- Slam Corp. (SLAM) to merge with Lynk Global, Inc. (Private) in a transaction valuing the pro forma entity at $914 million in Enterprise Value ($1,036 million of pro forma equity value assuming redemption of 96% and PIPE raise of $110.0 million).

- Lynk shareholders will receive equity consideration of ~$800 million at $10.0 per share subject to adjustments.

- The combined company will adopt a dual-class structure, with Topco Series A Common Stock carrying 1 vote per share & unable to convert into Topco Series Class B Common Stock under any circumstance, while Topco Series Class B Common Stock grants 10 votes per share, exclusively owned by Lynk Founders and convertible into an equivalent number of Topco Series A Common Stock at any time.

- Transaction is expected to raise ~$110 million through PIPE at $10.0 per share.

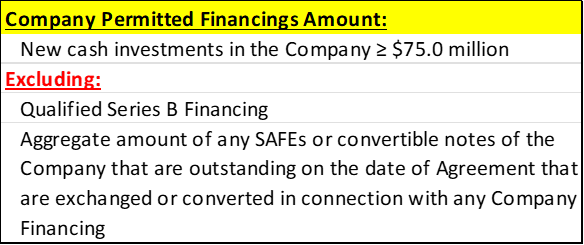

- The minimum NET Cash Condition will be met if the sum of the Private Placement Net Financing Amount and Trust Amount, including the Backstop Amount, exceeds $110 million minus the Company Permitted Financings Amount.

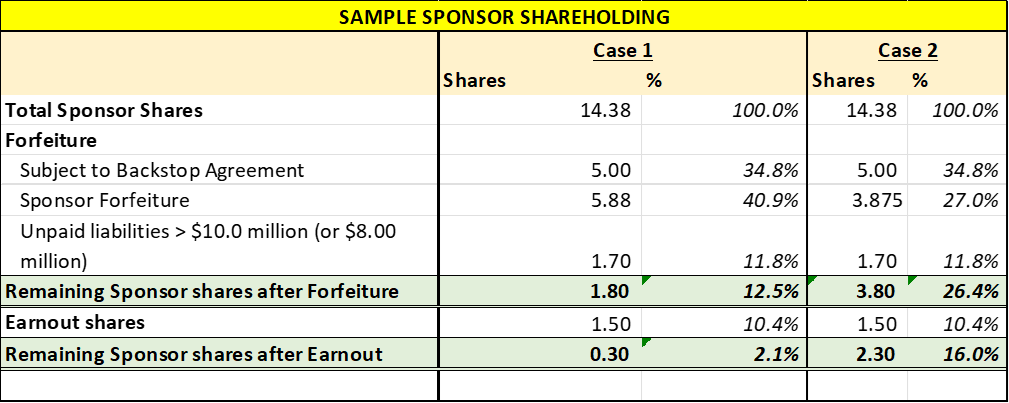

- Under the Backstop Agreement with Antara, if the Minimum Cash Condition is not met, the Investor has committed to offset any redemptions by investing up to $25.0 million at $10.0 per share, with an additional provision in a side letter whereby the Sponsor has pledged to forfeit 5.00 million sponsor shares (*or 34.8%).

- The Sponsor has agreed that upon satisfaction of the Minimum Cash Condition, any unpaid principal on the outstanding promissory notes made by the SLAM will be converted into a corresponding number of Topco Shares at a rate of the unpaid principal amount divided by $10.0 per share, subject to earnout provisions and vesting at $15.0 per share (5 years post-closing); however, in the event the Minimum Cash Condition is not met, the unpaid principal will be automatically considered canceled.

- The Sponsor will forfeit 5.88 million shares (*40.9%) if the Private Placement Net Financing Amount plus Trust Amount (including Backstop Amount) is equal to or exceeds $110 million minus the Company Permitted Financings Amount, and the Private Placement Gross Financing Amount plus Trust Amount (including Backstop Amount) is less than $200 million minus the Company Permitted Financings Amount. If the Private Placement Gross Financing Amount plus Trust Amount (including Backstop Amount,) is equal to or exceeds $200 million minus the Company Permitted Financings Amount, Sponsor will forfeit only 3.88 million shares (*27%).

