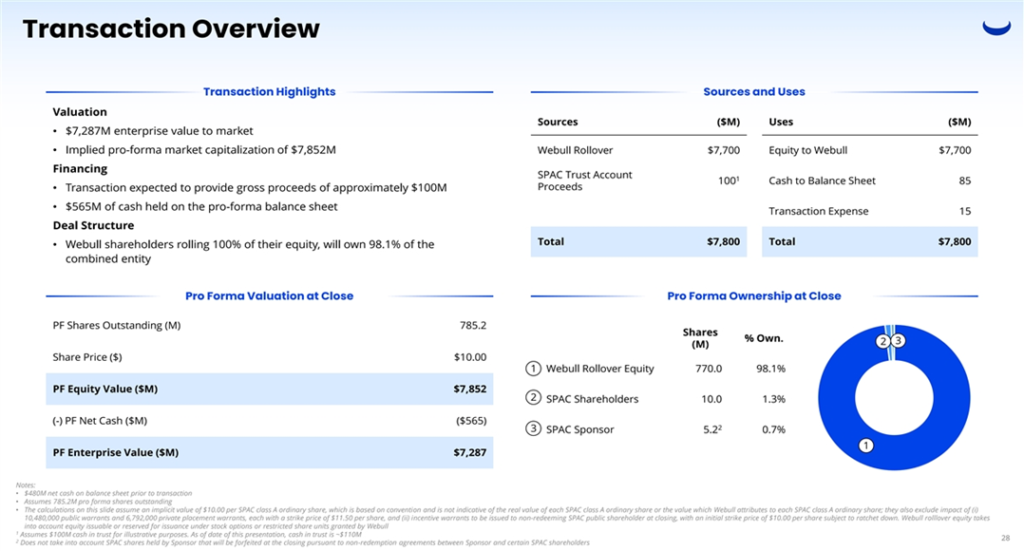

- SK Growth Opportunities Corporation (SKGR) to merge with Webull Corporation (Private) in a transaction valuing the pro forma entity at $7,287 million in Enterprise Value ($7,852 million of equity value assuming no further redemptions).

- Webull shareholders will receive aggregate consideration of $7,700 million at $10.0 per share. The combined company will adopt a dual-class structure, where Class A Ordinary Shares carry 1 vote each and cannot be converted into Company Class B Ordinary Shares under any circumstance, while Class B Ordinary Shares hold 20 votes each and will be exclusively owned by Webull Founders, with the option to convert them into an equivalent number of Company Class A Ordinary Shares at any time.

- Before closing, SKGR and Webull may mutually agree to enter PIPE (Private Investment in Public Equity) agreements.

- Sponsor has agreed to forfeit up to 2.00 million sponsor shares (*38.17% of the total) for the execution of additional Non-Redemption Agreements. If the number of shares forfeited falls short of 2.00 million at closing, the Sponsor will also forfeit the difference without receiving any consideration. Additionally, the Webull has agreed to indemnify the Sponsor and its Insiders for any indemnifiable amounts payable under certain circumstances, up to a limit of $5.00 million.

- No minimum cash condition.

- Webull will pay extension expenses if the agreement is terminated due to mutual consent.

- Business combination transaction is targeted to close in the second half of 2024.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.5 Redeemable Warrant

- #Cash in Trust: $109,415,775 (~108.8% of Public Offering)

- Public Shares Outstanding: 10,056,597 shares

- Private Shares Outstanding: 3,960,464 shares

- Reported Trust Value/Share: $10.88 per share

- Current Liquidation Date: September 30, 2024

- Outside Liquidation Date: September 30, 2024

- Name of Target: Webull Corporation

- Description of Target: Webull is a leading digital investment platform built on next generation global infrastructure. The Webull Group operates in 15 regions globally and is backed by private equity investors located in the United States, Europe and Asia. Webull serves 20 million registered users globally, providing retail investors with 24/7 access to global financial markets. Users can put investment strategies to work by trading global stocks, ETFs, options and fractional shares, through Webull’s trading platform.

- Announced Date: February 28, 2024

- Expected Close: “Second Half of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1912461/000119312524049453/d798354dex991.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1912461/000119312524049453/g798354ex99_2p29g1.jpg):

- Pro Forma Enterprise Value: $7,287 million

- Pro Forma Equity Value: $7,852 million

- Transaction share price: $10.0 per share

- SPAC Public Shareholders Receive (*1.29%):

- *10,056,597 Company Class A Ordinary Shares (1 for 1)

- *10.48 million Company Warrants (1 for 1)

- SPAC Sponsors Receive (*0.25%):

- *1,960,464 Company Class A Ordinary Shares (1 for 1)

- *6,792,000 Company Warrants (1 for 1)

- Target Shareholders Receive (*98.4%):

- Equity consideration of $7,700 million at $10.0 per share

- Combined company will have a dual-class structure:

- Class A Ordinary Share:

- 1 vote

- cannot be converted into company Class B Ordinary Shares under any circumstance

- Class B Ordinary Share:

- 20 Votes

- Target Founders will beneficially own all Company Class B Ordinary Shares

- may be converted into the same number of Company Class A Ordinary Shares at any time

- Class A Ordinary Share:

- PIPE / Financing:

- May enter into PIPE agreements mutually acceptable to SPAC & Target before closing

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Sponsor agreed to forfeit up to 2.00 million sponsor shares (or *38.17%) for execution of additional Non-Redemption Agreements

- If shares forfeited are less than 2.00 million at closing, such difference shall also be forfeited for no consideration

- Target agreed to indemnify Sponsor & Insiders for any Indemnifiable Amounts payable under certain circumstances up to $5.00 million

- Lock-up:

- SPAC Sponsor:

- Shares: 12 months post-closing

- Warrants: 30 days post-closing

- Key Target Shareholders: 180 days post-closing

- SPAC Sponsor:

- Closing Conditions:

- Termination date: March 31, 2025

- No minimum cash condition

- SPAC is subject to certain covenants with respect to its efforts to effect an extension from September 30, 2024 to March 31, 2025

- Other customary closing conditions

- Termination:

- Target will pay extension expenses if the agreement is terminated due to mutual consent

- Extension expenses include: costs and expenses incurred by SPAC, Sponsor or their Affiliates to extend beyond September 30, 2024

- Other standard termination clause

- Target will pay extension expenses if the agreement is terminated due to mutual consent

- Advisors:

- SPAC Financial Advisor: Cohen & Company Capital Markets, a division of J.V.B. Financial Group, LLC

- Target US Legal Advisor: Kirkland & Ellis LLP

- SPAC US Legal Advisor: Wilson Sonsini Goodrich & Rosati, Professional Corporation

- Financials (N/A):

- No financials or projections provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- No information provided

*Denotes estimated figures by CPC

#Reported as on December 29, 2023 (Extension meeting results)