 years post-closing after accounting for any claims settlement

- indemnification obligation will continue for a further 3 years for tax and environmental matters

- indemnification will be capped at 0.30 million SPAC Class B Ordinary Shares and subject to a tipping basket of $2.25 million

- 0.30 million SPAC Class B Ordinary shares will be kept as security to indemnify against certain pending litigations and will be given to the shareholders over a period of 2 years post-closing:

- PIPE / Financing:

- Parties to pursue commitments for PIPE of up to $15.0 million

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsor: 6 months post-closing

- Early release: If price ≥ $12.0 after 150 days post-closing

- Key Target Shareholder: 6 months post-closing

- Early release: If price ≥ $12.0 after 150 days post-closing

- SPAC Sponsor: 6 months post-closing

- Closing Conditions:

- Termination date: June 30, 2024

- No minimum cash condition

- Other customary closing conditions

- Termination:

- Standard termination clauses

- No termination fees

- Advisors:

- SPAC US Legal Advisor: The Crone Law Group P.C

- Target US Legal Advisor: Graubard Miller

- SPAC Cayman Legal Advisor: Ogier

- Target Cayman Legal Advisor: Harneys

- SPAC Financial Advisor: Ever Talent Consultants Limited

- Target China Legal Advisor: Han Kun Law Offices

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- Reserve the sum of 15% shares post-closing and shares of the SPAC subject to issuance upon exercise of the Assumed Warrants immediately following the closing

- With customary evergreen provision

- Reserve the sum of 15% shares post-closing and shares of the SPAC subject to issuance upon exercise of the Assumed Warrants immediately following the closing

*Denotes estimated figures by CPC

#Reported as on 30th September 2023 (10-Q filling)