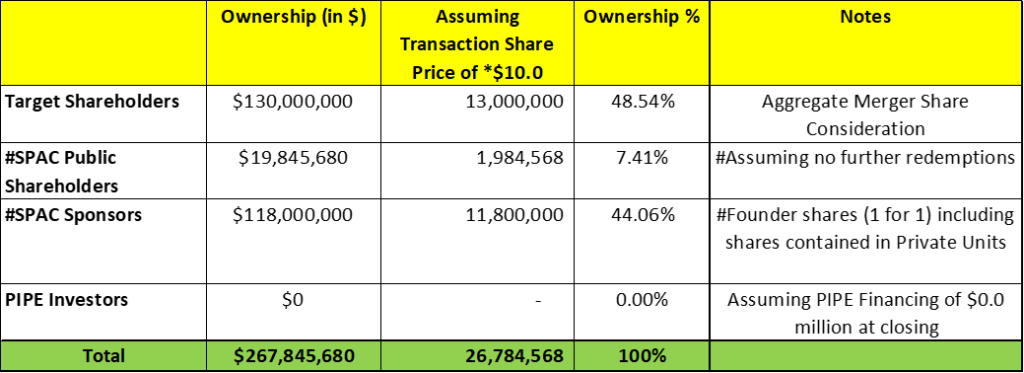

- ShoulderUp Technology Acquisition Corp. (SUAC) to merge with SEE ID (Private) in a transaction valuing the pro forma entity at *$247 million in Enterprise Value (*$268 million equity value assuming no further redemptions from the current level).

- SEE ID shareholders will receive equity consideration of $130 million at $10.0 per share.

- Sponsor agreed to subject 2.65 million sponsor shares (*25.35%) to earnout provisions vesting equally at $15.0 and $20.0 respectively.

- Sponsor also agreed to use 3.15 million sponsor shares (or *30.14%) to maximize the amount of capital raised on behalf of the resulting public company (including PIPEs, NRAs etc.)

- Minimum NET cash condition of $6.00 million.

- Business combination transaction is targeted to close in the second quarter of 2024.

- SPAC Details:

- Unit Structure: 1 share of Class A common stock + 0.5 Redeemable Warrant

- #Cash in Trust: $20,937,192 (105.5% of Public Offering)

- Public Shares Outstanding: 1,984,568 shares

- Private Shares Outstanding: 11.8 million shares (including 1.35 million shares contained in Private Units)

- Reported Trust Value/Share: $10.55

- Current Liquidation Date: May 19, 2024

- Outside Liquidation Date: May 19, 2024

- Name of Target: SEE ID

- Description of Target: At the heart of the technological revolution in asset management and security lies SEE ID, a trailblazing SaaS service that is redefining the paradigms of asset intelligence, assurance, and safety. By harnessing the power of IoT tracking technology, SEE ID stands at the forefront of innovation, offering patented solutions that are not just advanced but transformative. Through relentless research and development, SEE ID has pioneered a suite of technologies that empower organizations to not only streamline their logistics and supply chain processes but also bolster operational security to unprecedented levels. Leveraging state-of-the-art AI engines, cutting-edge 5G RF and BLE technology, and seamless cloud integrations, SEE ID transcends traditional boundaries, offering real-time asset visibility and predictive analytics that integrate effortlessly with existing infrastructure. This is not just technology; it’s a vision for a more secure, efficient, and connected world.

- Announced Date: March 22, 2024

- Expected Close: “Second Quarter of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1885461/000121390024025178/ea020154101ex99-1_shoulderup.htm

- Transaction Terms (N/A):

- Pro Forma Equity Value: *$268 million

- Pro Forma Enterprise Value: *$247 million

- Target Shareholders Receive (~*48.5%):

- Aggregate merger share consideration of $130 million at $10.0 per share

- PIPE / Financing:

- Nil

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Sponsor agreed to:

- subject 2.65 million sponsor shares (*25.35%) to vesting & forfeiture as follows:

- 1.325 million shares @ $15.0 per share

- 1.325 million shares @ $20.0 per share

- use 3.15 million sponsor shares (or *30.14%) to maximize the amount of capital raised on behalf of the resulting public company (including PIPEs, NRAs etc.)

- subject 2.65 million sponsor shares (*25.35%) to vesting & forfeiture as follows:

- Lock-up:

- SPAC Sponsors: 180 days post-closing

- Target Shareholders: Same as sponsors

- Closing Conditions:

- Termination date: August 31, 2024

- Minimum NET cash condition of $6.00 million:

- Cash includes CIT – Redemptions – Trust Account Expenses + PIPE – SPAC Transaction Expenses – Company Transaction Expenses – Company Change of Control Expenses

- PCAOB Financials by May 15, 2024

- SPAC liabilities at closing ≤ $250,000

- SPAC should have a line of credit (including an ELOC) on customary terms of ≥ $50 million and ≤ $100 million before closing (will not count towards SPAC minimum cash condition)

- SPAC Public Warrants amended to remove the ability of the holders of the warrants to exercise the warrants on a cashless basis

- Other customary closing conditions

- Cash includes CIT – Redemptions – Trust Account Expenses + PIPE – SPAC Transaction Expenses – Company Transaction Expenses – Company Change of Control Expenses

- Termination:

- No termination fee

- Other standard termination clauses

- Advisors:

- SPAC Legal Advisors: DLA Piper LLP (US)

- Target Legal Advisors: Rice Reuther Sullivan & Carroll LLP and Holland & Hart LLP

- Financials (N/A):

- No historical or projected financials provided

- Comparables (N/A):

- No valuations provided

- Parent Equity Incentive Plan

- 15% of shares outstanding post-closing with an automatic annual increase of 2%

*Denotes estimated figures by CPC

#Reported as on November 13, 2023