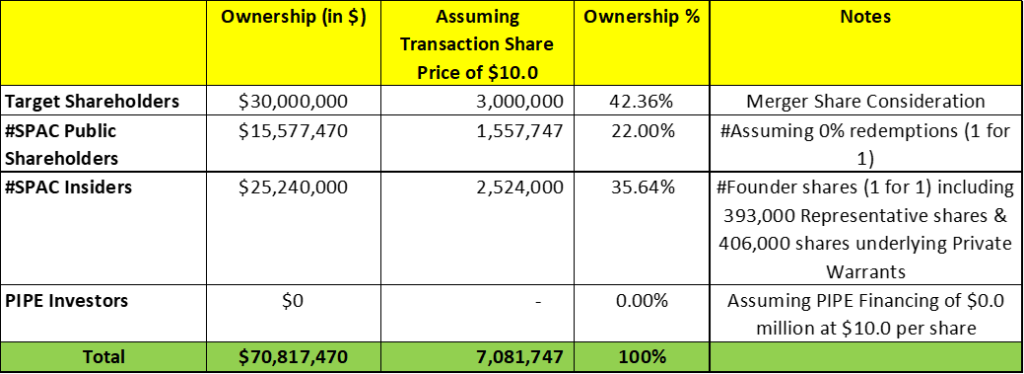

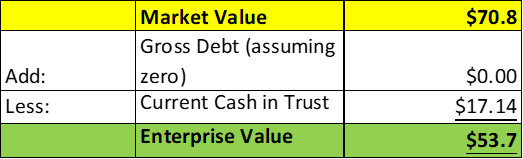

- Bannix Acquisition Corp. (BNIX) to acquire VisionWave (Private) in a transaction valuing the pro forma entity at *$53.7 million in Enterprise Value (*$70.8 million of equity value assuming no further redemptions).

- VisionWave shareholders will receive equity consideration of 3.00 million shares.

- No minimum cash condition.

- No termination fees.

- SPAC Details:

- Unit Structure: 1 share of Common Stock + 1 Redeemable Warrant + 1 Right

- #Cash in Trust: *$17,144,640 (~*110% of Public Offering; including 1 month extension payment of $25,000)

- Public Shares Outstanding: 1,557,747 shares

- Private Shares Outstanding: 2,524,000 shares (including 393,000 Representative shares & 406,000 shares underlying Private Warrants)

- Estimated Trust Value/Share: *$11.0 per share

- Current Liquidation Date: April 14, 2024

- Outside Liquidation Date: September 14, 2024

- Name of Target: VisionWave Technologies

- Description of Target: VisionWave technologies is a provider of cloud business management software

- Announced Date: March 27, 2024

- Expected Close: Not provided

- Press Release: https://www.globenewswire.com/news-release/2024/03/28/2854005/0/en/Bannix-and-GBT-Partner-to-Bring-Revolutionary-Imaging-Tech-VisionWave-to-Market.html

- Transaction Terms (N/A):

- Transaction share price: *$10.0 per share

- Pro Forma Equity Value: *$70.8 million

- Pro Forma Enterprise Value: *$53.7 million

- Target Shareholders Receive (~*42.3%):

- 3.00 million shares of common stock of Bannix

- PIPE / Financing:

- Nil

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsor: 1-year post-closing

- Early release: If the price equals or exceeds $12.0 per share after 150 days post-closing

- Key Target Shareholders: Not provided

- SPAC Sponsor: 1-year post-closing

- Closing Conditions:

- Termination date: September 14, 2024

- No minimum cash condition

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clause

- Advisors:

- SPAC US Legal Advisor: Fleming PLLC

- Financials (N/A):

- No financials or projections provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- No information provided

*Denotes estimated figures by CPC

#Estimated as on March 18, 2024 (Funding of extension payment)