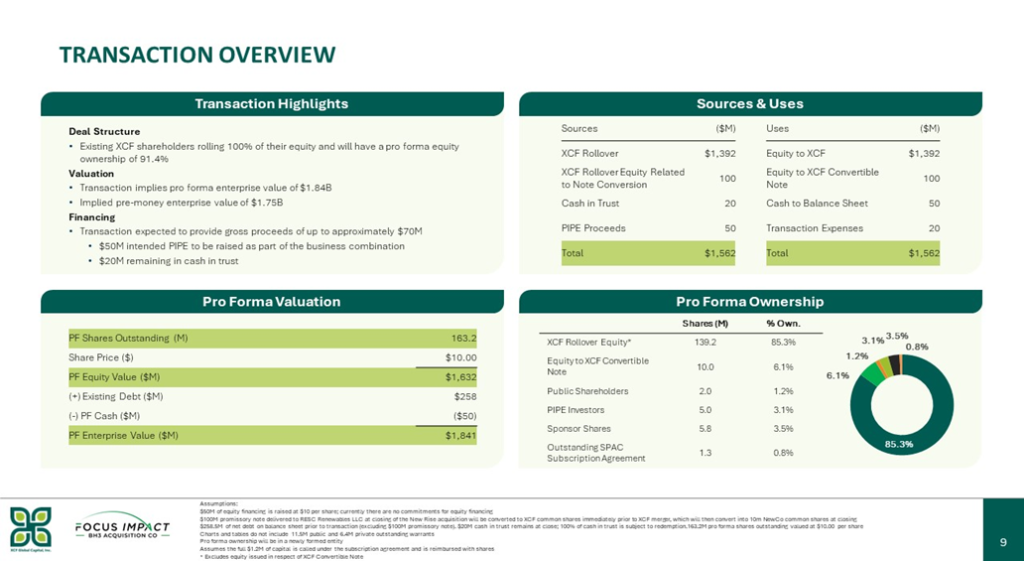

- Focus Impact BH3 Acquisition Company (BHAC) to merge with XCF Global Capital, Inc (Private) in a transaction valuing the pro forma entity at $1,841 million in Enterprise Value ($1,632 million of equity value assuming no further redemptions).

- XCF shareholders will receive aggregate consideration of $1,750 million subject to adjustments.

- $50.0 million intended PIPE to be raised as part of the business combination.

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in the second half of 2024.

- SPAC Details:

- Unit Structure: 1 Class A ordinary share + 0.5 Redeemable Warrant

- #Cash in Trust: $25.4 million (~110% of Public Offering; including 2 months extension payment at $0.35 per unredeemed share)

- Public Shares Outstanding: 2,312,029 shares

- Private Shares Outstanding: 5.75 million shares (including 3.0 million Class A shares)

- Estimated Trust Value/Share: *$11.0 per share

- Current Liquidation Date: April 30,2024

- Outside Liquidation Date: July 31, 2024

- Name of Target: XCF Global Capital, Inc.

- Description of Target: XCF Global leads the charge in producing Sustainable Aviation Fuel (“SAF”), committed to reducing the global carbon footprint through expanding the market for clean-burning, sustainable biofuels. The Company is developing and operating state-of-the-art clean fuel SAF production facilities engineered to the highest levels of compliance, reliability, and quality.

- Announced Date: March 12, 2024

- Expected Close: “Second Half of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1851612/000114036124012745/ef20023810_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1851612/000114036124012745/ef20023810_ex99-2slide09.jpg):

- Transaction share price: $10.0 per share

- Pro Forma Enterprise Value: $1,841 million

- Pro Forma Equity Value: $1,632 million

- SPAC Public Shareholders Receive (~1.2%):

- *2,312,029 Newco Class A Shares (1 for 1)

- SPAC Sponsors Receive (~3.5%):

- *5.75 million Newco Ordinary Shares (1 for 1)

- Target Shareholders Receive (~85.3%):