- If Unpaid SLAM Liabilities at closing exceed $10.0 million (or $8.00 million subject to conditions), the Sponsor will either forfeit a number of sponsor shares valued at the excess at $10.0 per share or pay the excess in cash to the SLAM.

- Sponsor also agreed to subject 1.50 million Topco Shares (or *10.4% sponsor shares) to earnout at $12.0 per share (5 years post-closing).

- All SLAM IPO underwriters should have agreed to waive 100% of their deferred underwriting fee.

- Business combination transaction is targeted to close in the second half of 2024.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.25 Redeemable Warrant

- #Cash in Trust: *$98,878,296 (*108.9% of Public Offering; including $80,000 extension payment up to February 25, 2024)

- Public Shares Outstanding: 9,077,959 shares

- Private Shares Outstanding: 14,375,000 shares

- Estimated Trust Value/Share: *$10.89 per share

- Current Liquidation Date: February 25, 2024

- Outside Liquidation Date: December 25, 2024

- Name of Target: Lynk Global, Inc.

- Description of Target: Lynk is a patented, proven, and commercially-licensed satellite-direct-to-standard-mobile-phone system. Today, Lynk allows commercial subscribers to send and receive text messages to and from space, via standard unmodified mobile devices. Lynk’s service has been tested and proven in over 25 countries and is currently being deployed commercially, based on 36 MNO commercial service contracts covering approximately 50 countries. Lynk is currently providing cell broadcast (emergency) alerts, and two-way SMS messaging, and intends to launch voice and mobile broadband services in the future. By partnering with Lynk via a simple roaming agreement, a mobile network operator opens the door to new revenue in untapped markets, gives subscribers peace of mind with ubiquitous connectivity, and provides a potential pathway to economic prosperity for billions.

- Announced Date: February 5, 2024

- Expected Close: “Second Half of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1838162/000119312524023614/d762554dex991.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1838162/000119312524023614/g762554ex99_2p7g1.jpg):

| Redemption Rate: | 96% |

| Transaction Price | $10.0 |

| Pro Forma Enterprise Value: | $914 million |

| Pro Forma Equity Value: | $1,036 million |

- Target Shareholders Receive (~79%):

- Equity consideration of $800 million at $10.0 per share subject to following adjustments:

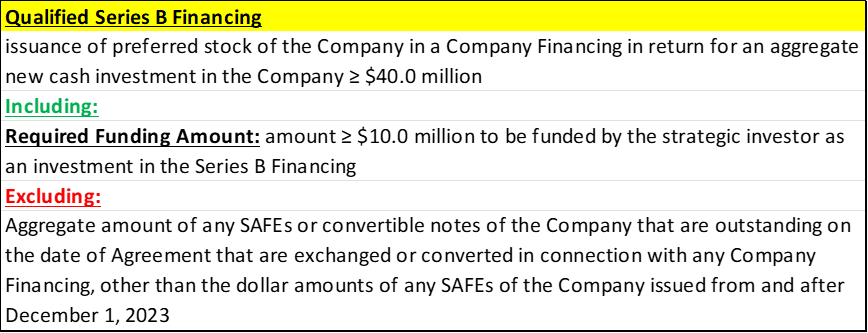

- $800 million + Aggregate gross proceeds raised (by Company Permitted Financings, including a Qualified Series B Financing) above $40.0 million + Aggregate exercise price in respect of all unexercised Vested Company Options and Company Warrants outstanding

- Equity consideration of $800 million at $10.0 per share subject to following adjustments:

- Combined company will have a dual-class structure:

- Topco Series A Common Stock:

- 1 vote

- cannot be converted into Topco Series Class B Common Stock under any circumstance

- Topco Series B Common Stock:

- 10 Votes

- Company Founders will beneficially own all Topco Series Class B Common Stock

- may be converted into the same number of Topco Series A Common Stock at any time

