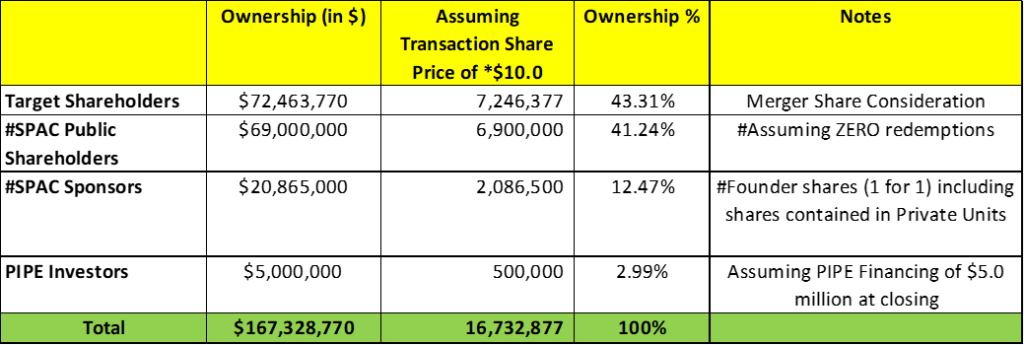

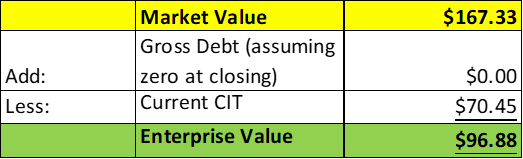

- Bowen Acquisition Corp (BOWN) to acquire Qianzhi BioTech (Private) in a transaction valuing the pro forma entity at *$96.9 million in Enterprise Value (*$167 million of equity value assuming zero redemptions and PIPE raise of $5.00 million).

- Qianzhi BioTech shareholders will receive equity consideration of 7,246,377 shares and earnout consideration of 1.40 million shares. Earnouts will vest upon achievement of certain net income milestones during the fiscal years ended March 31, 2025, and 2026.

- Transaction requires BOWN and Qianzhi BioTech to make reasonable efforts to raise $5.00 million in PIPE by issuing equity or equity-linked securities of BOWN.

- No minimum cash condition.

- No termination fees.

- All costs and expenses related to the Agreement and other transactions outlined within it will be covered by Qianzhi BioTech.

- Business combination transaction is targeted to close either in the second or third quarter of 2024.

- SPAC Details:

- Unit Structure: 1 Ordinary Share + 1 Right

- #Cash in Trust: $70,450,871 (102.1% of Public Offering)

- Public Shares Outstanding: 6.90 million shares

- Private Shares Outstanding: 2,086,500 shares (including 361,500 shares contained in Private Units)

- Reported Trust Value/Share: $10.21

- Current Liquidation Date: October 14, 2024

- Outside Liquidation Date: January 14, 2025

- Name of Target: Qianzhi BioTech

- Description of Target: Qianzhi BioTech, based in Shenzhen, China, is a health and wellness focused biotech company and an early adopter and developer of plant-based and ozonated products for antibacterial, skincare, gynecological and andrological applications. The majority of Qianzhi BioTech’s products are ozonated, oil-based and infused with formulated herbal ingredients. Qianzhi Biotech’s other proprietary products include ozonated disinfectant products produced by ambient temperature ozone curing technology. Qianzhi BioTech believes that its ozonated disinfectants are safer, more environmentally friendly and more efficient, as compared to traditional alcohol, chlorine or phenol based disinfectants.

- Announced Date: January 18, 2024

- Expected Close: “Second or Third Quarter of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1973056/000149315224003599/ex99-1.htm

- Transaction Terms (N/A):

- Pro Forma Equity Value: *$167 million

- Pro Forma Enterprise Value: *$96.9 million

- Target Shareholders Receive (~*43.31%):

- Equity consideration of 7,246,377 SPAC Ordinary Shares (a portion will be deposited in escrow)

- Earnout consideration of 1.40 million Earnout Shares:

- vesting subject to achievement of certain net income milestones during the fiscal years ended March 31, 2025 and 2026 (Milestone information not available)

- PIPE / Financing (~*2.99%):

- SPAC and Target will make reasonable efforts to attract investors to enter into subscription agreements with SPAC

- At closing, PIPE Investors will acquire equity or equity-linked securities of SPAC totalling $5.00 million in aggregate

- SPAC and Target will make reasonable efforts to attract investors to enter into subscription agreements with SPAC

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC sponsor: 6 months post-closing

- Target Shareholders: Not provided

- Closing Conditions:

- Termination date: December 31, 2024

- No minimum cash condition

- Approval by the Committee on Foreign Investment in the United States (CFIUS)

- Approval of all necessary filings with the China Securities Regulatory Commission (CSRC)

- Closing of PIPE Financing

- Dissenting Shareholders < 5%

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clause

- Advisors:

- SPAC US Legal Advisor: Graubard Miller

- Target US Legal Advisor: Becker & Poliakoff

- SPAC PRC Legal Advisor: Han Kun Law

- Target PRC Legal Advisor: Jingsh & H Y Leung (Qianhai) Law Firm

- SPAC Cayman Legal Advisor: Ogier

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan:

- Reserve up to 5% of SPAC Ordinary Shares outstanding at closing

- Fees & Expenses:

- All costs and expenses related to the Agreement and other transactions outlined within it will be covered by the Target

*Denotes estimated figures by CPC

#Reported as on September 30, 2023