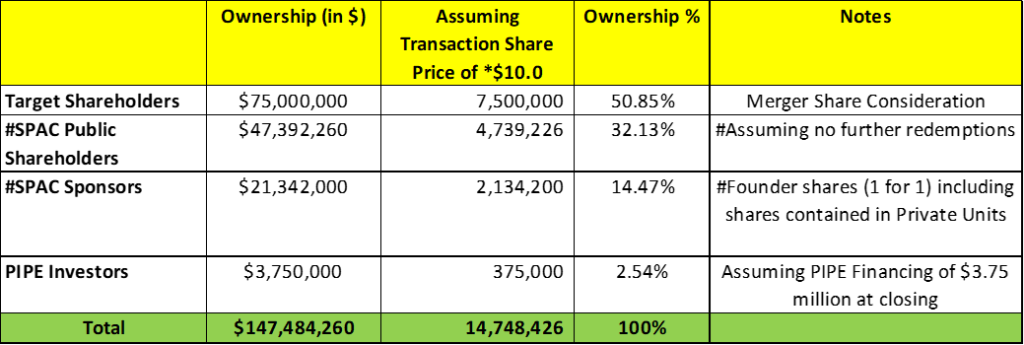

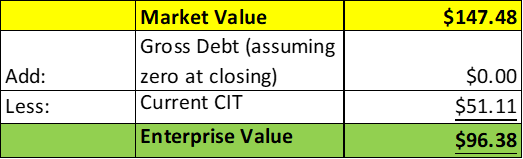

- AlphaTime Acquisition Corp (ATMC) to acquire HCYC Asia (Private) in a transaction valuing the pro forma entity at $96.4 million in Enterprise Value (*$147 million of equity value assuming no further redemptions and PIPE raise of $3.75 million).

- HCYC shareholders will receive an equity consideration of $75.0 million with earnout consideration of 1.50 million shares. The earnout consideration is divided into two conditions: 0.75 million shares are contingent upon Net Income exceeding $5.00 million as per audited financial statements for the year ended December 31, 2024, while another 0.75 million shares are dependent upon Net Income exceeding $10.0 million as per audited financial statements for the year ended December 31, 2025. In case the PubCo 2024 Audited Financials do not show net income exceeding $5.00 million but the PubCo 2025 Audited Financials do exceed $15.0 million, HCYC shareholders will still receive 1.50 million shares.

- ATMC and HCYC will use their commercially reasonable efforts to enter into PIPE Investments of at least $3.75 million.

- No termination fees.

- Business combination transaction is expected to be closed in early 2024.

- SPAC Details:

- Unit Structure: 1 Ordinary Share + 1 Redeemable Warrant + 1 Right

- #Cash in Trust: $51,273,602 (*108.2% of Public Offering)

- Public Shares Outstanding: 4,739,226 shares

- Private Shares Outstanding: 2,134,200 shares (including 409,200 shares contained in Private Units)

- Reported Trust Value/Share: *$10.82

- Current Liquidation Date: April 4, 2024

- Outside Liquidation Date: January 4, 2025

- Name of Target: HCYC Asia

- Description of Target: HCYC Asia has been in Hong Kong for a period of thirteen years. HCYC Asia holds a professional insurance brokerage license, allowing it to operate within Hong Kong’s insurance sector. HCYC Asia partners with multiple insurance companies, such as AXA China Region Insurance Co Ltd, AIA International Limited, Prudential Hong Kong Limited, FTLife Insurance Company Limited. HCYC actively leverages the resources and technological expertise of these business partners, with the aim of delivering professional, customized, and value-added services to both individual and corporate clients. HCYC believes this approach provides them, and HCYC Hong Kong, with a distinct advantage in the marketplace.

- Announced Date: January 5, 2024

- Expected Close: “Early 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1889106/000149315224001613/ex99-1.htm

- Transaction Terms (N/A):

- Pro Forma Equity Value: *$147 million

- Pro Forma Enterprise Value: *$96.4 million

- Target Shareholders Receive (~*50.9%):

- Equity consideration of $75.0 million

- 750,000 PubCo Ordinary Shares issued to the Principal Shareholder will be held in escrow for the benefit of the ATMC shareholders

- Equity consideration of $75.0 million

- Earnout Consideration:

- 2024 Earnout Shares: 0.75 million Earnout Shares if 2024 audited financials show a net income > $5.00 million

- 2025 Earnout Shares: 0.75 million Earnout Shares if 2025 audited financials show a net income > $10.0 million

- 1.50 million Earnout Shares if the PubCo 2024 Audited Financials do not reflect net income in excess of $5.00 million, but the PubCo 2025 Audited Financials reflect net income in excess of $15.0 million

- PIPE / Financing:

- ATMC and HCYC to use their commercially reasonable efforts to enter into PIPE Investments ≥ $3.75 million

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC sponsor (50%): 6 months post-closing

- Early release (50%): if price equals or exceeds $12.5 per share after closing

- Target Shareholders: Not provided

- SPAC sponsor (50%): 6 months post-closing

- Closing Conditions:

- Termination date: October 31, 2024

- PIPE Investment must be obtained

- PubCo must qualify as a “foreign private issuer” within the meaning of Rule 405 under the Securities Act

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clause

- Advisors:

- Target Legal Advisor: Celine & Partners PLLC

- SPAC Legal Advisor: Winston & Strawn LLP

- SPAC Hong-Kong Legal Advisor: Han Kun Law Offices LLP

- SPAC Cayman Legal Advisor: Ogier

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- No information provided

*Denotes estimated figures by CPC

#Estimated as on January 4, 2024 (Extension Meeting Results)