- Topco Series A Common Stock:

- PIPE / Financing (~10.6%):

- Expected to raise ~$110 million through PIPE at $10.0 per share

- Redemption Protections:

- Backstop Agreement with Antara:

- If Minimum Cash Condition is not met, Investor has agreed to offset any redemptions through an investment of up to $25.0 million at $10.0 per share and Investor has also entered into a side letter pursuant to which the Sponsor has agreed to forfeit 5.00 million sponsor shares (or *34.8%)

- Backstop Agreement with Antara:

- Support Agreement:

- Standard voting support

- If Unpaid SPAC Liabilities at closing > $10.0 million, Sponsor will either:

- forfeit a number sponsor shares having a value equal to such excess at $10.0

- OR

- pay such excess in cash to SPAC

- Sponsor cap will become $8.00 million (instead of $10.0 million above) if:

- Private Placement Net Financing Amount + Trust Amount (including Backstop Amount, if any) < $110 million – Company Permitted Financings Amount

- Sponsor cap will become $8.00 million (instead of $10.0 million above) if:

- pay such excess in cash to SPAC

- Sponsor has agreed:

- When Minimum Cash Condition is satisfied:

- to convert any unpaid principal (cannot be paid in cash under any circumstance) on the outstanding promissory notes made by SLAM into a number of Topco Shares equal to the unpaid principal amount divided by $10.0 per share

- above shares will become subject to earnout provisions and will vest at $15.0 per share (5 years post-closing)

- When Minimum Cash Condition is not satisfied, the unpaid principal will be automatically deemed cancelled

- When Minimum Cash Condition is satisfied:

- Sponsor Forfeiture:

- Sponsor shall forfeit 5,875,000 shares (or *40.9%) when the following two conditions are satisfied:

- Private Placement Net Financing Amount + Trust Amount (including Backstop Amount, if any) ≥ $110 million – Company Permitted Financings Amount

- Private Placement Gross Financing Amount + Trust Amount (including Backstop Amount, if any) < $200 million – Company Permitted Financings Amount

- Sponsor shall forfeit 3,875,000 shares (or *27%) when the following condition is satisfied:

- Private Placement Gross Financing Amount + Trust Amount (including Backstop Amount, if any) ≥ $200 million – Company Permitted Financings Amount

- Sponsor shall forfeit 5,875,000 shares (or *40.9%) when the following two conditions are satisfied:

- Sponsor Earnout (5 years post-closing):

- 1.50 million ( or *10.4%) Topco Shares at $12.0 per share

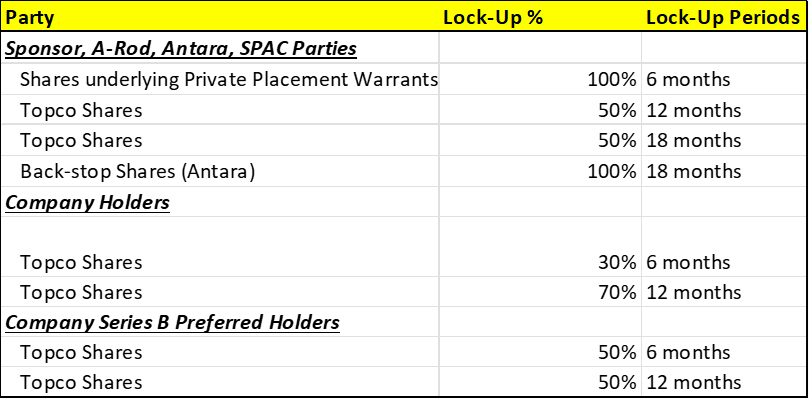

- Lock-up:

- Closing Conditions:

- Termination date: August 31, 2024

- SPAC binding subscription agreements by May 31, 2024 in an amount ≥ ($85.0 million – Company Permitted Financings Amount)

- Minimum NET Cash Condition equal to:

- Private Placement Net Financing Amount + Trust Amount (including the Backstop Amount, if any) > $110 million – Company Permitted Financings Amount