- Equity consideration of $1,750 million at $10.0 per share subject to adjustments related to net debt & transaction expenses:

- ~$1,392 million

- Equity consideration of $1,750 million at $10.0 per share subject to adjustments related to net debt & transaction expenses:

- PIPE / Financing (~3.1%):

- Expected to raise $50.0 million in PIPE at $10.0 per share

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsor: 12 months post-closing

- Early release: If the price equals or exceeds $12.0 per share after 150 days post-closing

- Key Target Shareholders:

- Target Management: Same as sponsor

- Target Stockholders (~90% shares): Same as sponsor

- Early release:

- SPAC Sponsor: 12 months post-closing

| % of Lock-up shares | May transfer on or after |

| 10% | 90 days following the first quarterly earnings release published following the Closing |

| 30% | 180 days following closing |

| 60% | 360 days following closing |

- Closing Conditions:

- Termination date: September 11, 2024 (November 11, 2024 if the Registration Statement is not declared effective by September 11, 2024)

- No minimum cash condition

- PCAOB Financials by April 15, 2024

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clause

- Advisors:

- Target Financial Advisor: Cohen & Company Capital Markets, a division of J.V.B. Financial Group, LLC

- SPAC Legal Advisor: Kirkland & Ellis LLP

- Target Legal Advisor: Stradley Ronon Stevens & Young, LLP

- SPAC Capital Market Advisor: BTIG, LLC

- Target Joint Capital Market Advisor: Height Capital Markets

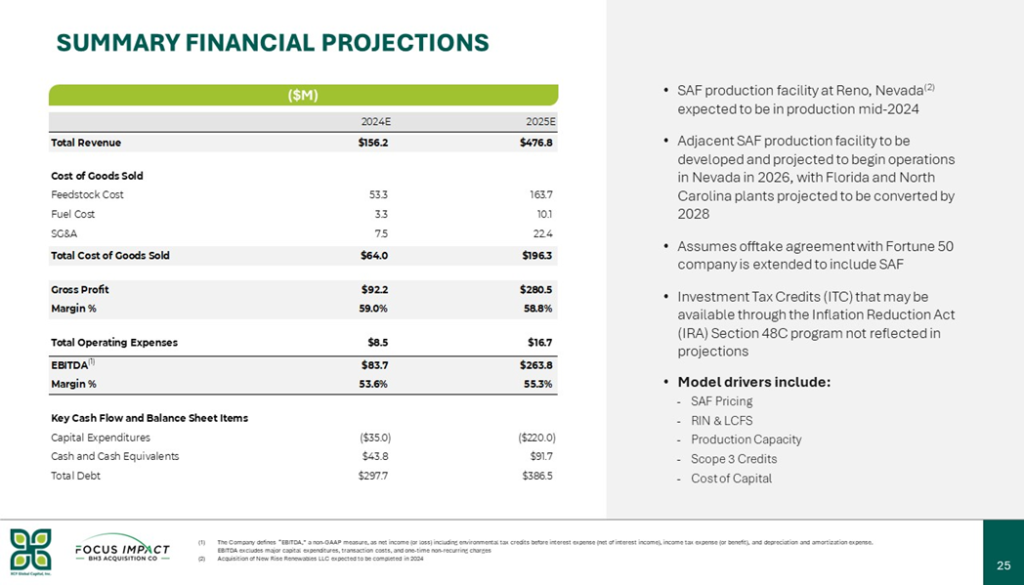

- Financials (https://www.sec.gov/Archives/edgar/data/1851612/000114036124012745/ef20023810_ex99-2slide25.jpg):

- Comparables (https://www.sec.gov/Archives/edgar/data/1851612/000114036124012745/ef20023810_ex99-2slide24.jpg):

- Equity Incentive Plan

- 7.0% of aggregate Newco Class A Shares at closing (on a fully diluted basis)

*Denotes estimated figures by CPC

#Estimated as on March 12, 2024