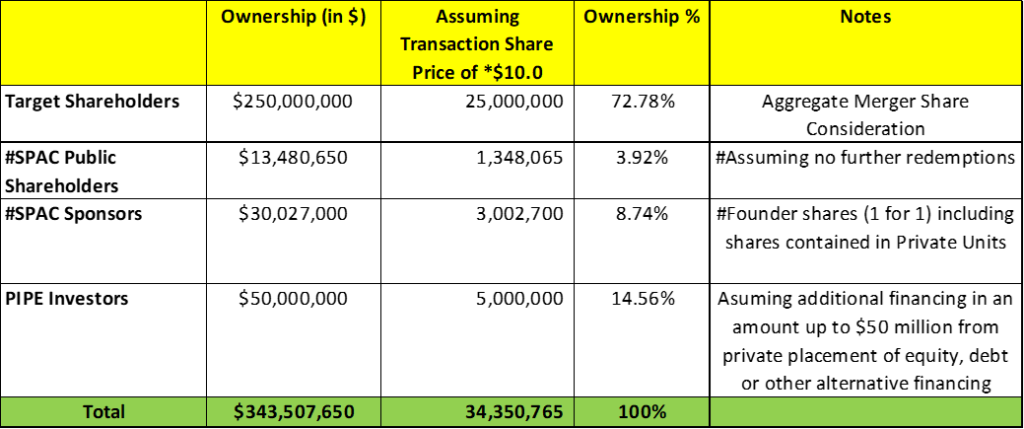

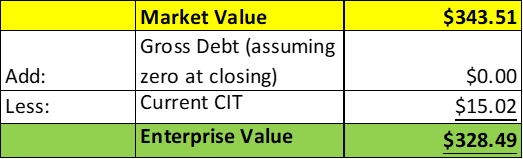

- Vision Sensing Acquisition Corp. (VSAC) to merge with Mediforum (Private) in a transaction valuing the pro forma entity at *$328 million in Enterprise Value (*$344 million equity value assuming no further redemptions from the current level and assuming PIPE raise of $50.0 million).

- Mediforum shareholders will receive an equity consideration of $250 million at $10.0 per share.

- Both parties will use commercially reasonable efforts to obtain transaction financing for an amount up to $50.0 million.

- No minimum cash condition.

- No termination fees.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.75 Redeemable Warrant

- #Cash in Trust: $15,022,196 (*111.4% of Public Offering; including 3 extension payments of $60,000)

- Public Shares Outstanding: 1,348,065 shares

- Private Shares Outstanding: 3,002,700 shares (including 472,700 shares contained in Private Units)

- Estimated Trust Value/Share: *$11.14 per share

- Current Liquidation Date: February 3, 2024

- Outside Liquidation Date: May 3, 2024

- Name of Target: Mediforum

- Description of Target: Mediforum Co., Ltd is a leading Korean biotechnology company established in 2015, headquartered in Seoul, Korea and led by a management team that has a deep understanding of the biotech industry and a proven track record of success. Mediforum’s mission is to enhance the quality of life for those facing conditions like Alzheimer’s disease (AD) and neuropathic pain. With a diverse portfolio, including anti-dementia medications and health functional foods, our flagship product, PM012, is currently in Phase 2b trials for Alzheimer’s disease (AD), with plans for subsequent Phase 3 trials in Korea and the U.S. PM012 also explores indications for Parkinson’s disease (PD) and stroke. Addressing the non-narcotic therapies, MF018 is in Phase 2 for Chemotherapy-Induced Peripheral Neuropathy (CIPN), with Phase 3 trials planned. Its versatility extends to Diabetic Peripheral Neuropathy (DPN). As Mediforum anticipate its listing on NASDAQ, Mediforum is poised to become the first Korean biotech on this global platform, solidifying their commitment to technology, innovation, and transformative healthcare solutions.

- Announced Date: January 16, 2024

- Expected Close: “Not provided”

- Press Release: https://www.sec.gov/Archives/edgar/data/1883983/000149315224002500/ex99-1.htm

- Transaction Terms (N/A):

- Pro Forma Equity Value: *$344 million

- Pro Forma Enterprise Value: *$328 million

- SPAC Public Shareholders Receive (*3.92%):

- *1,348,065 Pubco Shares (1 for 1)

- SPAC Sponsor Receive (*8.74%):

- *3,002,700 Pubco Shares (1 for 1)

- Target Shareholders Receive (*72.8%):

- Equity consideration of $250 million at $10.0 per share (25.0 million Class A Ordinary Shares of PubCo)

- PIPE / Financing:

- Both parties will use commercially reasonable efforts to obtain transaction financing for an amount up to $50.0 million

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsors: 6-months post-closing

- Early release: If price equals or exceeds $12.0 per share after closing

- Target Shareholders: Not provided

- SPAC Sponsors: 6-months post-closing

- Closing Conditions:

- Termination date: June 30, 2024

- No minimum cash condition

- Company Audited Financial Statements by February 15, 2024

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clauses

- Advisors:

- Target Korean Legal Advisors: Next Law LLP

- Target US Legal Advisors: Loeb & Loeb LLP

- Target Lead Advisor: Norwich Capital Limited

- Target Co-Advisor: American General Business Association & SME Overseas IPO Capital Group

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- No information provided

*Denotes estimated figures by CPC

#Estimated as on January 3, 2024 (3rd extension payment)