- Company Qualified Series B Financing by March 15, 2024 & Specified (Strategic) Investor shall have committed to pay the Company ≥ $10.0 million

- Waiver of 100% Deferred underwriting fee by all SPAC IPO Underwriters

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clauses

- Advisors:

- Target Legal Advisor: Goodwin Procter LLP

- SPAC Legal Advisor: Kirkland & Ellis LLP

- Target Financial Advisor: JonesTrading Institutional Services LLC

- Target Capital Market Advisor: BTIG, LLC

- BTIG, LLC Legal Advisor: DLA Piper LLP (US)

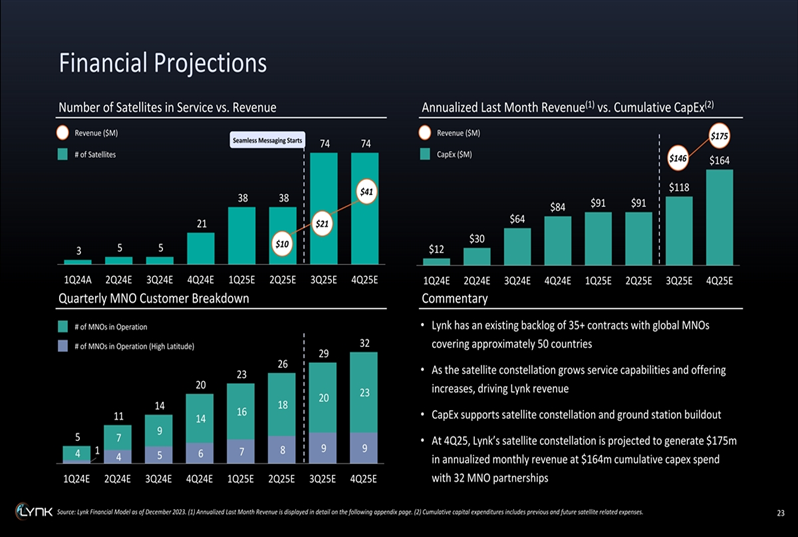

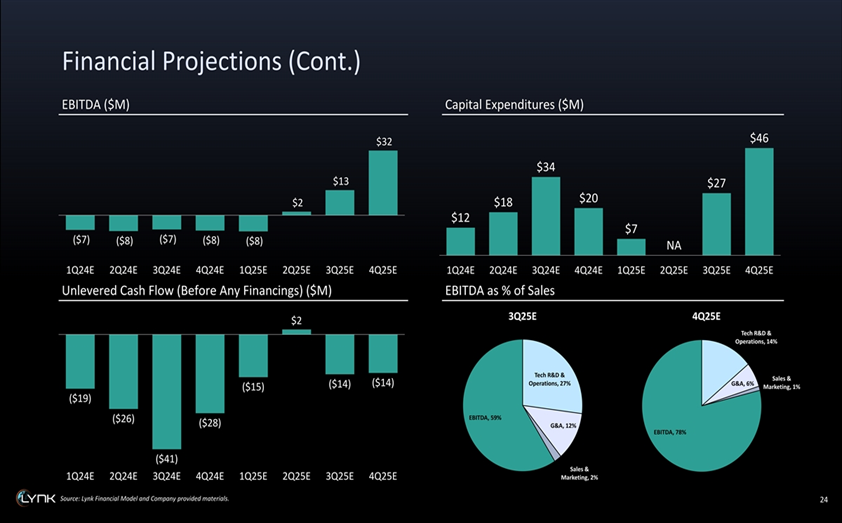

- Financials (https://www.sec.gov/Archives/edgar/data/1838162/000119312524023614/g762554ex99_2p23g1.jpg & https://www.sec.gov/Archives/edgar/data/1838162/000119312524023614/g762554ex99_2p24g1.jpg):

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- Share reserve equal to 10% of the aggregate number of Topco Shares outstanding immediately following the Closing on a fully diluted basis

*Denotes estimated figures by CPC

#Estimated as on February 5, 2024