- Zalatoris II Acquisition Corp. (ZLS) to acquire Eco Modular (Private) in a transaction valuing the pro forma entity at $600 million in Enterprise Value ($666 million equity value) assuming zero redemptions from the current level of 70.3%.

- Eco Modular shareholders will receive an equity consideration of $126 million (subject to adjustments) at a price which is equal to lower of $10.00 or the redemption price. *95.0% consideration will be paid at the time of closing and the balance shall be released subject to debt and other working capital adjustments.

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in first quarter of 2024.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 1/3 Redeemable Warrant

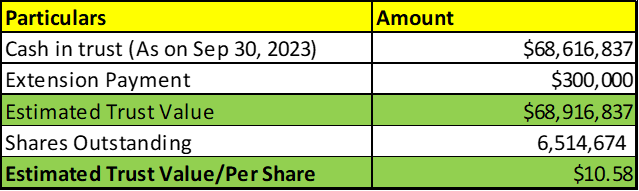

- #Cash in Trust: *$68,916,837 (105.8 % of Public Offering)

- Public Shares Outstanding: 6,514,674 shares

- Private Shares Outstanding: 5,490,283 shares

- Estimated Trust Value/Share: $10.58

- Current Liquidation Date: January 3, 2024

- Outside Liquidation Date: August 3, 2024

- Name of Target: Eco Modular

- Target Description: Eco Modular, combining its established business with Ecohouse Developments, a pioneering force in the modular construction sector. Ecohouse, with a 15-year legacy, has successfully delivered over 7,000 single Modular Accessory Dwelling Units (ADUs). The company operates two cutting-edge manufacturing facilities in Eastern Europe, employing Structured Insulated Panels technology to ensure efficient and high-standard construction. Eco Modular’s comprehensive approach encompasses the production, assembly, and distribution of modular units, with strategic showrooms UK and Europe, with a dedicated team of over 120 staff. In its current phase, Eco Modular is achieving remarkable success. The company’s short-term strategy involves doubling production capacity, expanding showrooms, and intensifying sales efforts to achieve a goal of over 500 units a month in the UK and Europe. Eco Modular’s M&A strategy in the UK aims to enhance its market presence and customer base for Accessory Dwelling Units

- Announced Date: December 5, 2023

- Expected Close: First Quarter of 2024

- Press Release: https://www.sec.gov/Archives/edgar/data/1853397/000121390023093143/ea189326ex99-1_zalat2.htm

- Transaction Terms (N/A):

| Redemption Rate | 0% from current level of 70.3% |

| Share Price | $10.00 per share |

| Enterprise Value | $600 million |

| Market Cap Value | $666 million |

- Target Shareholders Receive (~*18.9%):

- Equity consideration of $126 million at share price which is equal to the lesser of $10.00 or redemption price

- $119.7 million (or *95%) will be given at the closing and $6.3 million (or *5%) will be placed in escrow and released in the following manner:

- Actual Consideration (calculated 90 days post-closing) > Closing Consideration:

- Adjusted Amount divided by the Redemption Price (not exceeding escrow shares)

- Actual Consideration (calculated 90 days post-closing) < Closing Consideration:

- Shares with a value equal to the absolute value of the Adjustment Amount will be forfeited

- Actual Consideration (calculated 90 days post-closing) > Closing Consideration:

- Actual Consideration (90 days post-closing) shall be calculated subject to the following adjustments:

- $119.7 million (or *95%) will be given at the closing and $6.3 million (or *5%) will be placed in escrow and released in the following manner:

- Equity consideration of $126 million at share price which is equal to the lesser of $10.00 or redemption price

| $126 million | |

| Add/Less: | Net working capital |

| Add/Less: | Closing Net Indebtedness |

| Less: | Unpaid Transaction Expense at closing |

- Notes:

- Net Working Capital = All Current Assets (excluding closing cash) – All Current Liabilities (excluding closing cash)

- Target Net Working Capital Amount = €1,253,379.98

- Closing Net Indebtedness = aggregate amount of all Indebtedness of the Target Company – Target’s closing cash

- Target net indebtedness = €2,390,445.27

- Net Working Capital = All Current Assets (excluding closing cash) – All Current Liabilities (excluding closing cash)

- PIPE / Financing:

- Nil

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsor: 1-year post-closing

- Early release: If price ≥ $12.0 after 120 days post-closing

- Key Target Shareholders: 12 months post-closing

- SPAC Sponsor: 1-year post-closing

- Closing Conditions:

- Termination date: No information provided

- Audited Company Financials by February 28, 2024

- Other customary closing conditions

- Termination:

- Standard termination clauses

- No termination fees

- Advisors:

- SPAC Legal Advisor: Nelson Mullins Riley & Scarborough LLP

- SPAC M&A Advisor: Meteora Capital LLC

- Target Legal Advisor: Arthur Cox LLP

- Target Financial Advisor: Calabrese Consulting LLC

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- Reserve 10% of the combined company

- Bonus plan of $1.00 million to be paid to employees of the Target Company at the Closing

*Denotes estimated figures by CPC

#Estimated as on 5th December, 2023 (fifth extension payment)